I have written about Amazon (NASDAQ:AMZN) stock many times before and I have been consistent with my message. Long term, AMZN stock will be higher. This management team under the leadership of Jeff Bezos has earned the benefit of the doubt. They have executed very well on their plans for over a decade. That’s how they’ve come to dominate so many verticals including the cloud.

In the last five years, Amazon stock continues to clobber the averages and all of the top five tech mega-cap companies. It’s up more than 472% while the S&P 500 is up only 52%. For reference, Apple (NASDAQ:AAPL), Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL) and Facebook (NASDAQ:FB) are up 120% to 160%. Microsoft (NASDAQ:MSFT) is up 220% for the same period. There is no doubt that AMZN is a star among giants.

In spite of the winning record, lately the consensus on Wall Street is that AMZN is not a stock to buy today. The reason they cite is that management is in spending mode. This to me is the opportunity because whenever AMZN spends money, it usually results in a new revenue source. But for now and from the report the company delivered on their last earnings call, the critics have their reasons to avoid the stock.

For the long term, dips are buying opportunities. Since I am not a perma-bull just for the sake of being one, I prefer to trade the AMZN price action based on the short-term levels.

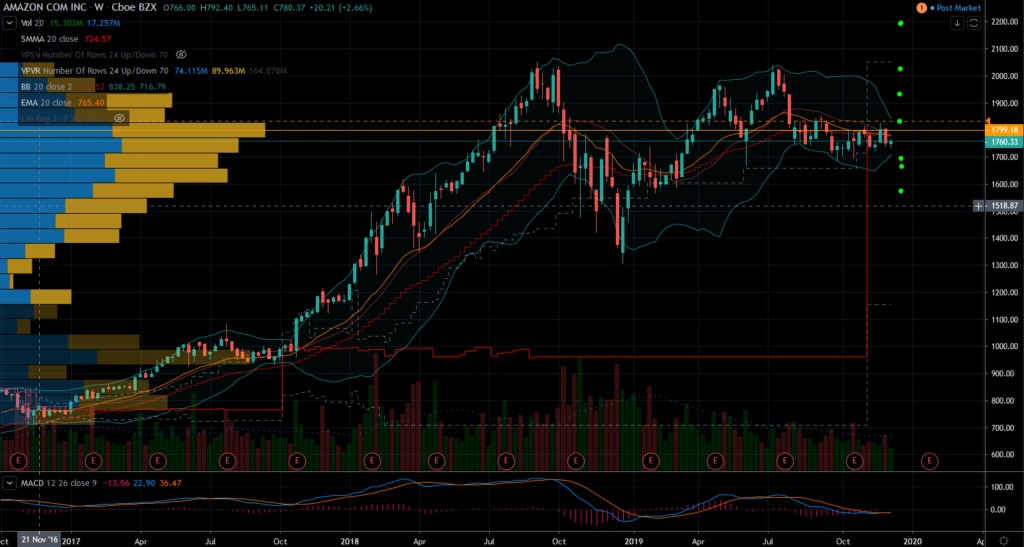

Amazon stock looks like a stock that is consolidating around its five-year point of control. This is the level where most of the price action occurred during that stretch of time. As buyers and sellers fight it out around $1,760 they establish a strong base. Bulls then use this base to mount another breakout rally. This is also the case on lower time frame charts. The 12-month daily chart also shows the AMZN stock price has been pivoting around the $1,777 point of control. These levels tend to be sticky as they provide support, but are also tough to break through.

Resistance Is AMZN Stock’s Upside Opportunity

If and when AMZN stock rises above the zone it will overshoot much higher. Depending on the investor trading speed there are a few different bullish trigger levels, the slowest of which is near $1,833 per share. Above it the bulls can launch a rally that can bring about $150 of upside potential. This would bring it close to filling a gap just below $2,000 per share.

Shorter term, there are resistance levels at $1,766 and $1,789. But these are also bullish triggers when they are taken out. It is important to note that $1,808 was a major failure point from late November which will also be strong resistance on the way up.

Amazon Needs to Hold Important Levels

I promised you that I won’t be a perma-bull, so it is not all coming up roses for AMZN stock these days. Yes, there is strong support near $1,740, but if it closes below $1,730 or $1,723, sellers will gain momentum downward. But even then the damage should be contained.

There is a very clear bounce level from the earnings reaction near $1,690 per share. Usually emphatic rejections of a level like the one from the earnings report and from Oct. 19 are tough levels to breach.

There are other ways of trading Amazon stock without being in immediate danger through options. A few weeks ago I wrote about selling the Amazon January $1,550 puts and collecting $6 for the risk. This trade is now a huge win with $4 of profit without any money out of pocket to do it. The risk then would have been to own AMZN stock but with an 11% buffer. The options markets offer hundreds of ways to trade AMZN bullish, bearish, or both.

Nicolas Chahine is the managing director of SellSpreads.com. As of this writing, he did not hold a position in any of the aforementioned securities. Join his live chat room for free here.