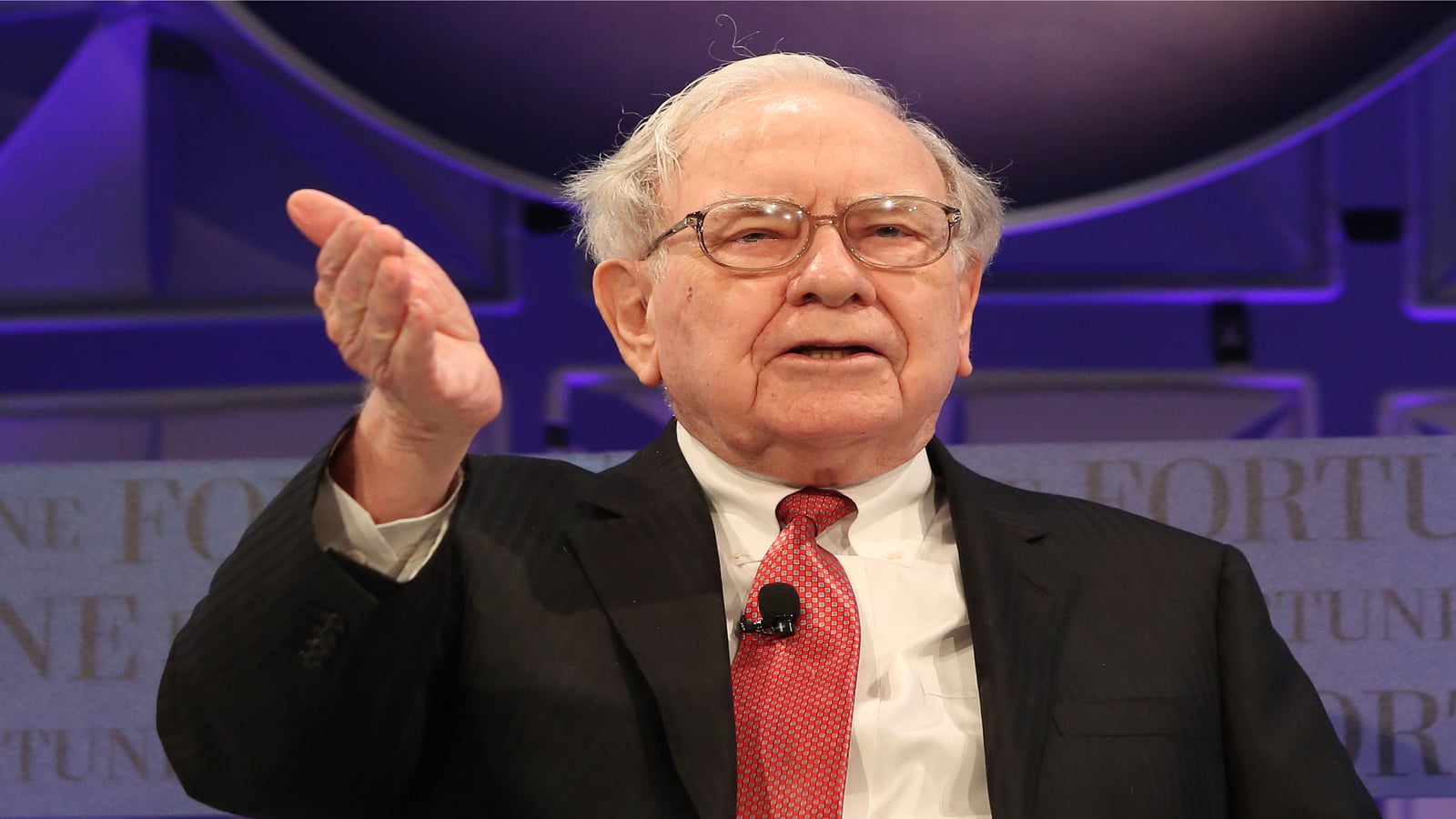

Amid an increasingly uncertain macro environment with heightened geopolitical tensions and a sell-off in the broad indices like the S&P 500, it may be reassuring that there are still some safe havens we can fall back on for solid returns. In this case, it’s the emergence of Warren Buffett stocks that may give growth and stability to our portfolios.

This article highlights Warren Buffett stocks chosen for their long-term growth potential and may trade at undervalued levels. As one of the grandfathers of value investing, Buffett himself may deem these picks to be worthy plays thanks to them being superb companies in their own right.

So here are the best Warren Buffett stocks to buy that may create the next generation of billionaires.

Microsoft (MSFT)

Microsoft (NASDAQ:MSFT) is surely one of those Warren Buffett stocks that has the potential to make you rich. In addition to being one of the bluest of chips, MSFT also has staggering growth potential. Much of its growth in the near term can be chalked up to its investment in generative AI, which could see it steal market share away from competitor search traffic.

As a huge company, MSFT also has other irons in the fire to propel its valuation upwards. One less talked about catalyst is its development of quantum computers. Although the technology at this stage is speculative and firmly in the realm of research and development, quantum computing will allow us to tackle problems presently impossible via classical computers. More processing power means we can model more complex systems more efficiently and with greater accuracy, such as financial markets, biological processes, and even weather and global warming patterns.

MSFT stock stands out among its competitors in the race to be the first to commercialize quantum technologies. It’s exploring a more experimental path which has more risk, but a greater potential upside if their investment pays off. To put their solution simply, their quantum system is speculated to be more stable than its competitors, but reaching that stability will take some time. By contrast, MSFT’s peers are exploring more well-understood systems but may come with bigger problems in scale, implementation, and being the first to get their quantum systems ready for commercialization. This gives MSFT a leg up, thus making it one of those Warren Buffet stocks we should keep an eye on.

Nvidia (NVDA)

Nvidia (NASDAQ:NVDA) is perhaps one of the most contentious growth stocks that people debate about. Detractors believe that it may have used up most if not all of its growth potential this year alone, while the bulls point towards the many avenues of growth it has yet to explore.

To name just a few of the industries NVDA serves, they include AI, blockchain, gaming, virtual reality, the metaverse, the chip market, and so much more. My view is that the company’s stock price will naturally reflect these catalysts moving forward, but since it trades at 113 times earnings, it may take longer than expected to get there.

The company will need to continue its absolutely stellar earnings performance to keep that earnings multiple stable, and that’s assuming that the stock price doesn’t continue to climb higher. The valuation still might be a little rich. Still, for those who firmly believe in the company’s outlook but are afraid of it being potentially overpriced, strategies like dollar cost averaging might be a robust solution to get cheaper shares over time.

Apple (AAPL)

I believe that Apple (NASDAQ:AAPL) lost a bit of its sex appeal this year as a growth stock. While AI took off with many of its magnificent seven embracing it, AAPL has had a relatively slow start. This, combined with lower-than-expected hardware sales has led it to be overshadowed by other companies on this list.

But AAPL might be looking to change that on the AI front. Apple could become a significant player in the AI space, leveraging its vast installed device base and robust services segment. The company could capitalize on AI by integrating it into consumer products, potentially transforming Siri into a more advanced conversational AI model. This approach could allow Apple to monetize AI through its existing subscription services, tapping into a substantial revenue potential without needing to convert new users aggressively.

This, along with a depressed AAPL stock price at just 30 times earnings, makes it one of those Warren Buffet stocks investors should consider adding to their portfolios.

On the date of publication, Matthew Farley did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.