U.S. stock futures are edging higher this morning after a messy Halloween session. Sellers emerged early yesterday after concerns over the U.S.-China trade war surfaced, but buyers returned mid-day and powered the market higher into the close.

Ahead of the bell, futures on the Dow Jones Industrial Average are up 0.42% and S&P 500 futures are higher by 0.44%. Nasdaq Composite futures have added 0.46%.

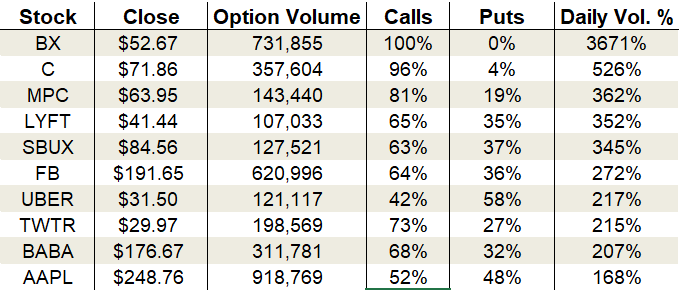

In the options pits, call volume pushed to its highest level of the week, with about 21.8 million calls changing hands. On the other side of the aisle, 17.4 million puts crossed the tables.

Meanwhile, over at the CBOE Volatility Index (VIX), the single-session equity put/call volume ratio rallied back to 0.75 — a two-week high. The 10-day moving average ticked back above 0.65.

Options traders were active in Lyft (NASDAQ:LYFT), Twitter (NYSE:TWTR) and Alibaba (NYSE:BABA), among other big names.

Let’s take a closer look.

Lyft (LYFT)

The initial gap higher in Lyft shares after earnings was swatted down faster than a flying paper wad by Dikembe Mutombo in a Geico commercial. No, No, No.

The ride-hailing company posted another round of losses for the third quarter but was able to top analysts’ revenue estimates. Revenue grew to $955.6 million compared to only $585 million from one year prior. On the bottom line, Lyft’s adjusted loss was $1.57 a share.

By day’s end, LYFT stock fell 6.1% amid heavy selling pressure. That’s compared to yesterday’s close, though. If you look at the drop from this Thursday morning’s high, it’s actually a 9.6% whacking. Suffice it to say, sellers ran the tables and reaffirmed the dominance of the intermediate-term downtrend. Until the stock can establish itself above the 50-day moving average, bullish trades are highly suspect.

On the options trading front, calls proved more popular despite the day’s beatdown. Over three and a half time times the average daily volume racked up, with 107,033 total contracts traded. 65% of the trading came from call options alone.

Twitter (TWTR)

After five straight down days following a nasty earnings report, buyers are finally coming to Twitter’s aid. Thursday’s intra-day rally pushed TWTR stock 3.9% off the lows, creating a textbook bullish hammer candle. Volume surged, suggesting the snap-back could have staying power.

The location of yesterday’s rebound isn’t a coincidence. Earlier this year, TWTR found support in the $29 zone multiple times. Buyers have once again returned to defend their turf. Here’s the bottom line. If you’ve been waiting for signs that a short-term low is forming, you now have them.

Selling naked puts offers a high probability path to bottom fishing here. I like the Dec $28 strike price that currently trades for 70 cents.

As far as options trading activity goes, calls dominated the session accounting for 73% of the take. The total number of contracts grew to 215% of the average daily volume, with 198,569 contracts traded.

Implied volatility continued its post-earnings drop, falling to 36% or the 14th percentile of its one-year range. Premiums are baking in daily moves of 68 cents or 2.3%

Alibaba (BABA)

Alibaba stock options were heating up ahead of this morning’s earnings report. The initial reaction to the numbers is positive and has the stock trading up slightly to $179. We haven’t even taken out yesterday’s high, though, so no need to pull out the pompoms yet.

For the September-ending quarter, the company posted adjusted earnings per share of $1.83 on revenue of $10.1 billion. Both metrics topped analyst estimates.

Any type of trading beneath $180 keeps BABA stock in the sloppy trading range it’s been stuck in since May. The stock remains dead money until it can achieve a sustained breakout. Its September attempt failed miserably. Let’s see if this morning’s mild jump can reignite buyers’ resolve.

On the options trading front, traders favored calls ahead of the report. Activity rose to 207% of the average daily volume, with 918,769 total contracts traded. Calls accounted for 68% of the session’s sum.

Options premiums were baking in a $6.32 move, so this morning’s $1.52 pop falls well within expectations. Implied volatility will get crushed at the open, making this a big win for volatility sellers.

As of this writing, Tyler Craig held bullish options positions in TWTR. For a free trial to the best trading community on the planet and Tyler’s current home, click here!