We’ve been pounding the table on buying the dip in tech stocks for weeks now, and it’s no wonder why.

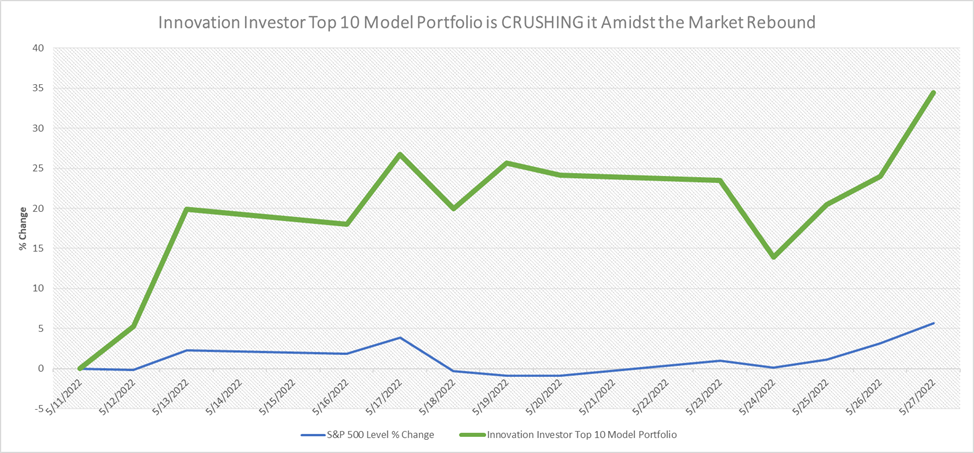

Since early May, the stock market has found its groove again, rising a little over 5%. During that same stretch, the Top 10 stocks portfolio in our Innovation Investor research service has soared almost 35%!

Of course, the big question is whether this recent strength is just a “head fake” or the beginning of a new bull market.

We think it’s the latter. And we’re not alone.

Have We Reached Peak Bearishness?

Major Wall Street bank Citi (NYSE:C) believes we’ve reached “peak bearishness” in the stock market.

In a research note published yesterday, analysts argued that Citi clients’ positioning data shows investors have already repositioned for a recession.

“In the end, we suspect the already recession-like repositioning and trading data could mean that in the near term, peak bearishness may be behind us. The fears of Fed tightening and a growth slowdown ahead have likely had its sharpest impact on prices and valuation.”

In other words, investors have already sold stocks like it’s 2008 all over again. So, further downside risk to equities on fears of a recession seems unlikely.

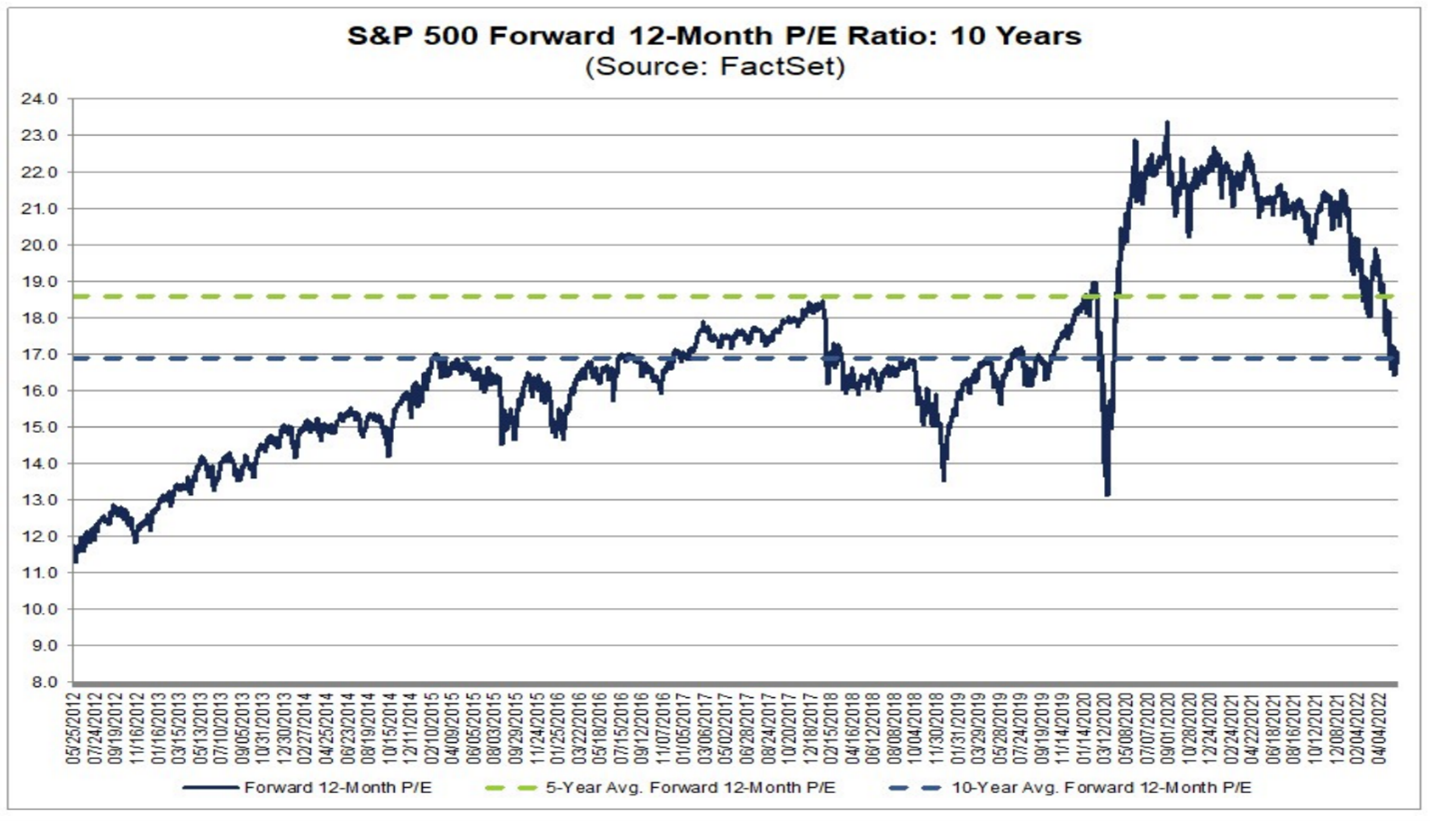

Supporting this point from Citi is the price-to-earnings multiple on the S&P 500. Entering 2022, the S&P was trading at over 20X forward earnings, a premium to both its five- and 10-year averages. However, following the recent market crash, the index now trades at less than 17X forward earnings. That’s below both those averages.

Equity multiples have already reset to a slower growth environment.

Instead, it all comes down to earnings.

Fortunately, earnings thus far have been really good, especially among tech companies. And it’s been particularly so among our Innovation Investor stocks.

Why else do you think they’ve soared 35% in less than a month?

We’re confident in the trajectory of earnings over the next 12 months. And coupled with this new data from Citi, that gives visibility to this market rebound being the “real deal.”

Significant Upside Potential in Tech Stocks

In a CNBC interview yesterday, Charles-Henry Monchau — chief investment officer at Bank Syz — said there are some huge upside opportunities appearing in the “speculative tech” space.

“Given the fact that there is indeed some cash on the sideline, this might be the high-octane, high-risk segments which might be favored by the markets.”

His advice? Be selective. Some speculative tech stocks will continue to get hammered. Others could rebound significantly.

We couldn’t agree more with this thesis.

The best place to invest in the market today is with high-quality speculative tech stocks. Investors have been throwing the baby out with the bath water in that space. This is leaving certain high-quality speculative tech stocks with enormous upside potential and little downside risk.

We’re talking about stocks with 3X, 5X, even 10X-plus upside potential — and less than 10- to 20% downside potential.

These stocks offer the best risk-reward profiles in the market today.

And those are the ones we’re loading up on in Innovation Investor.

The Final Word on Tech Stocks

A lot of folks look at the stock market these days and get really scared. But we’re getting really, really excited.

Honestly, I don’t think our team has even been more enthused about single-stock investment opportunities than we are today.

The reality is that the market follows a repeating cycle. For about nine or 10 years, it goes higher, led by huge rallies in growth stocks. Then, for about a year or two, it crashes, weighed by big declines in growth stocks. Then the crash ends. And we reenter a nine- or 10-year bull market where growth stocks rally hundreds (if not thousands) of percent.

1987 — big market crash. It took a few months to sort through everything. Then stocks soared throughout the 1990s.

2000 — big market crash. It took a year to bottom, and then stocks soared throughout the mid-2000s.

2008 — big market crash; took a year to sort through. Stocks soared throughout the 2010s.

2022 — lather, rinse, repeat. It’ll take a year to equalize. Then stocks will soar throughout the 2020s.

The investment implication? It’s time to load up on growth stocks for unbelievably large gains over the next decade.

We’re already doing that. And lately, we’ve been winning big. Learn more to hop on this wealth bandwagon.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.