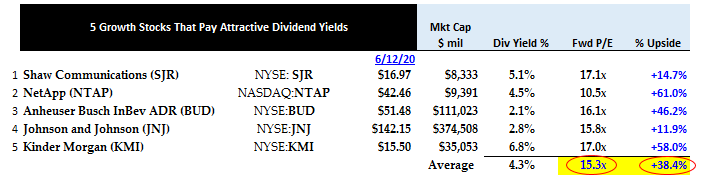

When considering stocks to highlight today, I wanted to find five growth stocks that not only pay attractive dividends but also have above-average upside prospects. But to be interesting for this list, these growth stocks also have to be reasonably cheap using fundamental metrics. The idea is that you get the best of both worlds — a cheap purchase points and high expected returns.

For example, the stocks I’ve honed in on here have expected earnings and/or free cash flow for the next year but still sell for less than sixteen to seventeen times earnings. In addition, the dividend yields are higher than average at 3% to 5%.

So, in a sense, you get both a growth stock and a relatively cheap stock. In fact, there is a term for this: GARP stocks (Growth At a Reasonable Price). You can Google the term “GARP stocks” and see what I mean.

GARP Stocks, Their Price Targets and Upside Potential

GARP stocks are in a sort of mid-point between the growth and value stock investment philosophies. They are cheap but their earnings are growing fast. They also pay attractive dividend yields.

The growth stocks also have good upside prospects. I measured the value of each stock using three different methods and then average them. The first is the price target based on its average dividend yield.

A second target price was derived by using the historical price-to-earnings ratio and applying it to forward earnings per share.

The last method uses comparable ratios of peers and applies those measures to derive the comp-based target price. I then averaged all three methods. The upside potential of all of these growth stocks is between 12% and 62%. As a group, they average about 38% upside potential.

The five cheap growth stocks I finally settled on are:

- Shaw Communications (NYSE:SJR)

- NetApp (NASDAQ:NTAP)

- Anheuser-Busch InBev (NYSE:BUD)

- Johnson & Johnson (NYSE:JNJ)

- Kinder Morgan (NYSE:KMI)

Let’s dive into this and look at these stocks further.

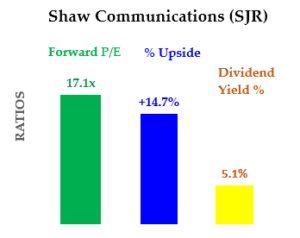

Growth Stocks: Shaw Communications (SJR)

Market Capitalization: $8.3 billion

Forward Price-Earnings Ratio: 17.1x

Dividend Yield: 5.1%

Target Price Upside: +14.7%

Shaw Communications is a Calgary, Canada-based internet broadband, TV and mobile phone provider. The company claims to be western Canada’s “leading networks and content experience” company. It serves British Columbia, Alberta, and southern Ontario with its mobile and TV package.

Earnings have been very steady at Shaw Communications. In the quarter ending February 2020, the company actually made slightly more net income than last year. Earnings were 24 cents per share vs. 23 cents last year.

Moreover, the company should make 99 cents per share in the year to August 2021 according to analysts polled by Seeking Alpha. That puts it on a reasonable 17 times earnings multiple.

Based on its historical dividend yield, the stock target is $18.24 per share, according to my calculations. The same method using its past five years’ historical P/E ratio derives a target of 21.79 per share.

Lastly, its comp-based target price is 18.34 per share. So, therefore, the average price target is $19.46 per share. That provides a very nice potential price appreciation upside of 14.7%.

Meanwhile, investors in SJR stock get paid a very attractive 5.1% dividend yield. In short, they get paid to wait for the value to emerge. The dividend is more than covered by expected earnings. This is an attractive GARP stock.

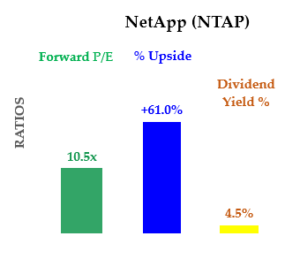

NetApp (NTAP)

Market Cap: $9.4 billion

Forward P/E ratio: 10.5x

Dividend Yield: 4.5%

Target Price Upside: +61%

NetAppis a physical flash array and cloud-based data storage company. Its revenues for the quarter and fiscal year ending April 24, 2020, took a hit like most technology companies. However, its prospects are for higher revenues and earnings this coming year, signaling an expected rebound. Companies still need to store their data, despite the recession.

Meanwhile, NetApp produced solid earnings margins and high free cash flow in the past year. In fact, NetApp is one of the few companies that still pay dividends and buy back shares despite the economic downturn.

For the year ending April 2022, analysts expect earnings per share of $4.05, according to Seeking Alpha. That is expected to be 22% over the earnings of $3.31 expected in the year ending April 2021. This means NTAP stock is cheap at just 10 times forward earnings.

Moreover, the dividend is very attractive with a 4.5% dividend yield. In addition, I used the same 3 point method to derive the stock’s expected target price of $68.35 per share. As a result, NTAP stock has an attractive +61% upside potential.

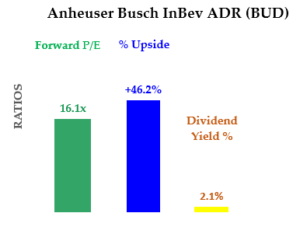

Anheuser-Busch InBev (BUD)

Market Cap: $111 billion

Forward P/E Ratio: 16.1x

Dividend Yield: 2.1%

Target Price Upside: +46.2%

Anheuser-Busch InBev makes Budweiser, Bud Light and other popular beers. The company posted a rare net income loss in Q1 ending March. But what the company calls “underlying earnings” fell 30% year-over-year from 73 cents to 51 cents per share.

But the good news is that people are drinking more alcohol now that lockdowns are over. In fact, the company claims its U.S. revenues were actually higher. But there is no getting around that volumes were down a lot (over 33% year-over-year) in April.

AB InBev reported that total alcohol sales grew 22% year-over-year for the week ending May 30. Earnings going forward after Q2 should show good growth.

For example, analysts at Seeking Alpha expect EPS of $3.2o by December 2021. This is 77% higher than the depressed earnings expected for this year. That also means BUD stock trades for just 16 times forward earnings, a very cheap price.

Moreover, the company’s $321 million acquisition of Craft Brew Alliance (NASDAQ:BREW) announced late last year is expected to close soon. That will boost BUD’s earnings over the next year.

Moreover, AB InBev’s dividend yield at 2.1% is still attractive. I estimate that the true value target price is $75.26, using the three methods outlined earlier. BUD stock has an upside of over +46% over the next year or so as a result.

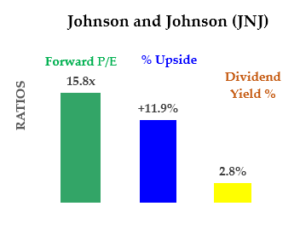

Johnson & Johnson (JNJ)

Market Cap: $142 billion

Forward P/E: 15.8x

Dividend Yield: 2.8%

Target Price Upside: +12%

Johnson & Johnson is one of the top five companies with a potential Covid-19 vaccine. It recently moved its Covid-19 phase 2 study forward so that it now will start in late July.

JNJ is a large-cap growth stock with earnings that are expected to grow 17% to $9.05 for the year ending December 2021. That gives JNJ stock a reasonable P/E ratio of just under 16 times.

Moreover, I estimate its true value, using the dividend yield method, the P/E method, and the comp method, is $159.09 per share. That represents an upside of 12% over the next year, not including its 2.8% dividend yield.

Moreover, all bets are off if its vaccine efforts pay off. You could see JNJ stock go through the roof as a result. So think of it as a GARP stock with a warrant or option on a huge payoff over the next year.

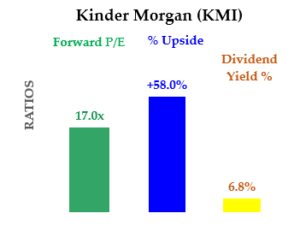

Kinder Morgan (KMI)

Market Cap: $35 billion

Forward P/E: 17x

Dividend Yield: 6.8%

Target Upside Potential: +58%

Kinder Morgan is a Houston-based natural gas pipeline and storage company, including liquified natural gas. Kinder Morgan is a massive midstream oil and gas company. The company operates 83,000 miles of natural gas pipelines and 147 terminals.

KMI stock yields 6.8% with its annual dividend per share set at $1.05 per share. Moreover, in the company’s most recent conference call on its Q1 2020 earnings, a possible increase was discussed. Management expects to increase the dividend per share rate to $1.25 in January 2021.

KMI has plenty of FCF to cover the dividend. Its LTM FCF yield as of Q1 2020 was 8%. This is higher than the 6.8% dividend yield and so the dividend is well covered. So this looks like a solid high dividend yield stock.

I estimate the stock’s value is $24.49 per share or +58% over today’s stock price. This, again, is based on the company’s historical dividend of 4%, its historical average P/E ratio of 35.9x and its comp P/E ratio of 16 times. This looks to be a good long-term investment for most investors.

The table below shows that the average P/E for the group as a whole is just over 15 times earnings and a dividend yield of 4.3%. This is better than the average stock, especially when you consider the average upside for the group.

Investors in GARP stocks like these tend to well over time. They offer the best of both the growth stock world (earnings growth) and value stocks (cheap prices). Therefore, investors tend to do well over time.

Moreover, you get paid to wait for the value to emerge. The dividend yield of over 4.3% annually represents a much better deal than you can get by leaving your money in the bank. In addition, you get all the upside potential of these stocks.

As of this writing, Mark Hake, CFA does not hold a position in any of the aforementioned securities. Mark Hake runs the Total Yield Value Guide which you can review here.