If you’ve ever glanced at Luckin Coffee (OTCMKTS:LKNCY) and thought about buying some Luckin stock, hear me say this: don’t do it. Even though company shares are down 95% from their peak, Luckin’s $2.50 stock price still reflects a buoyant alternate universe.

In reality, corporate insiders, preferred shareholders, and Chinese market regulators will strip what’s left of Luckin’s assets long before common shareholders see a dime.

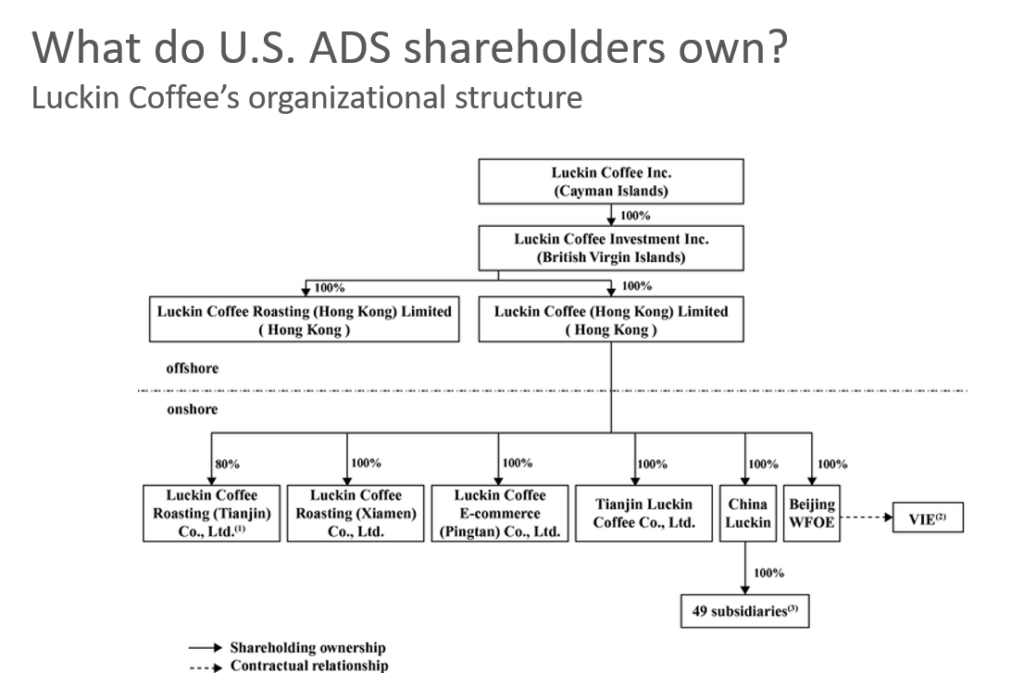

I’ve seen dozens of corporate fraud cases over the years. Still, this one reads more like an international crime thriller: shell companies in the Cayman Islands and the British Virgin Islands (BVI), millions of fake invoices to fool market regulators and a group of kingpins known as “The Iron Triangle.”

Even now, corporate insiders continue to run the show. Here’s the story of how they’re getting away with it, and why investors would be lucky to get more than $1 per share once the dust settles.

Luckin Stock: Coffee Crash

In April, anonymous private investigators exposed a massive fraud at Luckin Coffee. The once-hot startup had overstated revenues by over $300 million since its April 2019 initial public offering (IPO). Shares tumbled on the news, and over twelve directors and corporate insiders, including the CEO and Chairman, were immediately fired.

Yet, the company’s common shares are still worth over $600 million. In part, that’s because the company reportedly has $780 million in cash from its 2019 blockbuster IPO. (That figure is unaudited and could be far off). But in part, it’s also because remaining shareholders hold out hope that the new board might turn the company around.

Corporate Insiders Have First Dibs

Don’t give in to delusion. A group of three key people control Luckin: two ousted directors (Li Hui and Liu Erhai) and the former CEO Lu (Charles) Zhengyao. Together, they maintain at least 45% of voting rights through LLCs in the Cayman Islands and BVI. There are three reasons shareholders should worry.

Reason No. 1: Corporate insiders have a rather long history of bilking shareholders. Li, Liu and Lu are also known as Lu’s “Iron Triangle,” a group of three businessmen with a history of fraud. “The trio was previously exposed to have replicated what they did with UCAR Inc,” according to PingWest’s Chinese office, “namely extensively utilizing affiliated transactions to squeeze money out of entities they own.” (You can read more about Lu here.)

Reason No. 2: The old board remains entirely in control. On Monday, the company’s ousted board voted to hold a general meeting to reinstate Sean Shao, a fired director with connections to the company’s old CEO. According to investigations, Mr. Shao sits on 18 different corporate boards. At least ten have reported material weaknesses in accounting, and four accused of outright fraud.

Reason No. 3: The “light touch” liquidators have been unsuccessful in changing management. Luckin’s new CEO, Jinyi Guo, was part of Lu’s inner circle and former senior vice president. His sole qualification? He was the personal assistant to Lu at his previous job. The company also kept its 37-year-old CFO through the firings, a red flag for a company faced with accounting fraud.

Chinese Regulators Will Also Take a Cut

Last Friday, China’s Ministry of Finance announced it would take punitive actions against Luckin. Separately, China’s State Administration for Market Regulation said it was also taking steps to punish Luckin and related third-party companies for misconduct.

While regulators haven’t finalized dollar amounts yet, these punitive fines may end up bankrupting the company. And even if regulators are successful in recouping money from Luckin’s “Iron Triangle,” U.S. shareholders shouldn’t celebrate.

Considering current relations between the Chinese Ministry of Finance and the U.S. Government, there’s little reason to expect the Chinese regulator to compensate U.S. ADS stock holders. Luckin Coffee’s landlords, suppliers and government stakeholders will all come first.

Luckin Isn’t Starbucks China

Luckin’s stock holders have one final defense for holding on: Chinese growth. China, they reason, is a modernizing economy with a growing taste for coffee. If Starbucks can make it in China, why can’t a homegrown company like Luckin?

That’s because many investors often forget one thing: Luckin Coffee isn’t Starbucks.

On the one hand, Starbucks China doesn’t rely on “functional” coffee sales, industry jargon for habitual caffeine drinkers (in other words, coffee addicts). The category makes up just 10% of total revenue. Instead, the coffee chain generates the majority of income from dine-in customers at shopping malls looking for a place to relax.

Luckin Coffee, on the other hand, was built on a “to-go” mobile ordering model. Stores are typically small and are located in non-prime locations to save on rent. And the model relied on steep discounting to hook customers on its coffee. “To reach its goal of having 10,000 shops by 2021, the company relied on a strategy of offering generous discounts to lure patrons,” Bloomberg reported. “First-time customers got a free cup of coffee and six vouchers for 50% off future purchases. It’s a growth model that costs about $130 million in a year.”

The business model hasn’t worked well. A similar startup, Coffee Box, closed 40% of its 400 stores in the first quarter of 2019 after suffering steep losses and now only has ten remaining stores.

Can Luckin eventually improve its stock price? Of course. The company could get rid of its CEO and CFO, close underperforming stores, and replace the entire board with qualified industry veterans. But will that happen? Well, wake me up when it does.

What’s Next for Luckin Stock

In its three short years, Luckin Coffee has burned through at least $778 million of investor money. And losses are accelerating from the company’s breakneck expansion. In Q3 2019 alone, the company purportedly lost $82 million with 3,680 stores.

With 6,000 stores today, Luckin is likely burning through cash at an even faster rate.

How quickly, though? That’s anyone’s guess. The company hasn’t published accurate books for at least a year now, but we can take some shots. Here’s mine.

Between Jan. 1 through March 31, the company closed 86% of its stores. When it reopened, another 2,820 new locations appeared on its mobile app. Suppose we can trust this number (which we can’t), and assume the cost of each store opening is roughly in line with its reported numbers from initial F-1 filings (which we also can’t). In that case, the company would have burned through $283 million on store openings alone. Considering prior negative run rates, operating costs over the past nine months could have cost the company another $350 million to $450 million.

All this means it’s doubtful there’s much of the $780 million cash pile left for Luckin’s stock holders. And whatever remains, you can be sure that the Iron Triangle and regulators will get their hands on it first.

Tom Yeung, CFA, is a registered investment advisor on a mission to bring simplicity to the world of investing. As of this writing, Thomas Yeung did not hold a position in any of the aforementioned securities.