U.S. stock futures are trading in the red this morning after a mixed bag of earnings announcements last night. But the losses are mild, so no need for panic. Heading into the open futures on the Dow Jones Industrial Average are down 0.15% and S&P 500 futures are lower by 0.05%. Nasdaq Composite futures have gained 0.01%.

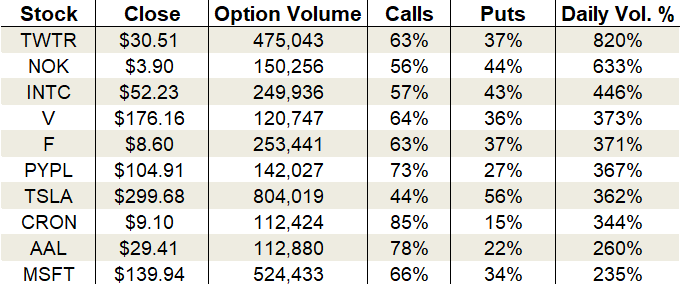

Action in the options pits continues to tell a story with calls as the hero. Overall volume once again settled near average levels. Specifically, about 19.2 million calls and 14.7 million puts changed hands on the session.

The numbers at the CBOE Volatility Index (VIX) mirrored the previous day’s session with the single-session equity put/call volume ratio remaining at 0.68. The 10-day moving average held its ground at 0.66.

Options activity was buzzing in Intel (NASDAQ:INTC), Tesla (NASDAQ:TSLA) and Cronos Group (NASDAQ:CRON), among others.

Let’s take a closer look.

Intel (INTC)

Intel topped expectations during last night’s earnings report and is pushing 3% higher in pre-market trading. During the initial buying blitz after the numbers were released, INTC stock actually popped 8% before falling back.

For the third quarter, the chipmaker posted earnings of $1.42 per share on revenue of $19.2 billion. Wall Street was only expecting $1.24 per share on $18.1 billion, so chalk this up as a strong beat.

Chart watchers will be pleased that this morning’s gap is clearing a six-month resistance zone at $53. If the gains hold and aren’t disrupted by rapid profit-taking at the open, INTC could be poised for a return to its April peak near $60. At any rate, as long as the stock is north of $51, it’s bullish.

On the options trading front, calls were the hot ticket ahead of earnings. Activity grew to 446% of the average daily volume, with 249,936 total contracts traded. Calls added 57% to the take.

Options premiums were baking in a move of $2.49 or 4.8%, so this morning’s 3% jump is arriving well within expectations. Implied volatility should fall dramatically throughout the session. I like selling out-of-the-money December puts here to game the breakout.

Tesla (TSLA)

Tesla shareholders were dancing in the streets yesterday after the company delivered killer results for the quarter. Analysts expected another round of losses, but TSLA turned a profit of $1.86 per share on revenue of $6.3 billion.

TSLA stock ended the day up 17.7% on its highest volume session of the year. It’s now well above the 200-day moving average and has returned to levels not seen since February. While it’s always challenging to build trades after a powerful gap into no man’s land, I’d much rather deploy bullish trades after a pause or pullback than fight the strength.

As far as options trading goes, puts outpaced calls on the session. Total activity climbed to over three and a half times the average daily volume, with 804,019 contracts traded. Puts added 56% to the session’s sum.

The size of the gap demolished volatility sellers. Ahead of the event, premiums were only pricing in a move of 7.3%. Implied volatility has now fallen to 46% or the 6th percentile of its one-year range. Moving forward, options are looking for daily moves of $8.71 or 2.9%, so adjust your expectations accordingly.

Cronos Group (CRON)

Buyers swarmed Cronos Group shares Thursday, pushing the popular pot stock up 6% on the day. Over 13.3 million shares traded, continuing a recent pattern of high volume up-days in the stock.

Things were quiet on the news front, so the catalyst is a question mark. But buyers and sellers don’t always need a news item to drive their decision-making. I’d view the recent flurry of buying as bulls establishing a foothold in a trend that has been completely and utterly bearish all year long.

It’s a start, yes, but much work remains before the trajectory of the longer-term trend is reversed. My line in the sand is $8. If that gets taken out to the downside, then abandon your bullish hopes.

On the options trading front, traders aggressively pushed into calls. Activity jumped to 344% of the average daily volume, with 112,424 total contracts traded. 85% of the trading came from call options alone.

The increased demand drove implied volatility higher on the day to 84% placing it at the 36th percentile of its one-year range. Premiums are now baking in daily moves of 48 cents or 5.3%.

As of this writing, Tyler Craig didn’t hold positions in any of the aforementioned securities. For a free trial to the best trading community on the planet and Tyler’s current home, click here!