U.S. stock futures are creeping higher after a quiet overnight session. The earnings season continues to roll forth with a mountain of companies releasing their quarterly reports last night.

Against this backdrop, futures on the Dow Jones Industrial Average are up 0.17% and S&P 500 futures are higher by 0.19%. Nasdaq Composite futures have gained 0.56%.

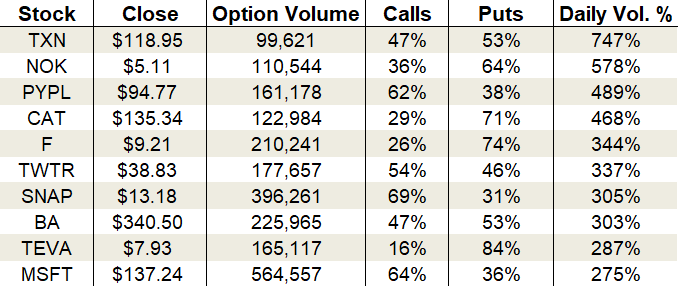

The action in the options pits was as average as it comes Wednesday. Calls outpaced puts by a modest margin while overall volume held near average levels. By day’s end, approximately 16.3 million calls and 14.2 million puts changed hands.

Meanwhile, over at the CBOE Volatility Index (VIX), the single-session equity put/call volume ratio pushed up to 0.69 but remains in the center of its 2019 range, providing little significance. The 10-day moving average held its ground near 0.65.

Options activity was buzzing in companies releasing quarterly earnings including Texas Instruments (NASDAQ:TXN), PayPal (NASDAQ:PYPL), and Twitter (NYSE:TWTR).

Let’s take a closer look.

Texas Instruments (TXN)

Source: ThinkorSwim

Texas Instruments just removed the punch bowl from the chip party. Previously the semiconductor industry was leading the market higher. You can use the VanEck Vectors Semiconductor ETF (NYSEARCA:SMH) for proof. But now, thanks to TXN’s dismal earnings report, investors are rethinking their bullish bias on the space.

The biggest disappointment during the numbers bonanza was Texas Instruments’ forward guidance. For fourth-quarter earnings, the company expects earnings of 91 cents to $1.09 per share on revenue of $3.1 billion to $3.3 billion. Analysts were gunning for $1.28 per share on revenue of $3.6 billion. The whiff had sellers swarming on Thursday, and TXN stock ended down 7.5%.

That said, buyers did emerge at the open helping TXN to fill part of the earnings gap throughout the day. The 200-day moving average and a key trend line sit at $115, so that’s the level to watch moving forward. If it gives way, watch out below.

On the options trading front, puts won the contest. Activity skyrocketed to 747% of the average daily volume, with 99,621 total contracts traded. Puts accounted for 53% of the tally.

With the uncertainty of earnings now in the rear-view mirror, implied volatility crashed to 25% placing it at the 19th percentile of its one-year range. Premiums are pricing in daily moves of $1.87 or 1.6%.

PayPal (PYPL)

Source: ThinkorSwim

PayPal entered last night’s earnings in desperate need of help. Since disappointing during the previous quarter’s report, PYPL stock had fallen as much as 22%, turning its trend lower across the board.

Well, the prayers of underwater bulls have been answered. PayPal shares are up 8.2% after the payment processing company topped estimates on the top and bottom line. For the quarter, PYPL posted adjusted earnings per share of 61 cents after accounting for an investment loss of 15 cents a share. Revenue grew 19% to $4.4 billion.

The up-gap is clearing resistance and could reverse PYPL stock’s daily downtrend in a single session. Anyone caught short the stock is about to suffer a nasty squeezing today.

Ahead of the earnings, options trading saw heavy call trading. Total activity climbed to nearly five times the average daily volume, with 161,178 contracts traded. 62% of the trading came from call options alone.

Options premiums were baking in a $4.77 move, so this morning’s $8.20 gap is pushing well outside of expectations. It should deliver gains to traders swinging long volatility trades like straddles or strangles into the event.

Twitter (TWTR)

Source: ThinkorSwim

Twitter shares are in some serious trouble this morning after whiffing on earnings. It’s unfortunate because TWTR stock was otherwise headed for a decent showing for the year. The shares are down just shy of 20% in pre-market trading.

Here’s the skinny on the third-quarter numbers. The company earned 17 cents a share on revenue of $823.7 million. Analysts were forecasting earnings of 20 cents on $874 million in sales, so the miss was substantial. The company claimed product issues and advertising “headwinds” were to blame for the dismal numbers.

The 20% hacking will carry TWTR stock deep below its 200-day moving average and unwind almost all of this year’s gains. While a relief rally could ensue due to the deeply oversold conditions, the technical uptrend is broken and rallies should be viewed with skepticism. The weak earnings are likely to keep a lid on the stock for the coming quarter.

On the options trading front, traders favored calls over puts ahead of the release. Activity swelled to 337% of the average daily volume, with 177,657 total contracts traded. Calls added 54% to the session’s sum.

Derivatives traders were baking in a move of $3.48 or 9%, so this morning’s 20% thumping fell way, way outside of expectations and will generate big-league gains to volatility buyers.

As of this writing, Tyler Craig didn’t hold positions in any of the aforementioned securities. For a free trial to the best trading community on the planet and Tyler’s current home, click here!