The titans of Wall Street reported earnings this morning, and the numbers were shockingly good.

While the stock market’s initial reaction is very mixed, the reality is that these strong bank earnings – coupled with falling inflation data – do create strong support for a big stock market rebound rally over the next few months.

From JPMorgan (JPM) to CitiBank (C) to Wells Fargo (WFC), America’s most important banks reported strong earnings this morning, broadly underscoring that the U.S. economy is not falling apart. Rather, the numbers suggest that the economy is still fairly healthy.

Consumer spending looks good. Lending volumes look decent. Financial market activity looks about average.

On the whole, the bank earnings painted a picture of a U.S. economy that – while not thriving – certainly isn’t collapsing. It is a slow-but-steady economy.

On its own, that data isn’t super valuable. But when coupled with recent inflation data, things are starting to look super bullish.

We are in a “sweet spot” right now. The U.S. economy is slowing enough to kill inflation but not slowing enough to kill the economy.

Two days ago, we learned that the consumer price inflation rate dropped by a record 100 basis points in March – its biggest drop in this cycle and one of its biggest drops ever.

A day later, we learned that the producer price inflation rate dropped by an even-bigger 220 basis points in March – also its biggest drop in this cycle and one of its biggest drops ever.

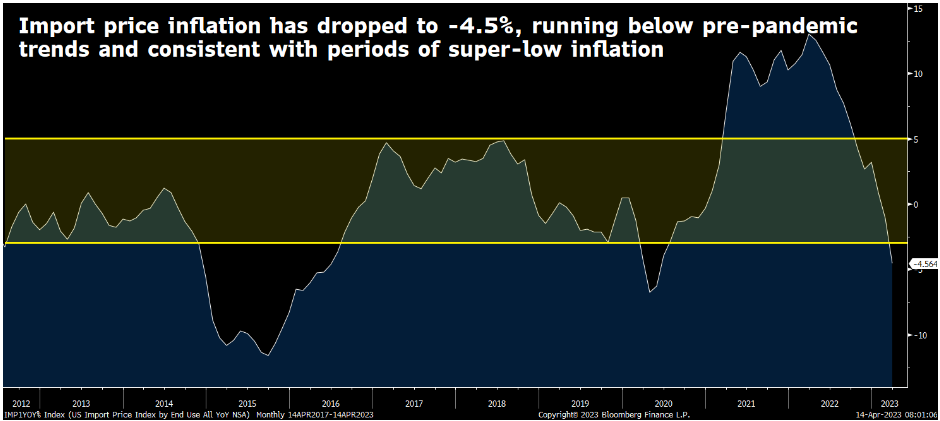

Today, we learned that the import price inflation rate dropped an even-bigger 350 basis points in March. And the export price inflation rate dropped by an astounding 400 basis points.

Bank Earnings Point to the New “Normal”?

Consumer price inflation is on track to get back to “normal” by June. Producer price inflation is already back to “normal.” And import price inflation is below “normal.”

Clearly, inflation is dying.

Yet, the economy is not dying.

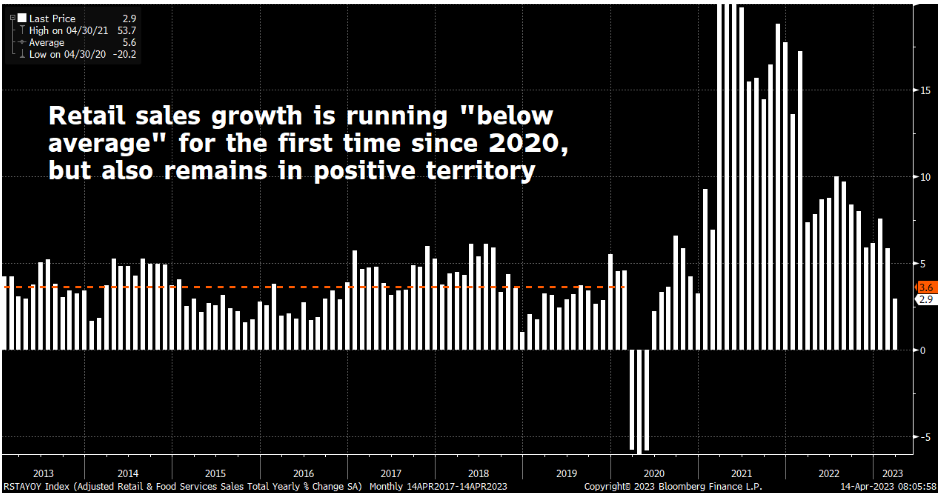

Retail sales growth slowed in March but remained positive. Year-over-year, retail sales rose 2.9% last month. That is consistent with a slow-and-steady economy, not a collapsing one.

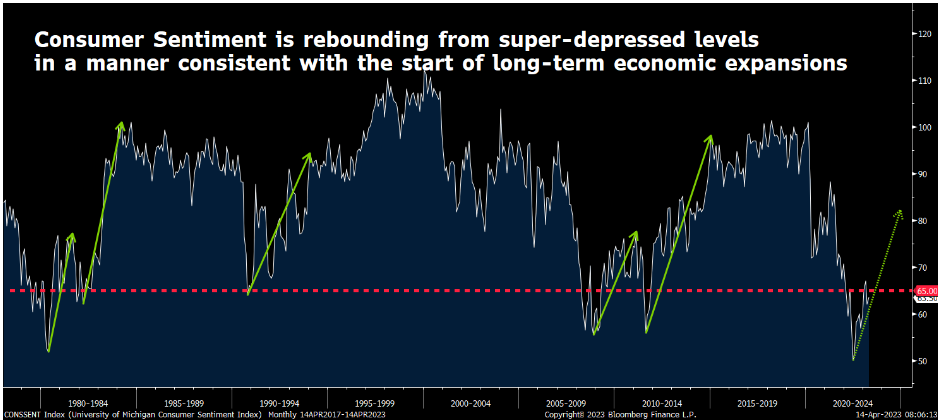

Meanwhile, consumer sentiment is rebounding in April.

The University of Michigan’s consumer sentiment index rose from 62 in March to 63.5 in April. The current conditions component rose from 66.3 to 68.6, while the expectations component rose from 59.2 to 60.3.

This continues a multi-month bounce higher in consumer sentiment from ultra-depressed levels. That sort of move is consistent with the start of a long-term economic expansion.

A Perfect Fit: The “Goldilocks” Environment

The data here, folks, is crystal clear.

This is a “Goldilocks” slowdown. The economy is slowing just enough to kill inflation but not enough to spark a recession.

That is a very bullish realization for stocks.

Just look at this week’s price action. As I write this, all the major stock indices are up big this week, thanks to all the “Goldilocks” data that has emerged.

The death of inflation (without a recession) is bullish for stocks.

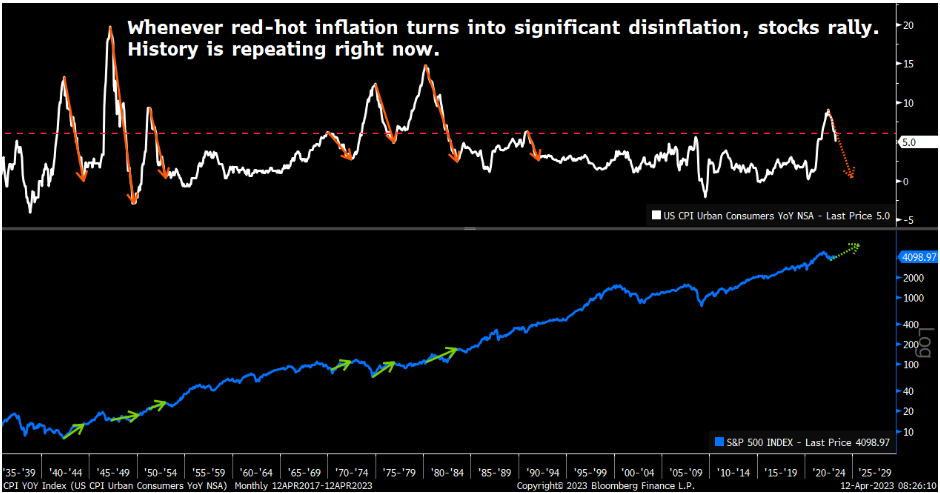

Going back to the 1930s, every single time that red-hot inflation turned into significant disinflation – exactly what we have today – stocks rallied in a major way. Every single time.

History is repeating itself right now.

Red-hot inflation is turning into disinflation. Stocks are rallying. And the more confirmation we get that this disinflation trend can continue without a recession – exactly what today’s bank earnings emphasized – the more stocks will rally.

The Final Word

The S&P 500 is up 16% since October, right around when inflation peaked. We think the market will rally another 20%-plus into the end of the year.

If it does, then certain individual stocks will rally more than 100% into the end of 2023.

Our job is to find those stocks.

We think we’ve found just the ones.

Specifically, the U.S. government is developing a top-secret technology some are comparing to the discovery of fire itself.

And one tiny stock is developing the best form of this technology right now.

This stock could be the next Microsoft (MSFT) or Nvidia (NVDA). It has a trillion-dollar potential. And it could be one of the stock market’s biggest winners this year.

Learn all about this stock and its breakthrough tech.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.