Wednesday was a push-pull day with mixed results. Small-cap stocks were green while the larger indices were slightly red. Since we’ve had a few strong days of late this suggests that the bulls are still in charge of the equity price action.

After hours Netflix (NASDAQ:NFLX) and International Business Machines (NYSE:IBM) reported earnings — and the market only had love for one company. Even though the NFLX metrics were not optimal, investors loved what they saw. Conversely, Wall Street hated what IBM reported. It is important to note that the short-term reactions to earnings are binary events. Investors should spend a few days chewing on the results before committing with confidence. But for now, the net effect of these two mega-cap stocks on the rest of the Nasdaq Composite is neutral so equities should continue the same price action as we get more earnings.

News from Europe this morning is good on the Brexit front so the Dow Jones Industrial Average, S&P 500 are up by 0.34% and 0.299%. Nasdaq Composite futures are up by 0.45%. This is after a mini dip so it’s nothing unusual — traders are just reacting to headlines.

In the options pits there were 17.5 million calls and only 14.4 million puts. The potential for optimism is still alive. On the other hand, the CBOE Volatility Index (VIX) single-session equity put/call volume ratio yesterday rose to 0.63 from 0.61 suggesting nervousness is persisting. But this is still below the 10-day moving average.

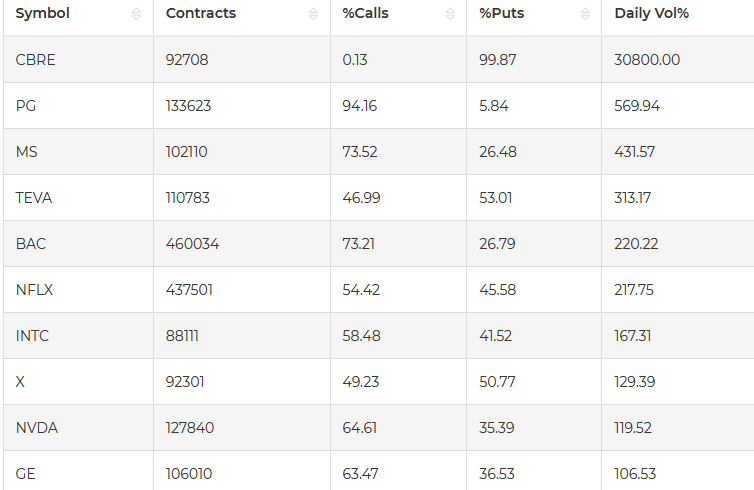

Options activity was abuzz in a handful of stocks like Intel (NASDAQ:INTC), CBRE Group (NYSE:CBRE) and Morgan Stanley (NYSE:MS).

Here is a better look.

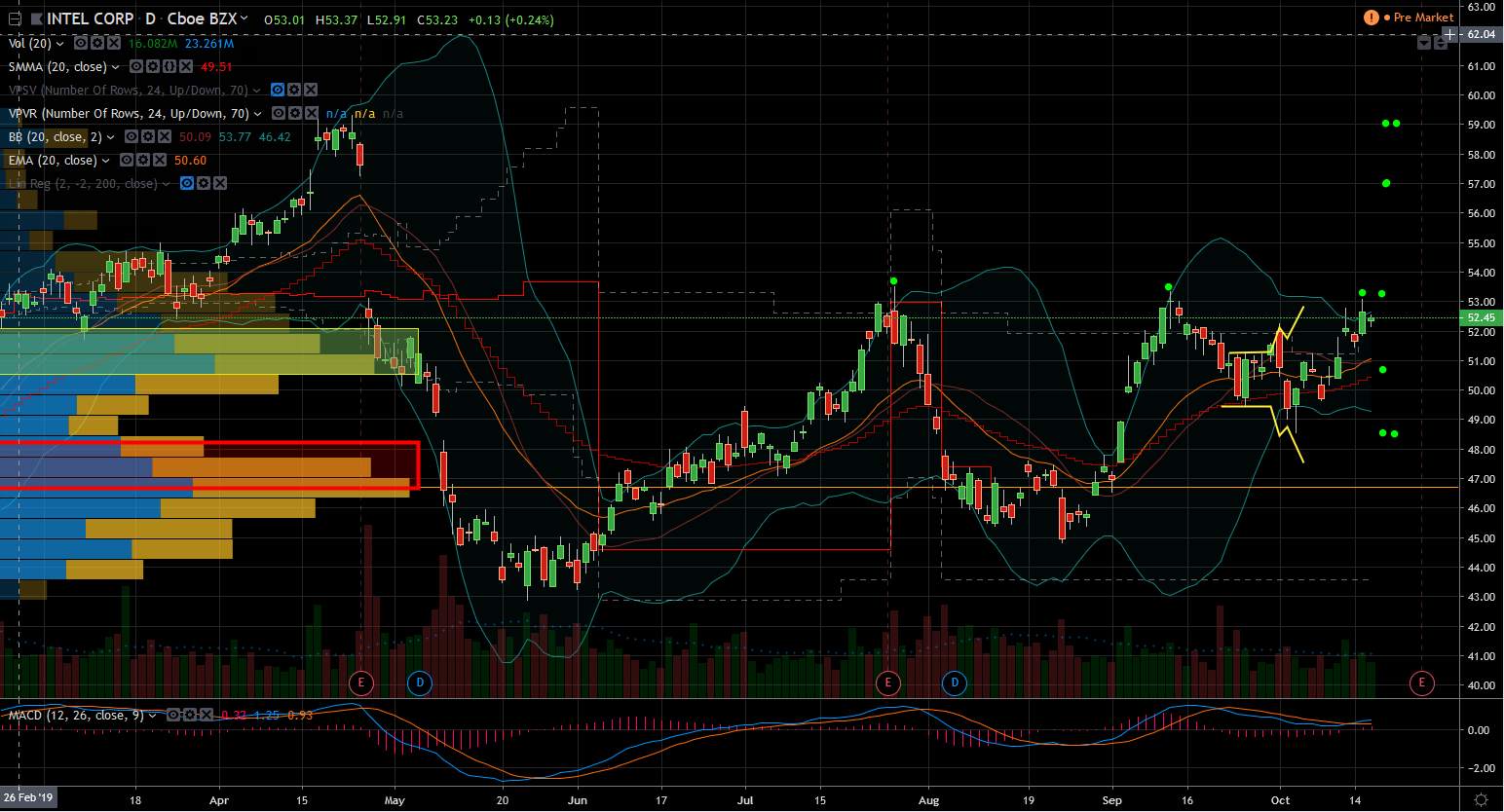

Intel (INTC)

The INTC stock chart is probably the only reason investors need to expect a spike now. If the bulls can close above $53 per share, INTC can spike $4 to close the giant gap from its last earnings report. This neckline would make for almost a 10% rally off the Oct. 3 low with a series of higher lows. So as long as INTC stock stays above $50.70 per share, bulls can afford a few initial failed attempts at taking out $53.

While this opportunity seems like a slam dunk, this is when investor need to be wary. The sector is still under threat from U.S.-China trade war headlines. The current rhetoric is cordial but both sides are as unpredictable as they get. So caution is definitely warranted. Add to this that earnings are still due out for INTC and others in its sector and this period will make for a wild ride.

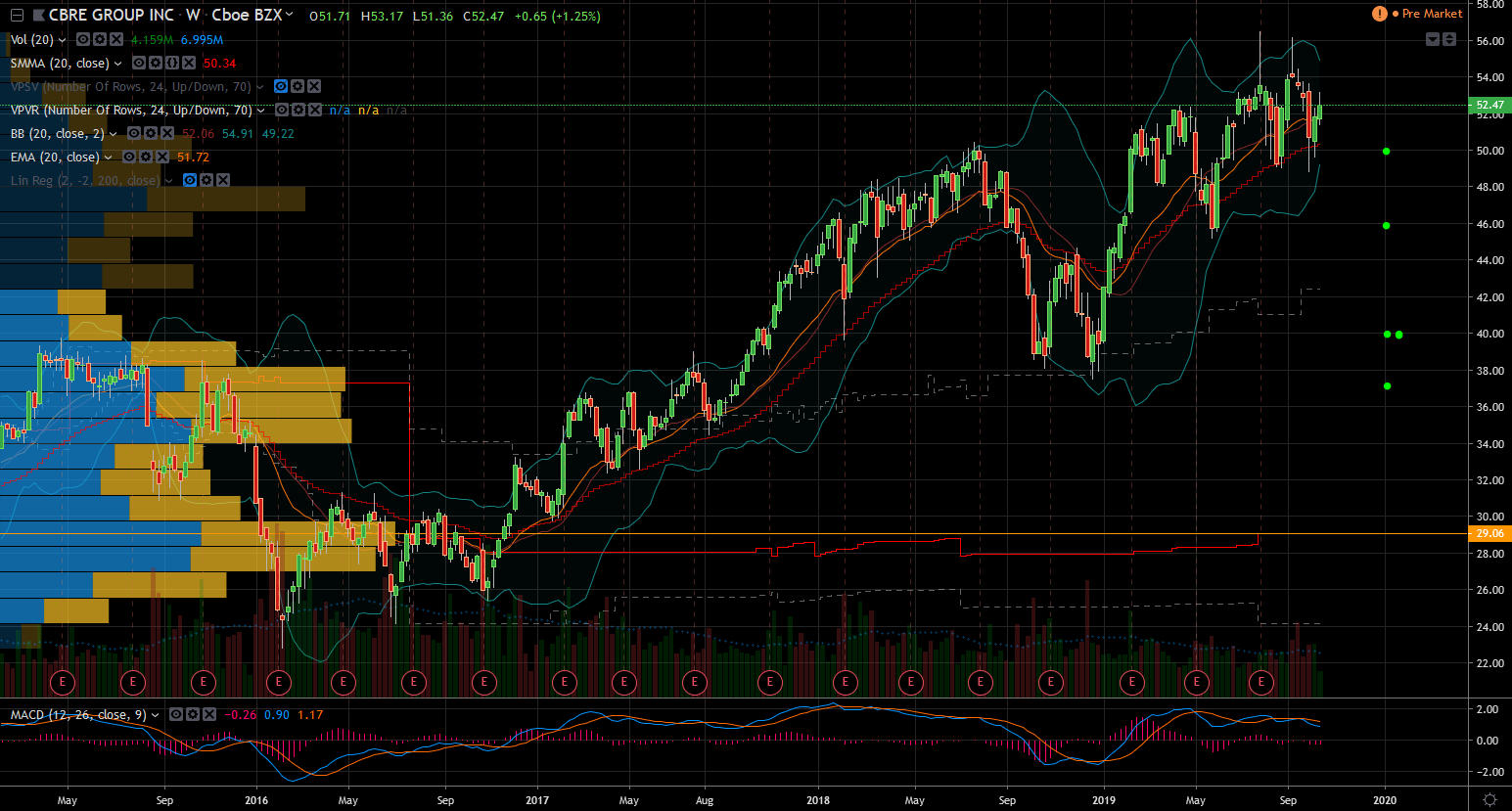

CBRE Group (CBRE)

The recent debacle that was the nixed IPO of WeWork caused ripples across all of Wall Street. So commercial real estate companies have a lot to worry about from the ongoing saga. My hunch is that this is not a financial disaster in the making but for now, caution is warranted.

In spite of the ruckus there, CBRE stock is near its highs going into its earnings in early November. But this week there was unusually heavy put action in its options to the tune of 30,000% of its daily volume. While I don’t condone chasing options action blindly, there is a big fight brewing between bulls and bears in CBRE stock.

Specifically, the December $40 puts were active so the sellers think that it is a safe level for CBRE stock. Conversely, the buyers believe that there is a legitimate way the stock can find its way there this year. There are dozens of other reasons for trading that put like a stock replacement strategy to leave the shares and replace them with a combination put/call position to stay bullish on CBRE. Nevertheless, it is a big enough stray from the average that it is worth noting.

Technically, there is no imminent sign that CBRE stock has reason to fall 25%. There are at least two pivot zones at $50 and $47 per share that would need really bad news to crumple this stock that much. Besides, $38 per share is a multi-year bulletproof support level.

Morgan Stanley (MS)

MS stock is up 4% in pre-market activity as management reported earnings — and the company beat on all the metrics that mattered. The team showed that they are navigating the headlines quite well even on trading. MS is cheap selling near its book value and trailing price-to-earnings ratio near 9. In addition it pays a dividend which is about double that of what the 10-year U.S. Treasury bond pays.

So as long as the stock markets in general are rising then MS stock will follow the trend. The zone around $45 per share has been pivotal for as long as the stock has been public. This could create some resistance in the long run. In addition, the morning prices place MS near its most recent failure point from Sept. 13 and July 29.

From a trading perspective, this is not an obvious entry point. I’d rather wait to see shares breach above those two fail points before chasing the momentum to $49 per share. But for now, if I am long MS stock then I can ride this rally until it shows signs of fizzle. A fade closer to $42.50 if it happens would be worth buying with proper stops.

In any of these three situations I have to divest my emotions from the trades. Nothing noted here is to speak against fundamentals with the companies. It is important to note the unusual activity then learn the levels that matter in the short term.

Nicolas Chahine is the managing director of SellSpreads.com. As of this writing, he did not hold a position in any of the aforementioned securities. Join his live chat room for free here.