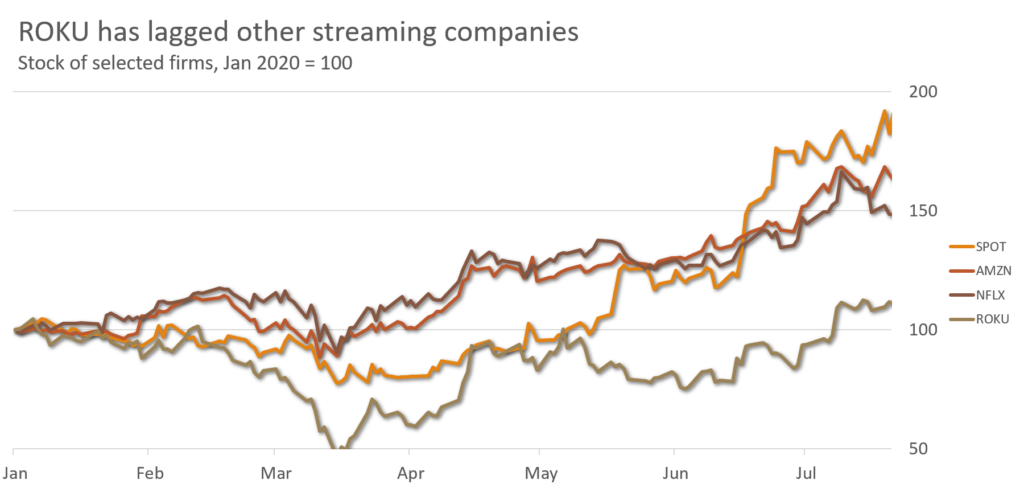

Since the beginning of the coronavirus pandemic, investors have nervously searched for quality “stay-at-home” stocks to protect their portfolio. Streaming stocks, in particular, have been a relatively bright spot in an otherwise down economy, with Amazon (NASDAQ:AMZN), Spotify (NYSE:SPOT), and Netflix (NASDAQ:NFLX) up between 50%-80% this year. So why is Roku (NASDAQ:ROKU), a video-on-demand (VOD) platform suited for the stay-at-home trend, up just 10%? Some investors might see Roku stock as a steal.

But don’t be fooled. Despite a meteoric 51% percent rise in 2019 sales, its growth has been largely thanks to a single source: TCL Electronics.

In other words, Roku has a growth problem. Smart investors should avoid its stock until the company diversifies its business.

Roku Stock Depends on TCL for Growth

“As a rule, a company can sell to powerful buyers and still come away with above-average profitability,” Harvard Business School professor Michael Porter wrote in 1979, “only if it is a low-cost producer in its industry or if its product enjoys some unusual, if not unique, features.”

By itself, Roku holds neither advantage. Its dongles compete directly with Amazon Fire Sticks, Google (NASDAQ:GOOG, NASDAQ:GOOGL) Chromecast and Apple (NASDAQ:AAPL) TV, where it’s neither the cheapest nor most feature-rich. Player revenues grew just 20% between 2015 through 2018, a rate far slower than peers.

So how did Roku grow 51% in 2019?

Thanks to an old 2014 agreement, Roku software found its way into smart TVs sold in the U.S. by TCL, a Chinese electronics manufacturer. And TCL has been growing. Thanks to low prices and aggressive sales, TCL’s market share in smart TVs skyrocketed from 1% in 2017 to 27% by 2019.

“This resounding success is largely due to our innovation, vertical integration, massive business scale,” said Chris Larson, Senior Vice President for TCL North America, continuing “and of course, strong relationships with partners like Roku.”

And Roku rode TCL’s success. Today, 1 in 3 smart TVs sold in the U.S. come with Roku’s software. Active accounts at Roku ballooned by 9.8 million in 2019 alone to 36.9 million. Sales have risen to $1.1 billion in 2019.

TCL Wants in on Roku’s Success

With these successes, investors might think Roku and TCL’s tie-up is a win-win for both sides. Over the past several years, however, it’s become clear that TCL ended up with the short end of the stick. And now they want in.

Roku makes 92% of its profits from advertising. The average revenue per customer in 2019 clocked in at $23.14. And how much does TCL receive? Thanks to their original 2014 agreement: none.

Sensing a missed opportunity, TCL has been working with other TV software providers to capture more customer revenue. In March 2020, the company announced a target of “profit from value-added Internet services exceeding 50%,” sending Roku’s shares down 5%.

Just three months later, TCL launched two Android TV models in the U.S., signalling the beginning of the end of the exclusive TCL/Roku partnership.

Roku Remains in Poor Competitive Position

TCL’s departure couldn’t have come at a worse moment for Roku.

Roku has lost money every year since its initial public offering (IPO) in 2015. Last year, the company lost $59 million. And in the first three months of 2020 alone, the company posted a $52 million loss. Demand for standalone Roku players has continued to lag. And though the average American now streams 8 hours of content per day, Roku has yet to turn a profit from its ad services.

What Should Investors Do About Roku?

As smart TVs continue to replace the conventional type, Roku’s sales will continue to grow. But its growth will come at a cost. That’s because TCL holds the keys to the customer. And to stay on the treadmill, Roku will have to make revenue concessions over the coming months. Already, rival Google has signaled willingness to cut its own share of revenue to drive aggressive growth. At the 2019 Connected TV World Summit, Google even announced plans to take zero revenue from TV operators.

Even in today’s market, Michael Porter’s advice from 1979 still holds true: to work with a behemoth like TCL, Roku will need to either cut costs or add unique features to its offerings. Doing either will decrease Roku’s already non-existent profits.

Morgan Stanley analyst Benjamin Swinburne places a $110 price target on Roku stock, a 35% downside. As Roku struggles to reach profitability and self-propelled growth this summer, investors should beware.

Tom Yeung, CFA, is a registered investment advisor on a mission to bring simplicity to the world of investing. As of this writing, Thomas Yeung did not hold a position in any of the aforementioned securities.