If you’re looking for a great comeback story, then Advanced Micro Devices (NASDAQ:AMD) stock is your answer.

I’ve written about AMD stock before, and recently named it one of my top semiconductor stock picks. But even since that writing, AMD stock has been extremely impressive. Even in the midst of the selloff regarding the coronavirus from China.

And to make it even better, there are some pretty exciting developments on the horizon for AMD.

That said, let’s take a closer look at this stock that has an “A” rating in my Portfolio Grader.

AMD Stock at a Glance

AMD stock is trading at $41.06, which is down 10.6% year-to-date. That’s not bad, though, considering the broader Nasdaq Composite is down around 24% and the S&P 500 lost 31% so far in 2020.

Looking at the bigger picture, however, really puts the AMD growth story into focus. Advanced Micro Devices stock is up a whopping 285% over the last two years; Even you take the coronavirus selloff into account!

By comparison, competitor Intel (NASDAQ:INTC) lost nearly 3% in the last two years, and Nvidia (NASDAQ:NVDA) took a nearly 10% thumping.

In its last earnings report in January, AMD posted earnings of 32 cents per share, beating analysts’ expectations of 31 cents per share. Revenue was $2.13 billion, which also topped expectations of $2.11 billion.

Revenue for AMD was also up about 50% year-over-year.

Looking ahead, analysts are expecting depressed earnings for the first half of the year in light of the coronavirus slowdown. Expectations are for earnings of roughly 18 cents per share in the first quarter, growing to 21 cents in Q2 and then to a more typical 29 cents per share in Q3.

The Bullish Case for AMD Stock

AMD isn’t a new company — it has been around for 50 years. But as recently as 2015, it was taking a huge beating at the hands of INTC and NVDA.

Disappointing product launches and sapping market share robbed AMD of its profitability. From 2014 to 2016, the stock price cratered by 93%, falling all the way to near $2 per share.

But, wow, what a difference five years makes.

At AMD’s annual Financial Analyst Day on March 5, company officials announced an aggressive growth plan.. This included their projected revenue to increase at about 20% of the compound annual growth rate.

And while those numbers do include current 2020 guidance, AMD says the impact from the coronavirus outbreak is expected to be “modest,” with revenue likely coming in at the lower end of guidance of about $1.8 billion.

AMD also is expecting sales to increase 150% over five years, from $6.7 billion in 2019 to $16 billion by 2024.

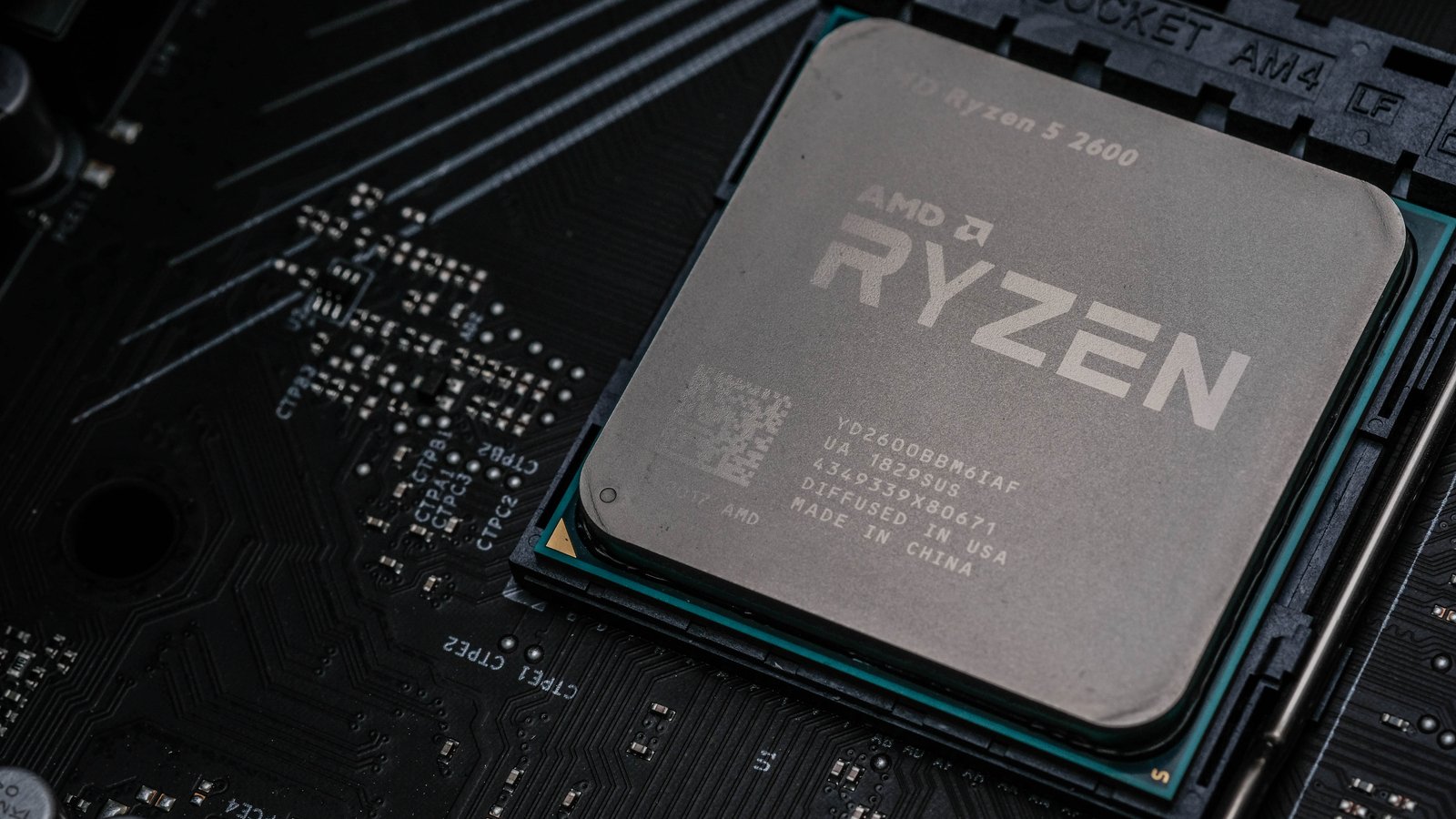

Furthermore, one reason why AMD can afford to be so bullish is its work with Microsoft (NASDAQ:MSFT). Last year, AMD provided processors for the first time to Microsoft’s Surface laptops, including a customized Ryzen 3000 chip with Radeon RX Vega 11 graphics.

Microsoft and AMD called it “the fastest mobile processor AMD has ever made.”

Now, there are reports that AMD’s Ryzen 4000-series chips are being used in Microsoft’s newest Surface computers. And even better for AMD and consumers, the 4000-series chips have improved battery life and thermal design that widen the performance gap between AMD and Intel processors.

And AMD is continuing to cut into Intel’s market share. A February survey showed that 21.4% of respondents were using AMD processors, up from 19.4% just two months prior.

All this means that AMD will continue to chip away — pardon the pun — at Intel’s market share for the foreseeable future. That’s exciting for investors.

The Bottom Line on Advanced Micro Devices Stock

If you’re watching your portfolio shrink in this bear market and are worried about how long it will take the global economy to recover from the coronavirus, AMD is a pretty appealing stock to help cure your blues.

The company’s stock is already less impacted than the broader market to the sell-off. However, it can be had at a hefty discount now.

And when you consider how AMD is outperforming its primary competitors and its opportunities with Microsoft’s Surface devices, then the sky’s the limit for this “A”-rated semiconductor stock.

Louis Navellier had an unconventional start, as a grad student who accidentally built a market-beating stock system — with returns rivaling even Warren Buffett. In his latest feat, Louis discovered the “Master Key” to profiting from the biggest tech revolution of this (or any) generation. Louis Navellier may hold some of the aforementioned securities in one or more of his newsletters.