The Hourly View for QSR

At the time of this writing, QSR (Get Ratings)’s price is down $-0.43 (-0.66%) from the hour prior. This is the 2nd hour in a row QSR has seen its price head down. Regarding the trend, note that the strongest trend exists on the 50 hour timeframe. Regarding moving averages, it should first be noted that price has crossed the 50 hour moving average, resulting in them so that price is now turning below it. The moving averages on the hourly timeframe suggest a choppiness in price, as the 20, 50, 100 and 200 are all in a mixed alignment — meaning the trend across timeframes is inconsistent, indicating a potential opportunity for rangebound traders.

Out of Restaraunts Hotels Motels stocks, QSR ranks 41st in regards to today’s price percentage change.

QSR’s Technical Outlook on the Daily Chart

At the time of this writing, QSR’s price is down $-0.59 (-0.91%) from the day prior. This is the 3rd day in a row QSR has seen its price head down. If you’re a trend trader, consider that the strongest clear trend on the daily chart exists on the 100 day timeframe. Of note is that the 20 day changed directions on QSR; it is now pointing down. The moving averages on the daily timeframe suggest a choppiness in price, as the 20, 50, 100 and 200 are all in a mixed alignment — meaning the trend across timeframes is inconsistent, indicating a potential opportunity for rangebound traders. Restaurant Brands International Inc’s price action over the past 90 days can be seen via the chart below.

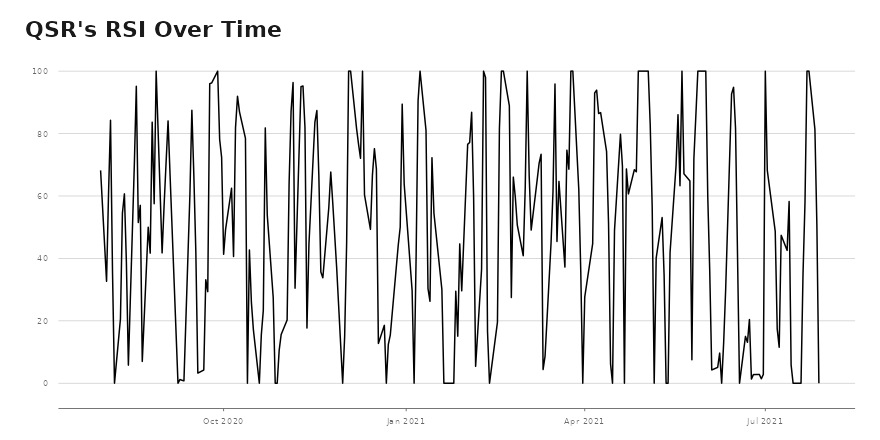

QSR: Daily RSI Analysis

- For QSR, its RSI is now at 0.

- QSR and RSI both have consistent trends, as they are both heading up.

For QSR News Traders

Investors and traders in QSR may be particularly interested in the following story that came out in the past day:

McDonald’s wins out in Guggenheim’s restaurant sector review; JACK, YUM and WEN rated highly

sshaw75/iStock Unreleased via Getty Images Guggenheim says its macro work suggests spending trends should remain robust over the next 12 to 24 months even as government subsidies wane. The firm thinks restaurant industry sales will be driven by healthy consumer balance sheets that should chains top expectations. McDonald’s (MCD), Jack…

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

5 WINNING Stock Chart Patterns

7 Best ETFs for the NEXT Bull Market