Here’s a bit of sobering news for Exxon Mobil (NYSE:XOM) bulls. Ten years ago, Exxon Mobil was a $70 stock. Today, XOM stock trades hands around $70. In other words, XOM stock hasn’t gone anywhere over the past decade. During that stretch, the S&P 500 has risen nearly 200%, Amazon (NASDAQ:AMZN) stock has jumped nearly 2,000%, and Netflix (NASDAQ:NFLX) stock has surged nearly 4,000%.

Here’s even more sobering news: XOM stock probably won’t go anywhere anytime soon, either.

Exxon Mobil is a big, complicated business with a lot of moving parts and many projects. But, when push comes to shove, all that really matters for XOM stock is the price of oil. As goes the price of oil, so goes Exxon Mobil stock.

So it shouldn’t be surprising that as XOM stock has gone nowhere over the past decade, neither have oil prices, which are down about 10% over the past decade.

Unfortunately, the present outlook for oil prices isn’t favorable. For the foreseeable future, oil prices will likely remain rangebound around current levels. Given that outlook, XOM stock will likely remain rangebound around current levels, too.

Consequently, investors should stay away from Exxon Mobil stock for now. The shares will likely be choppy for the foreseeable future, and the chances of a meaningful rally by XOM stock are too small to warrant dealing with the volatility of the shares.

Exxon Mobil Stock Is All About Oil

Exxon Mobil is a very complex, large company with a ton of moving parts. But, when it comes to XOM stock, things are much simpler. Specifically, the price of oil determines the performance of Exxon Mobil stock.

Exxon Mobil makes most of its money at the pump. Because of that, when oil prices are high, Exxon make a lot of money at the pump, and its margins are favorable. When oil prices are lower, though, it doesn’t make as much money at the pump, and its margins are less favorable.

Thus, it makes sense that, as goes the price of oil, so goes Exxon Mobil stock.

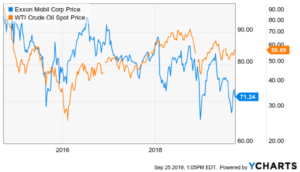

Click to Enlarge

Just look at the attached chart, which compares the price of XOM stock to the daily WTI Crude Oil Spot Price. The two move together. When oil prices dropped in 2015, XOM stock plunged. When oil prices rebounded in 2016, XOM stock rebounded. As oil prices have struggled to move higher in 2018-2019, so has the price of Exxon Mobil stock.

XOM and the price of oil are forever intertwined. Importantly, one leads the other. That is, XOM stock follows oil prices. Thus,to see where XOM stock price will go, it’s best to start with understanding where oil prices are headed.

Oil Prices Will Be Range-Bound

The unfortunate reality is that oil prices aren’t heading significantly higher anytime soon, so neither is Exxon Mobile stock price.

This seems somewhat counterintuitive. After all, there was just a huge drone strike against Saudi Arabia’s oil facilities which took out about 5% of the world’s oil production capacity in a day. Further, that drone strike was led by Iran, so geopolitical tensions in the oil-rich Middle East region are quickly escalating. If those tensions turn into armed conflict, recent academic research indicates that oil prices could easily soar towards and above $100 per barrel.

But that needs to be taken with a grain of salt. Saudi Arabia is already bringing oil production back online, and the country’s energy minister said that oil production levels would be back to normal – that is, pre-attack levels – by the end of September. Further, U.S. shale oil production has remained robust, and is poised to keep growing rapidly over the next several years. This production boom has led to a sharp rise in U.S. oil inventories.

In other words, Iranian drone strikes and rising geopolitical tensions were supposed to lead to a huge oil market supply shortage and an enduring increase in oil prices. Instead, Saudi oil production is coming back online much sooner than expected, and the U.S. continues to increase its oil production. We don’t have a supply shortage, and we likely won’t have one anytime soon, unless war, which is a wildcard, breaks out in the Middle East.

As a result, oil prices will likely remain rangebound around current levels for the foreseeable future, meaning XOM stock will likely remain rangebound, too.

The Bottom Line on XOM Stock

When it comes to Exxon Mobil stock, the one thing that matters above all else is the price of oil. As go oil prices, so goes XOM stock.

Oil prices will likely remain rangebound for the foreseeable future. As a result, XOM stock will remain rangebound, too. Consequently, it’s best to stay away from XOM stock for now.

As of this writing, Luke Lango was long AMZN and NFLX.