High-yield stocks that pay steadily growing and relatively high dividends tend to do quite well over time. The current average dividend yield of the S&P 500 is 1.92%, while the long-term average is 2.09%. After the financial crisis of 2008, the long-term yield value decreased from a peak of 3.86% to around 2% where it is today.

The current average dividend yield is up from a year ago when it was 1.76%. That’s a 9% difference. So finding high-yield stocks that can consistently boost their payouts more than a time 9% and have higher dividend yields than 2% should be the goal for income investors. Such companies tend to have higher than average payout ratios. They pay out the average 35% of earnings or better to investors.

Below are 5 stocks selling with higher than average dividend yields and whose dividends have been rising 15% or more per year. The companies have higher than average payout ratios.

None of these stocks are turnarounds. They have been growing consistently for the past several years. You can rely on them to continue to increase their dividends at these rates.

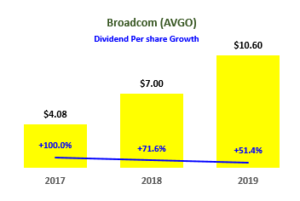

Broadcom (AVGO)

Dividend Yield: 3.7%

Broadcom (NASDAQ:AVGO) is a semiconductor company that makes a variety of chips used in data centers, set-top boxes, telecom equipment, and smartphones. Earnings have been growing consistently and have beat market expectations.

Broadcom stock trades at a low 13x price-to-earnings ratio and has a 3.7% dividend yield. AVGO pays out about half its earnings in dividends. Broadcom’s dividends have been growing consistently at a high rate over the past 3 years (+74%) and five years (+55%). Look for AVGO stock to follow this consistent trend. Broadcom’s earnings should do well over the next telecom cycle as 5G equipment begins to roll out.

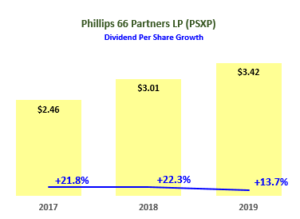

Phillips 66 Partners (PSXP)

Dividend Yield: 5.9%

Phillips 66 Partners (NYSE:PSXP) operates, develops and acquires crude oil, refined petroleum products and natural gas liquids pipelines, terminals and other transportation and midstream assets. PSXP stock sports a 5.9% dividend yield and trades for just 13 times trailing earnings per share.

PSXP pays out 83% of its annual earnings in dividends.

Phillips 66 stock is a high-quality master limited partnership with significant growth in the pipeline and terminal volumes expected over the next year. Several new pipelines and terminals are expected to come online during that period. Its assets are spread across the major shale oil-producing regions in the U.S.

PSXP stock has paid out consistently higher dividends to its shareholders and it should continue doing so. This is because analysts expect its volumes to increase as six projects come online in the next year or two.

Another reason is that the U.S. Energy Department has reported continuing growth in U.S. oil output from the Bakken region and other areas where PSXP operates.

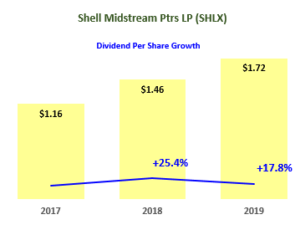

Shell Midstream Partners (SHLX)

Dividend Yield: 8.4%

Shell Midstream Partners (NYSE:SHLX) owns and operates energy pipelines and terminals. The company transports and stores crude oil, natural gas, and refinery gas products in the Gulf Coast and Midwest.

SHLX stock has increased its dividend 23% on average over the past four years. Shell Midstream stock has a high dividend yield at 8.4%. SHLX stock’s yield is high since it pays out over 100% of its earnings, using debt and asset sales to fund the overage. SHLX’s interest coverage ratio is sustainable at 2.2x and its free cash flow covers the dividend payments

Shell Midstream Partners has a number of existing projects under construction that should add a projected $1.5-$2 billion in EBITDA over the next several years. This will allow SHLX stock to continue its good track record in dividend increases.

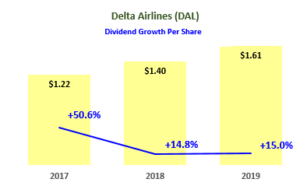

Delta Air Lines (DAL)

Dividend: 2.8%

Delta Air Lines (NYSE:DAL) has increased its dividend by over 27% on average over the past three years and 36% over 5 years. In 2018 the dividend rose 14.8% and recently DAL set the annual rate at $1.61, up 15.1%. The stock is a general play on economic growth as well as its moves to diversify earnings.

Delta’s recent Q2 revenues were up 9% year-over-year. Earnings shot up an incredible 32%. Analysts are especially optimistic about the new credit card that DAL is going to co-brand in partnership with American Express (NYSE:AXP).

Delta stock has an above-average dividend yield. With the DAL stock dividend rate at $1.61, the pay-out ratio is just 22%. So there is plenty of room for the company to continue to increase the dividend.

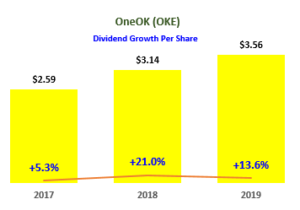

OneOK (OKE)

Dividend Yield: 4.7%

OneOK (NYSE:OKE) engages in the storage, sale and transportation of natural gas in the U.S. It owns pipelines and processing plants in the Mid-Continent and Rocky Mountain regions.

OKE stock pays a very healthy dividend of 4.7% and pays out 93% of its earnings as dividends.

OKE has $5.5 billion of projects under construction, including a number that will be completed soon. These will help support the OKE stock dividends.

OKE stock has increased its dividends on average over 13% annual for the past 3 and 5 years. Its distributable cash flow more than covers its cash dividend payments. OKE’s debt is under control with a net debt-to-EBITDA ratio of 4.2 times.

Investors can expect OKE stock to continue to raise its dividend over the next several years at a similar rate in 2019.

As of this writing, Mark Hake, CFA does not hold a position in any of the aforementioned securities. Mark Hake runs the Total Yield Value Guide which you can review here. The Guide focuses on high total yield value stocks and was launched on August 30. Subscribers during September receive a 20% discount, plus a two-week free trial.