U.S. stock futures are galloping out of the gate this morning. Buyers’ enthusiasm, which sent equities out on a high note, is returning to ring in the new year.

Ahead of the bell, futures on the Dow Jones Industrial Average are up 0.59% and S&P 500 futures are higher by 0.63%. Nasdaq Composite futures have added 0.86%.

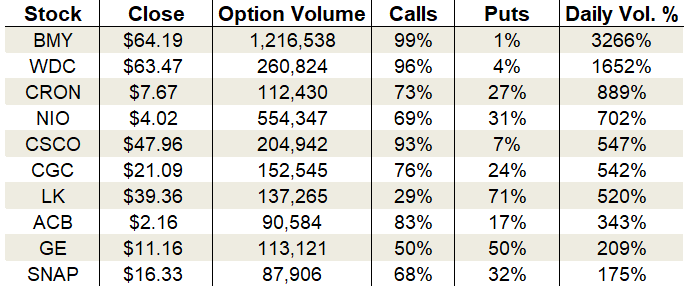

The pattern in the options pit on the last trading day of the year reflected the trend that carried us all through December. Call volumes outpaced puts by a massive margin, racking up 18.8 million contracts. Puts, by contrast, only saw 12.1 million contracts change hands.

Moving to the CBOE Volatility Index (VIX) revealed a similar disparity. The single-session equity put/call volume ratio dropped back to 0.56. At the same time, the 10-day moving average slipped to 0.53. Here’s the bottom line — complacency reigns and bulls are running away with this market.

Options traders zeroed in on pot stocks on Tuesday with Cronos (NASDAQ:CRON), Canopy Growth (NYSE:CGC) and Aurora Cannabis (NYSE:ACB) all landing atop the most-actives list. We’ll look at two of the three and take a renewed look at one of the best lookers in the healthcare sector — Bristol-Myers Squibb (NYSE:BMY).

Let’s take a closer look.

Bristol-Myers Squibb (BMY)

Bristol-Myers Squibb closed out the year whiskers from a 52-week closing high. It has taken full advantage of the healthcare sector’s fourth-quarter awakening. All told, BMY stock rallied 51% off its July lows. The turnabout was strong enough to turn every major moving average higher, confirming buyers are in full and total control of the trend.

The past three weeks have seen a classic high base pattern form, creating a clean breakout trade for spectators looking to get in on the bulls’ game. Watch for a close over $64.75 to confirm the next advance is afoot.

BMY’s bullish pattern aside, the real reason this healthcare giant saw more options action than any other stock was its dividend. Traders targeting its quarterly payout of 45 cents used call options to control the shares. The dividend yield is 2.8%.

As is always the case with dividend option plays, calls dominated the day claiming 99% of the 1,216,538 contracts that changed hands. The total activity ballooned to 1,873% of the average daily volume.

Implied volatility ended at 24% or the 16th percentile of its one-year range. Premiums are pricing in daily moves of 99 cents or 1.5%. The cheap pricing suggests long calls or call spreads are attractive bullish bets.

Cronos Group (CRON)

Cronos Group shares blasted higher Tuesday, ending the year with momentum at its back. CRON stock ended the rousing session up 15.9% with 19.8 million shares traded — its largest volume day of December. The gains were significant enough to push CRON back above its 50-day moving average for the first time since June.

And with that, the stock’s technical posture is looking up for the first time in ages. While much work remains before the longer-term damage is healed, buyers have finally established a foothold just in time for 2020. The next overhead resistance is $9.30, making it a logical target if bulls press their advantage this week.

The stock rally lit a fire under options trading Tuesday. Activity boomed to 510% of the average daily volume, with 112,430 total contracts traded. 73% of the trading came from call options alone.

The demand surge jammed implied volatility higher on the day to 85% placing it at the 40th percentile of its one-year range. Premiums are pumped so short puts aren’t a bad way to go if you’re fishing for a bottom here. The potential return on investment is high for this strategy right now.

Canopy Growth (CGC)

Cronos Group wasn’t the only marijuana stock feeling the love. Canopy Growth also levitated on the session, gaining 12.2% with 16.4 million shares crossing the tables. Like CRON, CGC stock now sits above its 20-day and 50-day moving averages and is quickly approaching a critical resistance zone.

Ever since October, $22.50 has sat atop the stock as an impenetrable ceiling. That’s the level to watch. A break above it would signal a shift in Canopy’s intermediate trend and justify deploying bullish trades. Volume patterns are also supporting a more optimistic view of CGC stock’s prospects. Accumulation days litter the landscape suggesting institutions are wading back into the waters.

On the options trading front, traders heavily favored calls on the session. Total activity swelled to 311% of the average daily volume, with 152,545 contracts traded. Calls drove 76% of the day’s tally.

Implied volatility rallied to 89% or the 76th percentile of its one-year range. Premiums are baking in $1.18 or 5.6% daily moves. Like CRON, naked puts offer big payouts if you’re willing to bank on the stock stagnating or rising from here.

As of this writing, Tyler Craig didn’t hold positions in any of the aforementioned securities. For a free trial to the best trading community on the planet and Tyler’s current home, click here!