The Hourly View for CMG

At the moment, CMG (Get Ratings)’s price is down $-6.98 (-0.38%) from the hour prior. This move is a reversal from the hour prior, which saw price move up. As for the trend on the hourly timeframe, we see the clearest trend on the 20 hour timeframe. The moving averages on the hourly timeframe suggest a bullishness in price, as the 20, 50, 100 and 200 are all in a bullish alignment — meaning the shorter durations are above the longer duration averages, implying a sound upward trend.

Out of Restaraunts Hotels Motels stocks, CMG ranks 68th in regards to today’s price percentage change.

CMG’s Technical Outlook on the Daily Chart

At the time of this writing, CMG’s price is down $-5.8 (-0.31%) from the day prior. This move is a reversal from the day prior, which saw price move up. If you’re a trend trader, consider that the strongest clear trend on the daily chart exists on the 20 day timeframe. The moving averages on the daily timeframe suggest a bullishness in price, as the 20, 50, 100 and 200 are all in a bullish alignment — meaning the shorter durations are above the longer duration averages, implying a sound upward trend. The chart below shows CMG’s price action over the past 90 days.

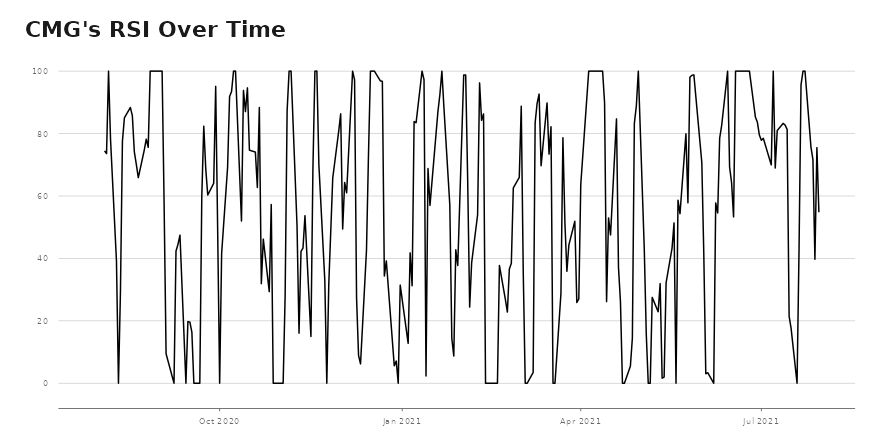

CMG: Daily RSI Analysis

- CMG’s RSI now stands at 54.7938.

- CMG and RSI may be exhibiting divergent trends. This may be something to monitor.

For CMG News Traders

Investors and traders in CMG may be particularly interested in the following story that came out in the past day:

The Russell 1000 Index is a market-capitalization-weighted index of the 1,000 largest publicly traded companies in the U.S. It represents approximately 92% of the total market capitalization of all listed stocks in the U.S. equity market. The Russell 1000 provided a total return of 39.4% over the past 12 months. Value investing is a factor-based investing strategy that involves picking stocks that you believe are trading for less than what they are intrinsically worth, usually by measuring the ratio of the stock’s price to one or more fundamental business metrics.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

5 WINNING Stock Chart Patterns

7 Best ETFs for the NEXT Bull Market