U.S. equities, including transportation stocks, were rallying to new record highs on Friday, pushing the S&P 500 up and over the 3,050 level for the first time. The move exits a long consolidation range going back to July and comes in the wake of better-than-expected employment data and a better-than-feared manufacturing report for October.

Nonfarm payrolls clocked in at 128,000 vs. the 80,000 analysts were expecting despite the GM (NYSE:GM) strike that recently ended.

The gains are coming across the board, with Apple (NASDAQ:AAPL) adding 2.4% and energy stocks moving on higher crude oil prices. But it’s the transportation sector that’s caught my eye, with the sector rallying nicely on expectations of an economic rebound as the Federal Reserve’s three recent interest rate cuts filter through the economy:

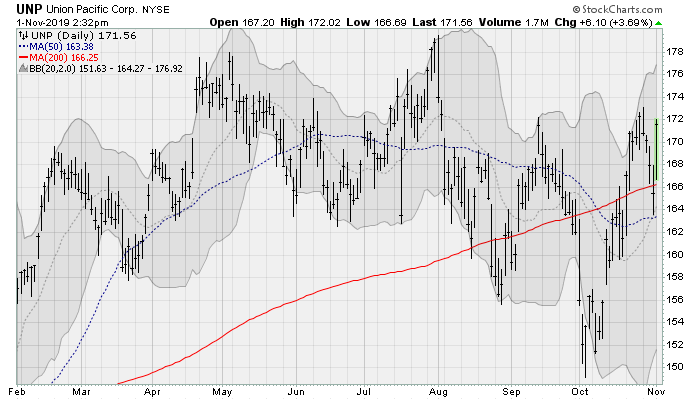

Transportation Stocks: Union Pacific (UNP)

Union Pacific (NYSE:UNP) shares are rising above their 200-day moving average, challenging the prior highs set earlier in the year near the $178-a-share threshold. Coverage on the stock was recently initiated by analysts at Wells Fargo, with a neutral rating.

The company is expected to next report results on Jan. 16 before the bell. Analysts are looking for earnings of $2.18 per share on revenues of $5.4 billion. Investors have recently been focusing on improving operating efficiency for the industry amid cost reduction efforts.

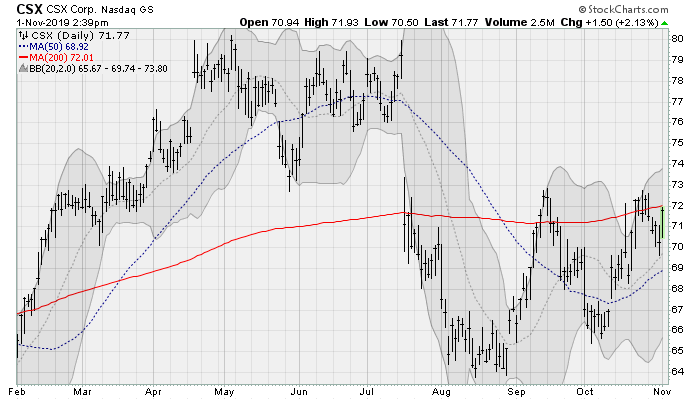

CSX (CSX)

CSX (NASDAQ:CSX) shares are challenging resistance near their 200-day moving average, setting up a return to highs last seen in July near $80 — which would be worth a gain of more than 10% from here. Investors recently celebrated a 1.9% improvement in its operating ratio on a year-over-year basis to 56.8%, a new company record.

This was drive by an 8% cut to expenses driven by lower fuel spending and a smaller train fleet resulting in fewer accidents and repairs.

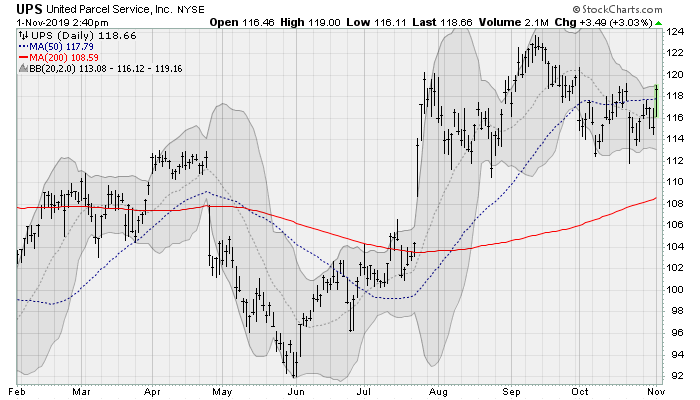

UPS (UPS)

UPS (NYSE:UPS) shares are climbing back up and over their 50-day moving average, setting up a run at the prior high near $124 and setting up a run at the all-time high near $128 set in early 2018. Coverage was also recently initiated by Wells Fargo analysts.

The company is expected to next report results on Jan. 30 before the bell. Analysts are looking for earnings of $2.11 per share on revenues of $20.6 billion.

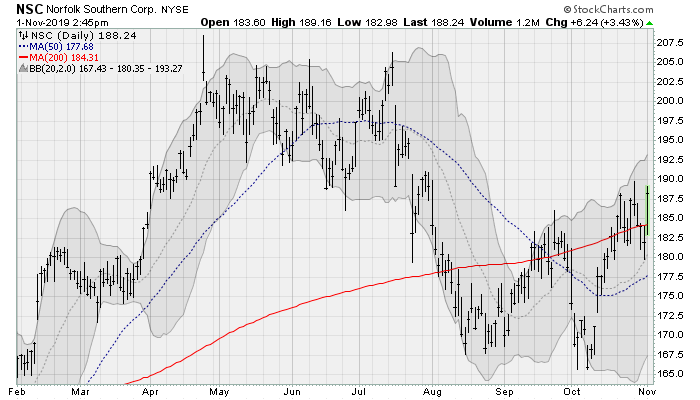

Norfolk Southern (NSC)

Norfolk Southern (NYSE:NSC) stock is rallying above its 200-day moving average, marking the latest in a long line of buyable pullbacks since a long-term uptrend started in early 2016. Wells Fargo analysts initiated coverage here as well with a $216 price target and a buy rating.

The company is expected to next report results on Jan. 23 before the bell. Analysts are looking for earnings of $2.40 per share on revenues of $2.8 billion.

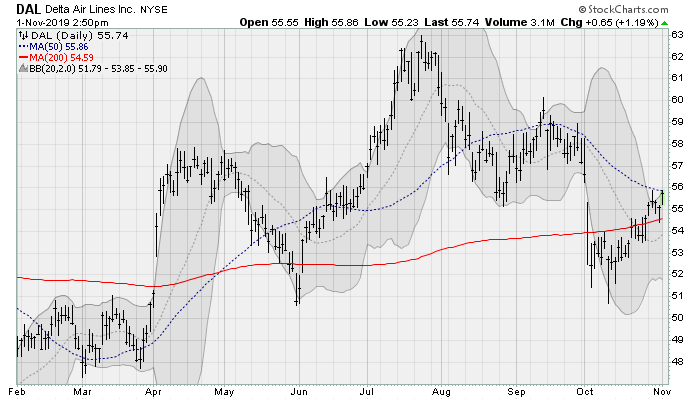

Delta Airlines (DAL)

Shares of Delta Airlines (NYSE:DAL) are poised to move up and over their 50-day moving average, setting up a run at the prior high near $63 set back in July. Better business fundamentals means more business and leisure travel for a company that has been able to avoid the fallout from Boeing’s (NYSE:BA) 737 MAX problems. Delta didn’t operate any of the aircraft in its fleet.

The company is expected to next report results on Jan. 14 before the bell. Analysts are looking for earnings of $1.36 per share on revenues of $11.4 billion.

As of this writing, William Roth did not hold a position in any of the aforementioned securities.