U.S. stock futures are inching higher on what is bound to be a low volume and likely low volatility trading session ahead of Thanksgiving. Heading into the open, futures on the Dow Jones Industrial Average are down 0.01%, and S&P 500 futures are higher by 0.06%. Nasdaq Composite futures have gained 0.16%.

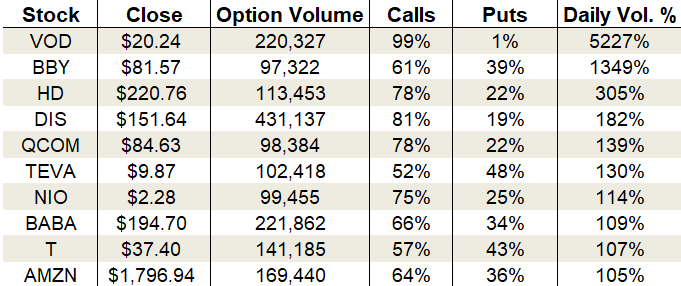

In the options pits, call volume fell to its lowest reading in a few weeks while put volume matched Monday’s metrics. About 18.2 million calls and 14.7 million puts traded by day’s end. Specifically, about 19.1 million calls and 14.6 million puts changed hands on the session.

As for the action at the CBOE Volatility Index (VIX), the single-session equity put/call volume ratio fell to 0.57, closing in line with its 10-day moving average. Its inability to maintain the few mild spikes seen over the past month show just how fleeting panic has been in this market.

Options traders were chasing call options yesterday in the following stocks. Best Buy (NYSE:BBY) saw renewed options interest after topping earnings estimates and launching to a new 52-week high. Home Depot (NYSE:HD) shares are recovering after a nasty earnings-driven flush. Finally, Amazon (NASDAQ:AMZN) is waking up after a month of ignoring the market rally.

Let’s take a closer look.

Best Buy (BBY)

Source: The thinkorswim® platform from TD Ameritrade

Third-quarter earnings lit a fire under Best Buy shares sending them to a new 52-week high. The ramp was stopped short of record levels, but only by pennies.

The consumer electronics retailer earned $1.13 per share on revenue of $9.76 billion. Both metrics grew by 22% and 2% compared to the year-ago quarter. Analysts were looking for $1.04 per share on $9.74 billion in sales. So chalk this up as a clear beat.

BBY stock launched 9.9% with over 13.9 million shares traded, making it the second most-active trading session of the year. With the gains, BBY was able to break out of its eight-month trading range and now looks supremely bullish heading into the holidays.

On the options trading front, traders chased calls all day long. Activity rocketed to 1,349% of the average daily volume, with 97,322 total contracts traded. Calls drove 61% of the day’s gain.

The post-earnings volatility crush was on full display driving the reading down to 31% or the 35th percentile of its one-year range. Premiums are now pricing in daily moves of $1.60 or 2%

The Trade: Sell the Jan $75/$70 bull put spread for 75 cents.

Home Depot (HD)

Source: The thinkorswim® platform from TD Ameritrade

A wrecking ball crashed into Home Depot shares after disappointing earnings sending them down almost 10%. But all signs point to buyers returning and further downside should be limited. The candlestick pattern over the past week has been textbook. Momentum slowed into support and selling pressure receded. Then, buyers swarmed in a big way creating two massive accumulation days.

While there are a still a few overhead resistance levels to contend with, a run back to $230 could be in the cards. A break below $216 would change my mind, but until then, it’s the bulls’ game to lose.

Tuesday’s options trading confirmed buyers’ return. Calls outpaced puts by a mile, accounting for 78% of the session’s sum. Total activity popped to 305%, with 113,453 contracts changing hands.

Implied volatility sits at 19% or the 16th percentile of its one-year range. Premiums are low, but there’s still enough juice to warrant bull puts if you want to bank on the stock not going much lower.

The Trade: Sell the Jan $205/$210 bull put spread for 50 cents.

Amazon (AMZN)

Source: The thinkorswim® platform from TD Ameritrade

For months Amazon has utterly refused to participate in the bull run. Meanwhile, seemingly every other tech stock has been flying high. But I have a sneaky suspicion that this week’s awakening could finally signal AMZN stock is ready to join the party. The past two sessions saw an uptick in volume and robust rallies that pushed higher into the closing bell showing the compelling conviction of buyers.

A break above the 200-day moving average and horizontal resistance at $1,810 is needed before I’m willing to throw my lot in with bulls. All it will take is one more day like Tuesday to get us there, though. So stay alert.

On the options trading front, calls proved more popular than puts. Activity edged slightly higher to 105% of the average daily volume, with 169,440 total contracts traded. 64% of the trading fell on the call side of the ledger.

Implied volatility continues to languish at the lower end of its range. At 19%, it sits at the 6th percentile. Premiums are baking in daily moves of $21.68 or 1.2%.

The Trade: Bull call spreads are my weapon of choice here if the stock can break out.

As of this writing, Tyler Craig held bullish positions in HD. For a free trial to the best trading community on the planet and Tyler’s current home, click here!