U.S. equities are treading water ahead of the Federal Reserve’s latest policy decision, with the Dow Jones Industrial Average holding near the 27,000 level. While most stocks are holding steady ahead of what is expected to be another interest rate cut, energy stocks are weakening here as West Texas Intermediate drops back below the $55-a-barrel level and traders shrug off Middle East tensions and worry about soft global economic data.

As a result, a number of key oil field services and oil production stocks are rolling over. Here are four to sell now:

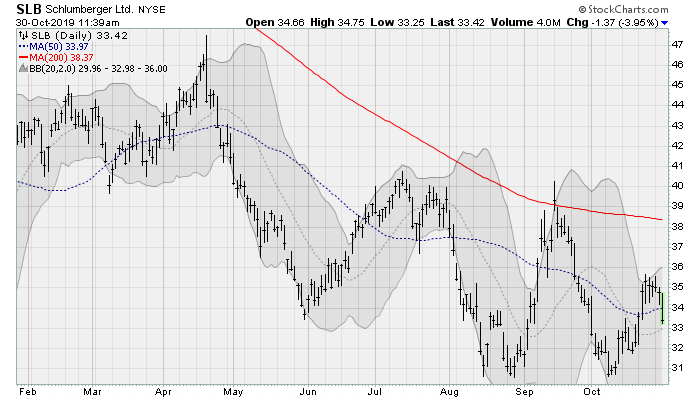

Schlumberger (SLB)

Shares of Schlumberger (NYSE:SLB) look set to fall back to triple-bottom support near the $31-a-share level after once again losing its 50-day moving average. This caps a massive downtrend pattern that started in early 2017 and has resulted in a loss of nearly 60% of value.

The company will next report results on Jan. 17 before the open. Analysts are looking for earnings of 38 cents per share on revenues of $8.2 billion.

Halliburton (HAL)

Halliburton (NYSE:HAL) shares are threatening to fall back below their 50-day moving average, returning to the lows near $17 tested back in August, after a series of analyst downgrades. Argus cut their rating to sell. Cowen analysts also lowered their price target as the industry cuts capacity and trims expenses.

HAL will next report results on Jan. 21 before the bell. Analysts are looking for earnings of 30 cents per share on revenues of $5.19 billion.

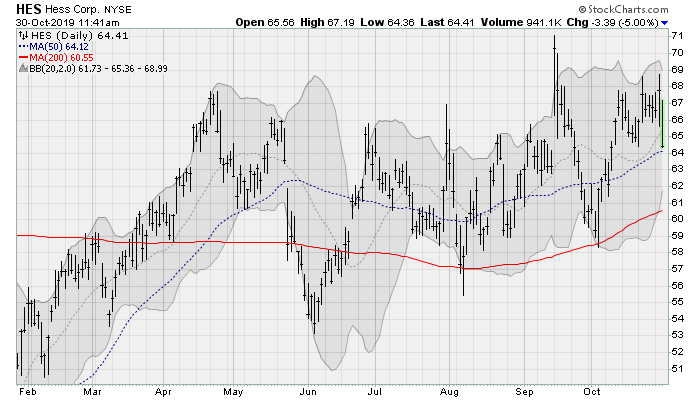

Hess (HES)

Shares of independent oil and gas producer Hess (NYSE:HES) are topping out near multi-month overhead resistance just under the $70-a-share level, setting up a likely retest of its 200-day moving average.

Hess reported results before the open this morning, with a loss of 32 cents per share missing estimates by a penny on a 17.1% drop in revenues. Sentiment isn’t looking great in the wake of an initiation of coverage by Citigroup analysts with a neutral rating back in late September.

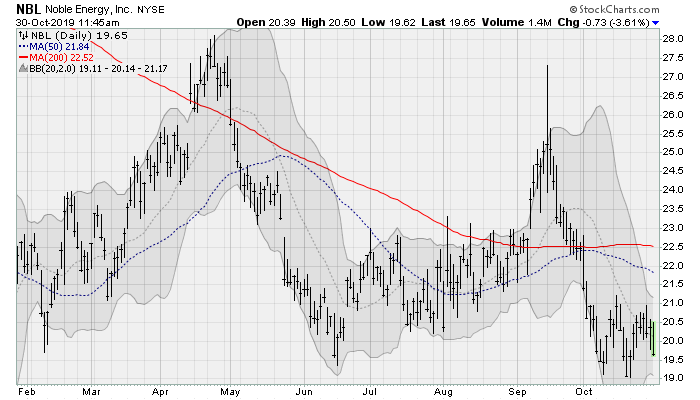

Noble Energy (NBL)

Noble Energy (NYSE:NBL) shares are testing critical late-2018 support near the $18-a-share level after forming a nasty looking double-top pattern near $27.

The company will next report results on Nov. 7 before the bell. Analysts are looking for a loss of 11 cents per share on revenues of $1.1 billion. Analysts at Oppenheimer recently warned of multiple compression heading into 2020 likely to weigh on share prices.