U.S. stock futures are trading higher this morning. Ahead of the bell, futures on the Dow Jones Industrial Average are up 0.18%, and S&P 500 futures are higher by 0.23%. Nasdaq-100 futures have added 0.19%.

In the options pits, put volume made a comeback, rising to match call demand. Overall volume levels remained low on the session though. Approximately 15.3 million calls and 15 million puts changed hands.

The push into puts was seen at the CBOE as well with the single-session equity put/call volume ratio popping to 0.74 — a one-month high. Meanwhile, the 10-day moving average continued cruising higher and ended at 0.66.

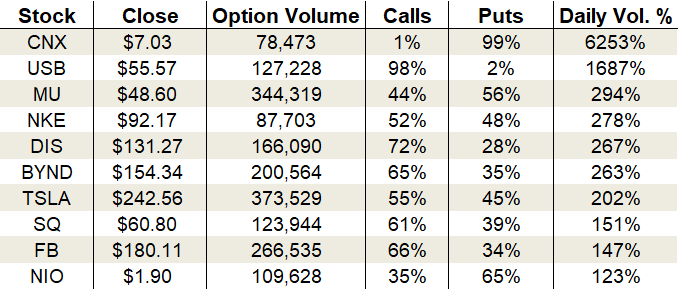

Three of the biggest names on the most-active options list were Micron Technology (NYSE:MU), Disney (NYSE:DIS) and Square (NYSE:SQ).

Let’s take a closer look:

Micron Technology (MU)

Micron Technology reported earnings last night, and the market didn’t like the numbers. MU stock is sliding 5.5% premarket.

For the fiscal fourth-quarter, the memory-chip maker posted earnings-per-share of 49 cents on revenue of $4.87 billion. Both metrics fell short of analyst estimates for 51 cents on $4.59 billion, according to FactSet. The adjusted earnings actually came out to 56 cents per share.

On the price front, MU stock had been on the mend over the past quarter, rising 51% from its summer low. This morning’s gap will push MU to its rising 50-day moving average and test buyers’ willingness to support the uptrend. A failure of the test sets the stage for a drop toward the next support zone at $42.

Options trading was buzzing ahead of yesterday’s report with puts favored over calls. Total activity jumped to 294% of the average daily volume, with 344,319 contracts traded. Puts accounted for 56% of the session’s sum.

Premiums were baking in a move of $3.29 or 6.8%, so this morning’s whack still falls inside of the expected move. Neither volatility buyers nor sellers will come out big winners this go around.

Disney (DIS)

All is not well with the mouse house. Despite the increased hubbub surrounding its November release of Disney+, its share price has been quietly trekking lower. Thursday’s decline pushed DIS stock to a fresh five-month low, momentarily breaching a major support zone before buyers emerged to save Mickey.

Disney shares are now 11% off the highs, and its 50-day and 20-day moving averages are cruising lower; $130 is the zone to watch. If it breaks, watch out below. Volume patterns aren’t helping matters. The past six trading sessions have seen four distribution days showing heavy selling pressure by institutions.

On the options trading front, calls led the charge despite the drubbing. Activity grew to over two-and-a-half times the average daily volume, with 166,090 total contracts traded; 72% of the trading came from call options alone.

The increased demand drove implied volatility higher on the day to 25%, placing it at the 36th percentile of its one-year range. Premiums are pricing in daily moves of $2.04 or 1.6%.

Square (SQ)

Square shares experienced a much-needed win yesterday after Wells Fargo (NYSE:WFC) upgraded the mobile payments company to “outperform.” Ever since whiffing on earnings in July, SQ stock has been under pressure, falling as much as 35%. The silver lining of all beatdowns is the lower valuations they bring, and Wells Fargo is taking note.

SQ stock rallied 3.9% and is up 12% over the past three sessions. The bump was enough to push SQ back above short-term resistance and its 20-day moving average for the first time since its deathly descent began. Two of the past three sessions have seen powerful accumulation, so volume patterns are supporting the bottoming bid. Don’t be surprised if the bottom for this quarter is in.

The upgrade lit a fire under options trading with calls outpacing puts. Activity grew to 151% of the average daily volume, with 123,944 total contracts traded; 61% of the trading came from call options alone.

Implied volatility remains low, but will likely start trekking higher into Micron’s next earnings release. At 45%, it currently sits at the 17th percentile of its one-year range. Long volatility trades aren’t a bad way to go here.

As of this writing, Tyler Craig held no positions in any of the aforementioned securities. For a free trial to the best trading community on the planet and Tyler’s current home, click here!