The trading sessions are starting to get quiet as we near Thanksgiving. Let’s look at a few top stock trades going into the last full trading session of the week.

Top Stock Trades for Tomorrow No. 1: Disney (DIS)

Disney (NYSE:DIS) stock has looked great ever since reporting earnings earlier this month. After hitting $150 a few weeks ago, shares recoiled and consolidated in a sideways pattern.

This flag resolved higher on Tuesday, with Disney breaking out to new highs.

What now? Well, as long as DIS can hold over $150, then it looks okay on the long side. Back below this mark and it may need more time to consolidate. Keep it simple.

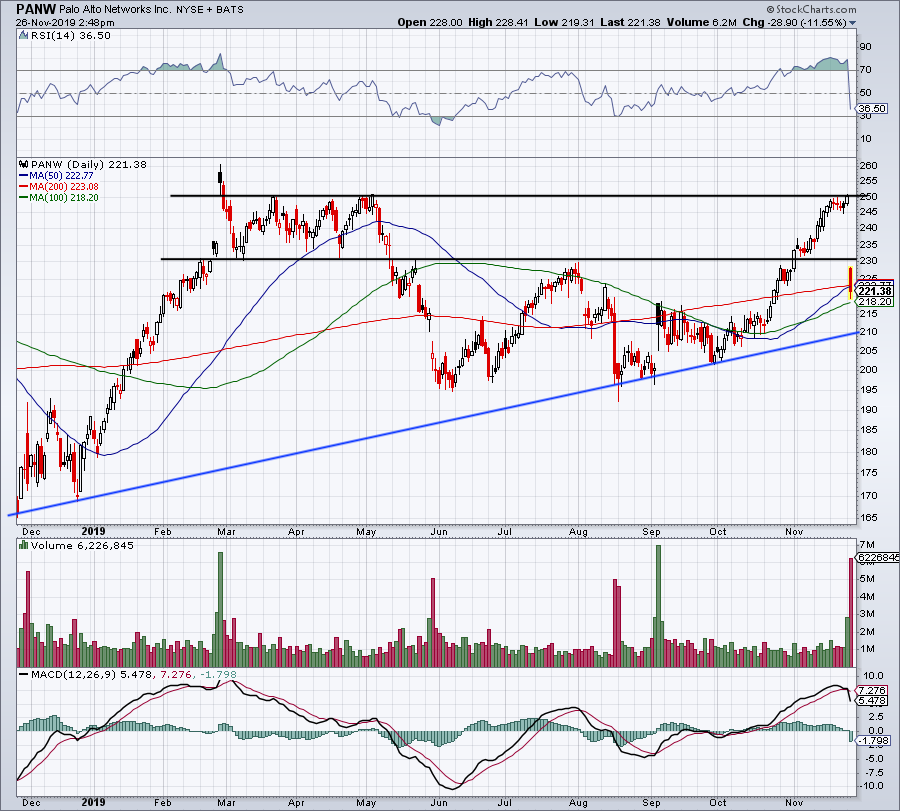

Top Stock Trades for Tomorrow No. 2: Palo Alto Networks (PANW)

Many traders were looking for Palo Alto Networks (NASDAQ:PANW) to break out over $250 when it reported earnings. Instead, it broke down.

Between $218 and $222, PANW has multiple major moving averages as potential support. Falling below them may bring up a test of long-term uptrend support, currently near $210.

If Palo Alto can use the $218 to $222 area as support, bulls will need to see the stock reclaim $230. Over this mark and PANW can begin filling the gap up toward $250.

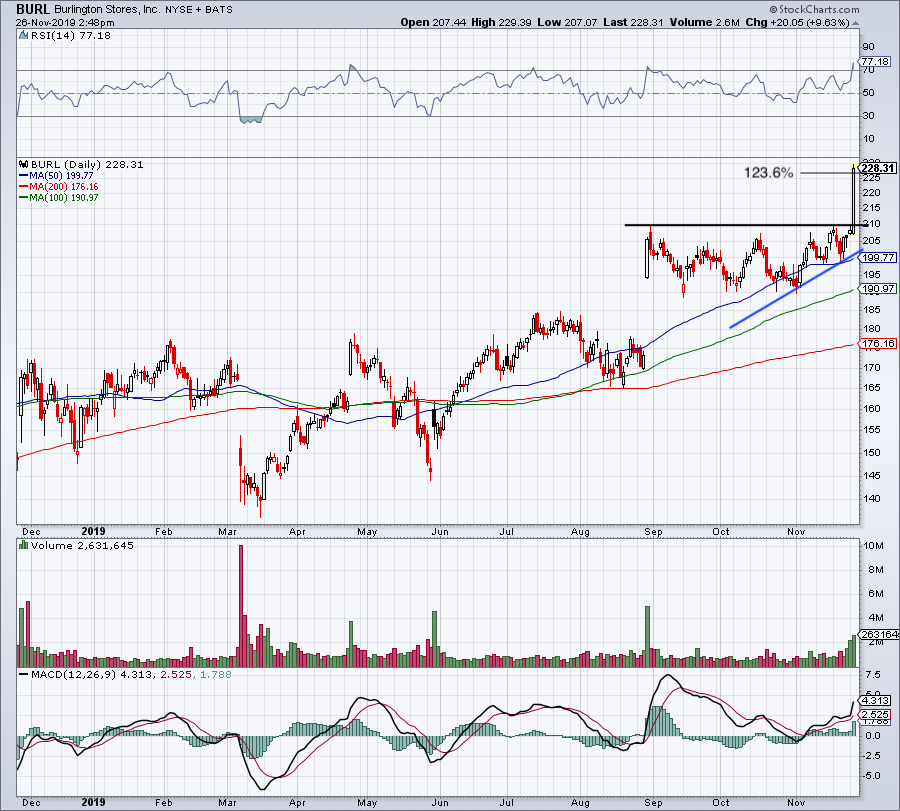

Top Stock Trades for Tomorrow No. 3: Burlington Stores (BURL)

Many retailers are struggling this earnings season, but Burlington Stores (NYSE:BURL) is not among them. Shares are up almost 9% after better-than-expected earnings.

On top of the strong move, BURL stock erupted for a big-time breakout. That move came over $210. Going forward, this is now the must-hold level for bulls. Back below this mark, and BURL stock will need to be reassessed.

From here, shares become a buy on the dips.

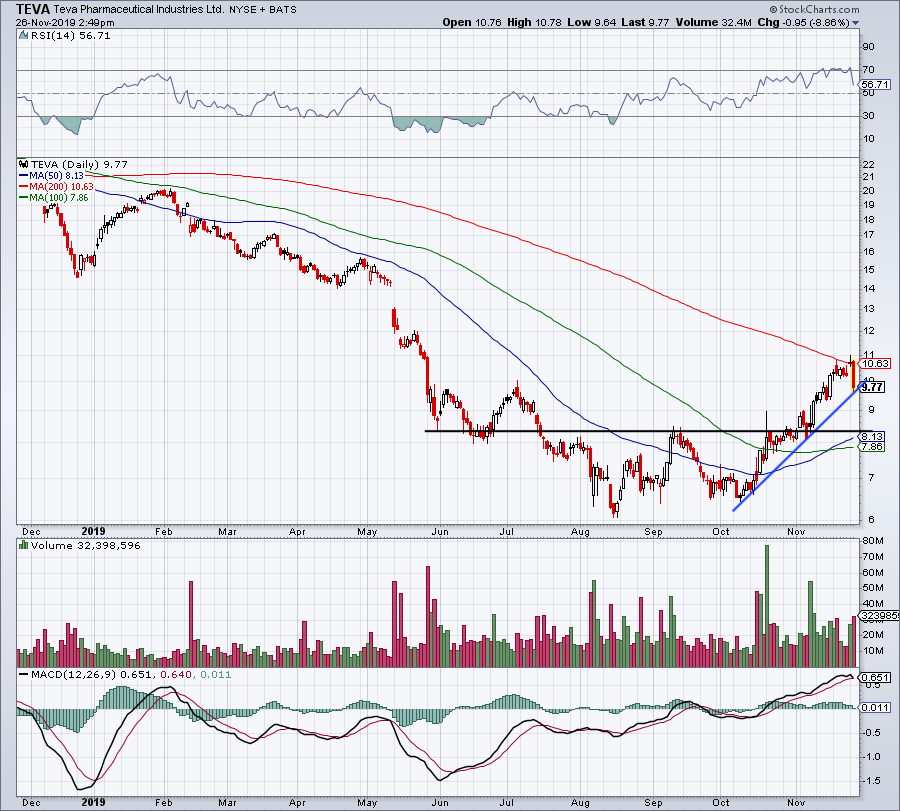

Top Stock Trades for Tomorrow No. 4: Teva (TEVA)

Teva (NYSE:TEVA) and others took it on the chin Tuesday as a criminal inquiry over the opioid epidemic weighs on investors.

News aside, the technicals paint a simple picture of the 200-day moving average rejecting Teva stock. While uptrend support (blue line) is buoying the name for now, it may be hard for bulls to put much faith in this mark. A break could easily send shares back down to the $8 to $8.50 area.

Falling below the 100-day at $7.86 could send shares back down to the $6.50 area. On a rebound, see if the stock can reclaim the 200-day moving average.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, Bret Kenwell is long DIS.