I’m feeling great today. Why? Because I’m pretty convinced current inflation data indicates the start of a big new bull market.

It is no secret why stocks crashed into a bear market in 2022. Inflation roared to 40-year highs, and the Fed was forced to respond with its most aggressive rate-hiking campaign ever. The result – a huge slowdown in the U.S. economy that sent stocks spiraling lower.

And it all started with runaway inflation.

But now inflation is dying – and fast.

Dying Inflation Is Supremely Bullish for Stocks

Yesterday, we learned that the consumer price inflation rate dropped more than 100 basis points in March to below 5%.

Sure, that is still well-above the Fed’s 2% target. But that enormous drop marks one of the sharpest monthly declines in inflation in U.S. history. At that pace, we will be back to 2% by June.

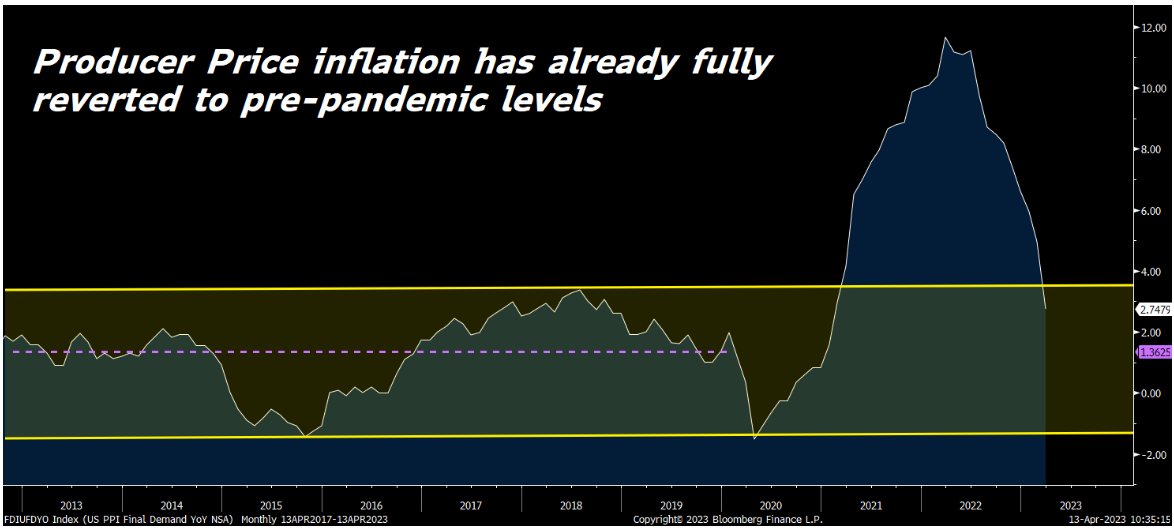

Further, if that data weren’t convincing enough to prove that inflation is dead, today we learned that the producer price inflation rate collapsed an astounding 220 basis points in March to just 2.7%!

That is a stone’s throw away from the Fed’s 2% target. At that rate, we will be below 2% producer price inflation by next month!

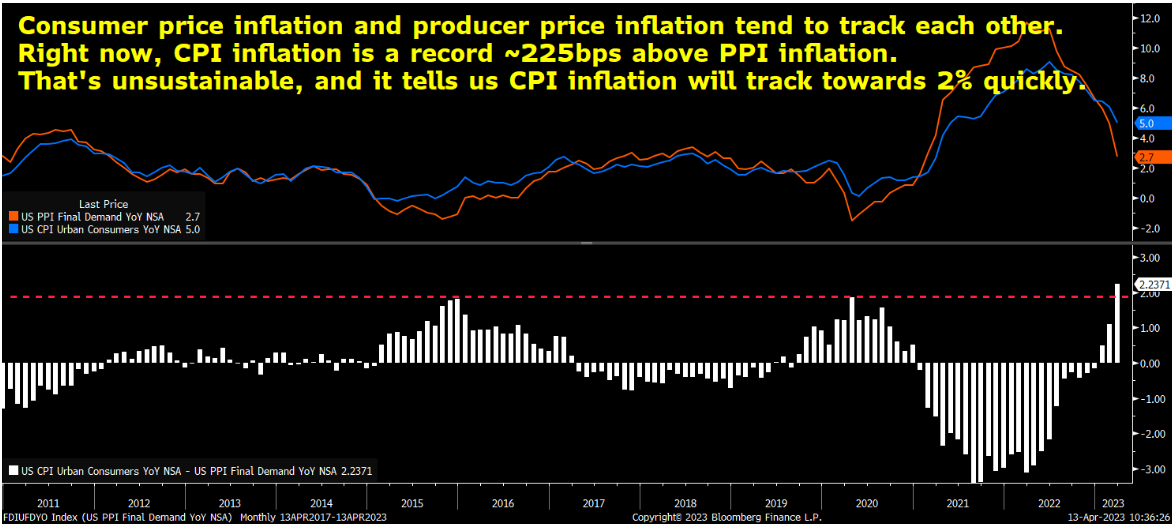

Now, normally, the consumer and producer price indices track one another.

But today, the consumer price index is running a record 225 basis points above the producer price index. This huge discrepancy strongly suggests that both indices will return to 2% by the summer.

For all the talk of how “sticky” inflation was, it seems it’s not that sticky after all. Red-hot inflation started in early 2022. About a year later, it’s basically dead.

And that is supremely bullish for stocks.

The Final Word

Just look at today’s price action. As I write this, all the major stock indices are up big. Our Core Portfolio is up 3% today and is now up nearly 25% in 2023!

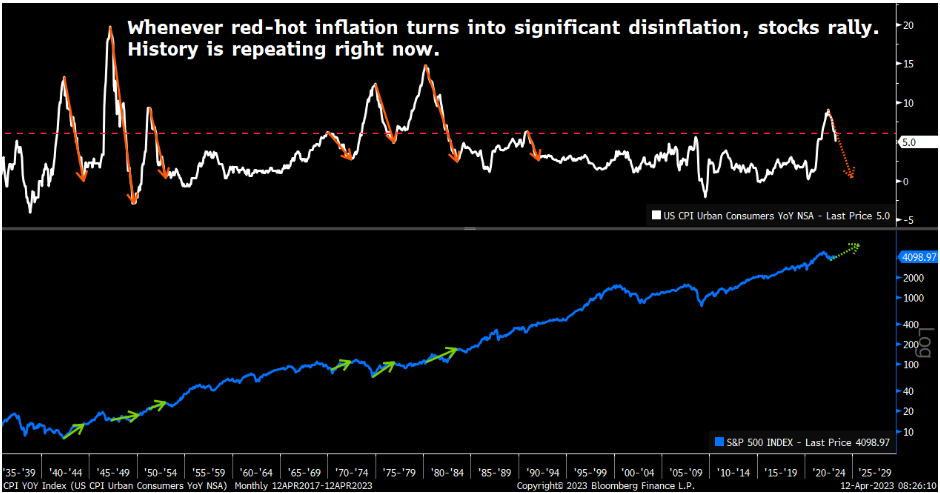

The death of inflation is bullish for stocks.

Going back to the 1930s, every single time that red-hot inflation became significant disinflation – exactly what we have today – stocks rallied in a major way.

History is repeating itself.

Inflation peaked in late 2022. And, indeed, stocks have been pushing higher ever since.

As this disinflation trend gains more momentum and we push closer to the Fed’s 2% target, this stock market rally will grow more powerful.

The S&P 500 is up 16% since October. We think it’ll rally another 20%-plus into the end of the year.

If it does, then certain individual stocks will rally more than 100% into the end of 2023.

And we think we’ve found just the ones.

Specifically, the U.S. government is developing a top-secret technology that many compare to the discovery of fire.

And one tiny company is developing the best form of this technology right now.

This stock could be the next Microsoft (MSFT) or Nvidia (NVDA). It has trillion-dollar potential. And it could be one of the stock market’s biggest winners this year.

Learn more about this stock and its breakthrough tech before it takes off.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.