People are seen wearing protective face masks outside a Chase Bank in New York, March 27, 2020.

Noam Galai

Major banks and health care companies will be the first to reveal how the early weeks of the coronavirus shutdowns impacted their profits, outlook, work force and customers.

Earnings season begins in the week ahead, with JPMorgan, Wells Fargo and Johnson & Johnson among the first to release first quarter earnings reports Tuesday. But the stock market that appears to be willing to overlook anticipated bad news for now.

“Most of the slowdown occurred in March,” said Art Hogan, chief market strategist at National Securities. “Do we react to the hypernegative economic data we see? What we do react to is any semblance of guidance. There is no clarity about duration of the economic slowdown. You’re going to see a preponderance of companies pulling their guidance for the calendar year … I think it’s going to be more companies doing that, than not.”

Stocks bounced higher in the four-day pre-Easter holiday week, with the S&P 500 up 12.1%, in the best week since 1974. Investors reacted to signs that new cases of the virus may be peaking in U.S. hot spots and Europe. The stock market also got a boost Thursday from the Fed’s announcement of a $2.3 trillion in programs to help the economy.

The market will turn its focus to earnings in the coming week, but there are also some important economic reports, including March retail sales. The virus shutdowns resulted in a rapid closing of many retail establishments, a sudden drop off in gasoline sales, and a steep decline in auto sales. That has resulted in a forecast for a 7% decline in March retail sales.

“People are more interested in news about the spread of the virus than they are about the economic data,” said Hogan. “We got another massive increase in jobless claims. That’s ignored because we’re listening to who is plateauing … Is New York actually getting better and we see a peak? I get the feeling people are going to look at the first quarter earnings and say, ‘we know this and you should pull your guidance.'”

Before March, analysts had expected an increase of several percent in first quarter earnings. According to Refinitiv’s I/B/E/S, the forecasts and some actual numbers point to an 8.1% decline. For the second quarter, earnings are expected to decline about 20%, while economists expect an unprecedented 30% contraction in GDP during the quarter.

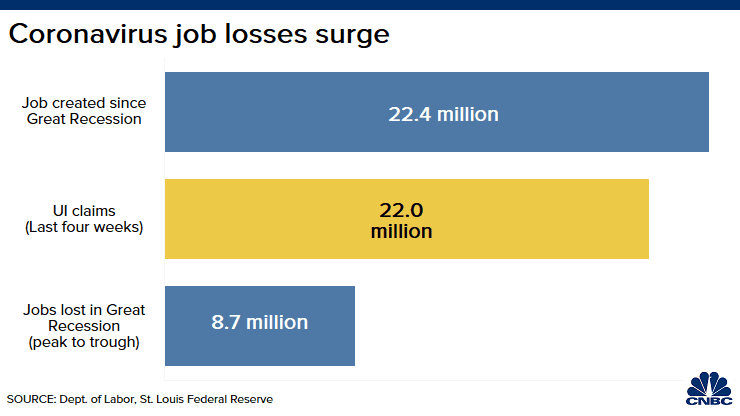

Weekly claims data will also be important, now with nearly 17 million claims filed in just three weeks. Economists expect millions more to be filed for the week ending April 11.

Other major banks report in the week ahead, including Citigroup, Bank of America and Goldman Sachs on Wednesday. Hogan said companies like JPMorgan may be able to reveal how the Fed’s programs are working, both those for small business lending and others that were intended to help the credit markets.

Earnings for financial companies are expected to be down 13.7%, according to I/B/E/S data. Communications services companies are expected to have fared the best in the first quarter, with an expected 7.8% earnings gain. Health care companies are expected to see a modest gain of 1.6%.

The market will also watch Johnson & Johnson and Abbott on Thursday, as they discuss not only their results but potential developments with coronavirus-related therapies or products. J&J is working on a potential coronavirus vaccine, while Abbott has a new test kit for the virus.

‘That’s going to be the more intriguing aspect of the conference call when Abbott talks about their new test kit and how fast it is, and what they can produce,” said Hogan.

Analysts are also watching to see whether companies discuss ways they are cutting back costs. “As we go through the earnings season, what we’re concerned about is what companies are going to cut their dividends,” said Quincy Krosby, chief market strategist at Prudential Financial.

UBS Global Wealth Management strategists said in a note that 51 companies, accounting for 27% of 2019 aggregate buybacks, have suspended their repurchase programs. More capital was returned to shareholders via buybacks than dividends.

“As a result, dividend payout ratios are somewhat low compared to other regions. So despite the expected sharp decline in profits for 2020, we expect more modest dividend cuts of 6-8%,” the UBS strategists wrote. “For now, we are assuming that the Federal Reserve does not require US banks to cut or suspend their dividends. We expect further dividend cuts in the consumer discretionary, energy, and real estate sectors. Healthcare, segments of tech, and consumer staples will likely report token dividend increases.”

Krosby said as the earnings season goes on, investors will be watching ways the economy could begin to return to normal.

“The market is moving in phases right now. The most important phase is the virus itself,” she said. She said it will matter a lot that New York continues to show positives, like a plateauing of cases and fewer hospitalizations.

Eventually companies will be able to talk about moving forward . “Are they seeing anything in terms of green shoots? Any positives? These are going to be very important as we go through the earnings season,” Krosby said. “That is complimented by when do we lift the restrictions on going back to work, and the polling data will be critical on when Americans feel comfortable going back to work, going back to a more normal environment.”

Week ahead calendar

Tuesday

Earnings: Johnson & Johnson, JPMorgan Chase, Wells Fargo, Fastenal, First Republic Bank, Infosys, JB Hunt

6:00 a.m. NFIB

8:30 a.m. Import prices

Wednesday

Earnings: Bank of America, Citigroup, Goldman Sachs, Charles Schwab, PNC Financial, U.S. Bancorp, UnitedHealth, Bed Bath & Beyond, Wipro

8:30 a.m. Retail sales

8:30 a.m. Empire State manufacturing

9:15 a.m. Industrial production

10:00 a.m. Business inventories

10:00 a.m. NAHB survey

2:00 p.m. Beige book

4:00 p.m. TIC data

Thursday

Earnings: Abbott Labs, BlackRock, Bank of NY Mellon, KeyCorp, Rite Aid, Intuitive Surgical

8:30 a.m. Initial claims

8:30 a.m. Housing starts

8:30 a.m. Philadelphia Fed survey

8:30 a.m. Business leaders survey

Friday

Earnings: Citizens Financial, Kansas City Southern, Regions Financial, Schlumberger, State Street