One of my favorite long-term growth stocks to buy today is fintech disruptor SoFi Technologies (SOFI).

In fact, for what it’s worth, all my favorite growth stocks are up more than 55% since mid-June. They’re crushing the Dow Jones, S&P 500, Nasdaq, Cathie Wood’s ARK Innovation ETF (ARKK), and Warren Buffett’s Berkshire Hathaway (BRK) by a mile.

Despite these huge gains since the stock market bottom, SoFi stock has been a big laggard. It’s up “only” 17% since mid-June.

We think that’s about to change in a big way.

Yesterday, the U.S. government confirmed that the continued extension of the student loan moratorium will end in about four months. For the past year, this loan repayment pause has been the biggest headwind weighing on SoFi stock. We believe this confirmation awakens a latent catalyst that will supercharge SoFi stock. And it could send shares about 250% higher over the next six months alone.

Here’s a deeper look.

Huge Catalyst Will Supercharge Growth in 2023

We’ve long said that SoFi is a 100%-growth company disguised as a 50%-growth company.

In short, that’s because every business line at SoFi is growing about 100% year-over-year, except for its student loan business. Due to the pandemic-era decision to pause student debt payments, that’s been shrinking. The shrinkage in the student loan business is causing a would-be 100%-plus topline revenue growth rate to be about 50%.

Just look at last quarter’s numbers.

Total members rose by 70%. Personal loan originations climbed 91%. Money product growth was 92%. Invest product growth was 89%. Credit card product growth was 227%. Relay product growth was 115%. At Work product growth was 117%.

On average, you’re talking about a growth rate of just under 115%.

But concurrent to that triple-digit growth everywhere else, student loan originations dropped 54% last quarter. That’s a massive plummet. It’s been happening for a while, and it’s due exclusively to the current student loan moratorium.

Remove that, and suddenly, SoFi goes from a ~50% growth company to a ~100% growth company.

Well, yesterday, the White House confirmed that the student loan moratorium will end in 2023. U.S. President Joe Biden announced he’d forgive about $10,000 in student debt per person (if they’re making less than $125,000). And he’s extending the current pause in student loan payments to December. But he also announced this is the final extension and that borrowers should plan to resume payments in January 2023.

That’s huge news for SoFi. When those payments do resume, student loan origination growth will go from -50% to +50%. And, as that happens, SoFi will morph into a 100%-growth company.

Of course, such a significant transformation of the growth profile will send SoFi stock higher.

How much higher? The fundamentals and technicals say a lot higher.

SoFi Stock Is Dramatically Undervalued

Per our analysis, SoFi stock is one of the most undervalued growth stocks in the market today. And consequently, as its valuation normalizes with a revenue growth surge in 2023, it has a ton of upside potential.

As stated earlier, SoFi will likely see its growth rates move above 100% in 2023. This is enormous growth for any company but especially so for a consumer finance company. Indeed, across the whole consumer finance industry, the average revenue growth rate currently is about 10%.

Therefore, SoFi is growing about 5X to 6X faster than the average consumer finance company. And it has the potential to grow more than 10X as fast in 2023.

Naturally, you’d expect a company growing 5X to 6X the industry norm to have a stock trading at 5X to 6X the industry-norm valuation, too. Growth and valuation should be correlated.

But that’s not the case with SoFi stock. And that’s the opportunity.

SoFi stock is trading at just 1.1X its book value. Your average consumer finance stock – growing 5X slower – trades at 2.2X book value, about double SoFi’s valuation multiple.

In other words, considering its growth profile, SoFi stock is dirt-cheap. And that growth profile will only dramatically improve from here.

As it does, we fully expect SoFi stock to turn into one of our biggest winners.

The Stock Looks Primed for a Breakout

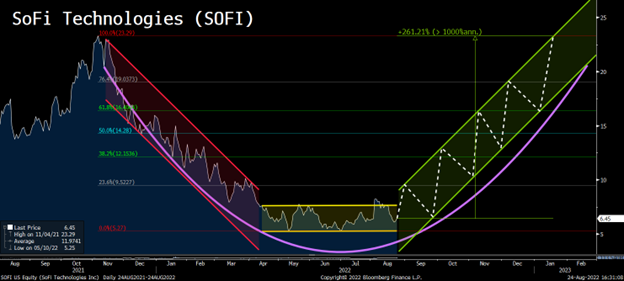

Looking at the chart, SoFi stock looks primed for a big breakout.

The stock was stuck in a multi-month decline from November 2021 until April 2022. From April to today, the stock has been in a sideways consolidation pattern. Normally, stocks enter these consolidation periods when they’re prepping for either a big move higher or a big move lower.

Recently, the stock has started to break to the upside of this consolidation channel on pretty big volume. That’s mostly thanks to strong earnings and the new student debt forgiveness decision. When coupled with the strengthening fundamental backdrop, this improving price action strongly suggests that the current consolidation pattern in SoFi will resolve in a brand-new uptrend.

We think that uptrend could look a lot like the previous downtrend – but in reverse.

That downtrend pushed SoFi stock from nearly $25 to $5 in just over seven months. Mirroring that, a new uptrend could elevate the stock from $5 back to nearly $25 by early 2023. That implies a gain of more than 250% over the next seven months alone.

The Final Word on SoFi Stock

We search for the most disruptive and promising early-stage companies positioned to grow like wildfire over the next decade. And we hope to score their investors small fortunes.

SoFi fits that bill. It’s the future “Amazon of Finance.” It will do to Bank of America (BAC) and Wells Fargo (WFC) in the 2020s what Amazon (AMZN) did to JCPenney and Sears in the 2010s. As that happens, SoFi stock will score early investors 10X (and perhaps even bigger) returns.

But it’s far from the only superstar growth stock we’re betting big on these days. In fact, it’s far from the best.

That’s a tiny space stock that I’ll wager 99% of investors have never heard of. But 100% of people will likely know the name of it before the year is out.

That’s because this tiny space firm is just weeks away from the most important space launch since Neil Armstrong walked on the moon in 1969.

Seriously – this launch could end up changing the world even more than that landmark moon landing mission of more than 50 years ago.

If it’s a success, this tiny stock could see its share price soar 10X in just a few weeks.

This just may be the most exciting investment opportunity in the market today.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.