Editor’s note: “A Golden Ticket to Beat the Fed and Profit in ‘Hidden Bull Markets’” was previously published in August 2022. It has since been updated to include the most relevant information available.

There’s always a bull market somewhere.

And indeed, there’s one happening right now.

In August of 2022, the Fed was hiking rates aggressively as it tried to wrangle decades-high inflation. It promised the U.S. economy would experience “pain,” and the Dow dropped 1,000 points. Even amid that, there were still bull markets out there. That same week, when the Dow plummeted, 1,296 U.S. stocks still rose on that day. And two rose more than 1,000%!

Just like in 2008, when the financial crisis caused a widespread crash, a dozen stocks still more than doubled.

Not to mention 2001. When stocks were reeling from the dot-com crash, more than 25 stocks still rose more than 300% that year.

Indeed, no matter the macroeconomic conditions – boom or bust, expansion or recession, bull market or bear market, rally or crash – there’s always a bull market somewhere.

We just have to find it.

Luckily, we’ve developed a proprietary and exceptionally complex quantitative system to find those bull markets wherever they are.

Here’s a deeper look.

A Bull Market Is Always Roaring

No matter what’s going on with the broad market indices or how many crises might be popping up around the globe, there’s always a sector, an asset class, or a group of stocks that’s surging – and making its investors fistfuls of money.

Why? Because we live in an $80 trillion global economy.

That’s a lot of money. In fact, it’s so much money that it’s guaranteed not all of it will always move in the same direction.

Let’s pull out the sports analogies.

Even the worst free-throw shooter in the world will hit at least a few throws if you give them 80 trillion shots. Even the worst batter will hit the ball a few times if you pitch to them 80 trillion times.

By the same token, even a few stocks will rise in the worst of macroeconomic conditions if you give those stocks $80 trillion to work with.

In our global economy, something is always going up, and something is always going down. Both are always true.

So, instead of focusing on what “the market” is doing, I recommend this. Keep in mind that it’s not so much a stock market as it is a market of stocks.

And thanks to those stocks’ wildly differing fates, there’s always a bull market printing money for investors who know where to look.

Huge Opportunity in the “Hidden Bull Markets”

Let’s take this a step further to make sure we’re on the same page.

When I write “bull market,” I don’t mean gains of 25%, 30%, or even 50%.

Now, I’m not scoffing at those returns. Who doesn’t want to make 50% on an investment?

But what I’m talking about is 100%-plus returns in a single year. And again, this is regardless of what’s happening in the S&P 500 or the Nasdaq, the commodities market, or elsewhere.

Let’s put some real numbers on this so that you can see for yourself.

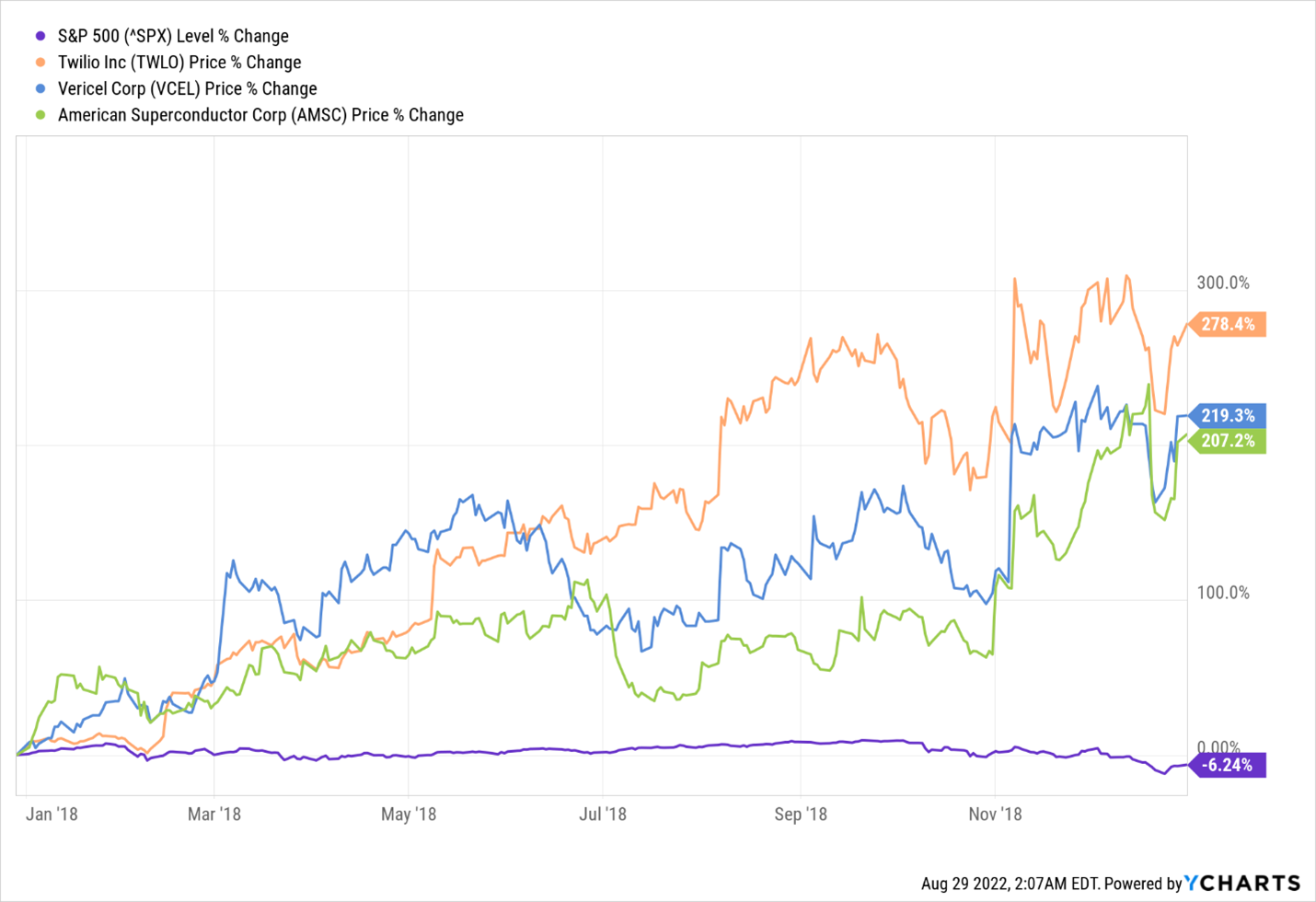

In 2018, the S&P fell by 6.24% for the entire year.

Meanwhile, over that same 12-month period, Bright Mountain Media (BMTM) soared 360%. Twilio (TWLO) climbed 278%. Vericel (VCEL) rose 219%, and American Superconductor (AMSC) jumped 207%.

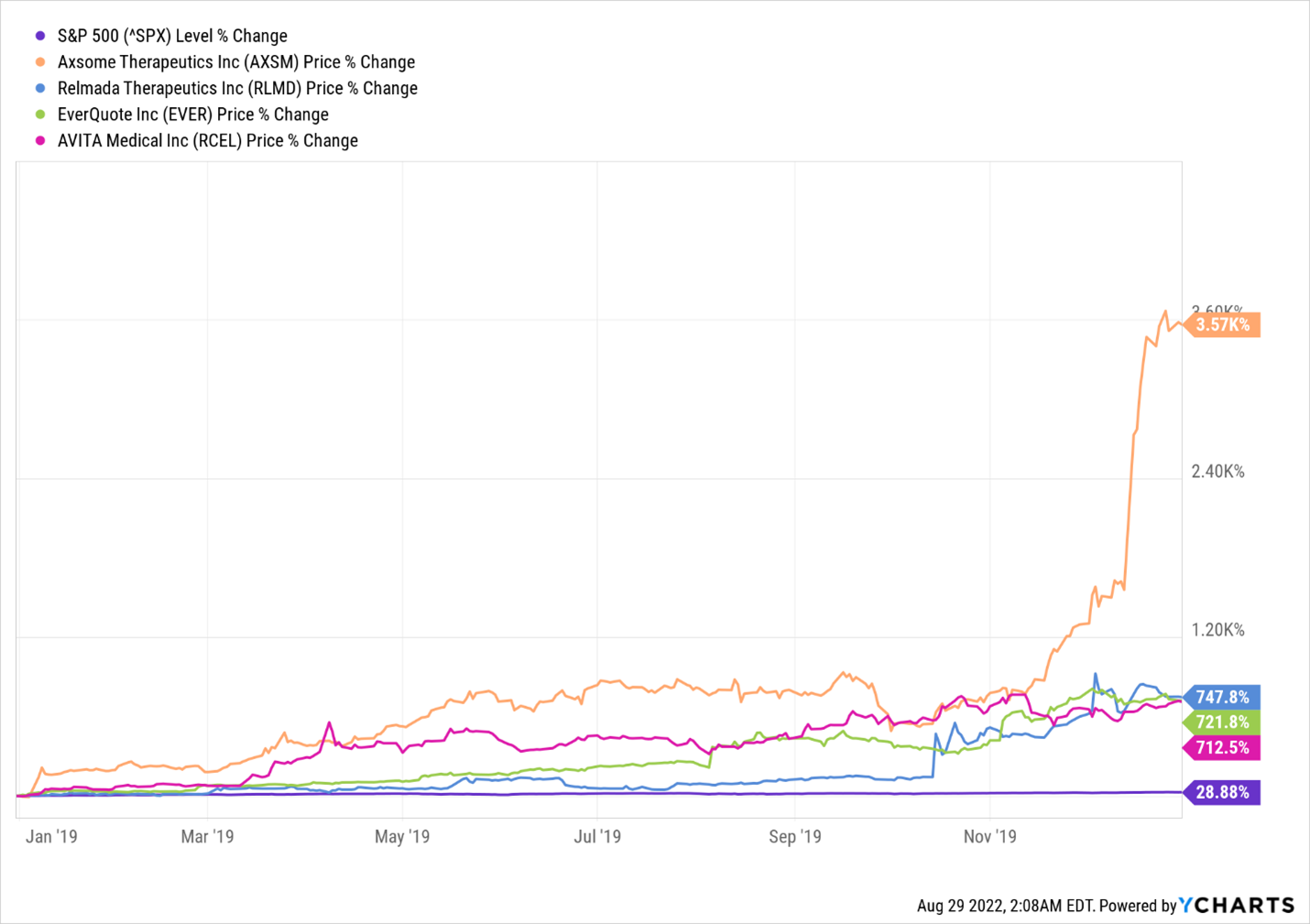

In 2019, the S&P had a great year, up 29%.

But that bull market was nothing compared to what happened for Axsome Therapeutics (AXSM), which erupted 3,565% over those same 12 months, Relmada Therapeutics (RLMD), up 748%. Not to mention EverQuote (EVER), which climbed 722%, or AVITA Medical (RCEL), up 713%.

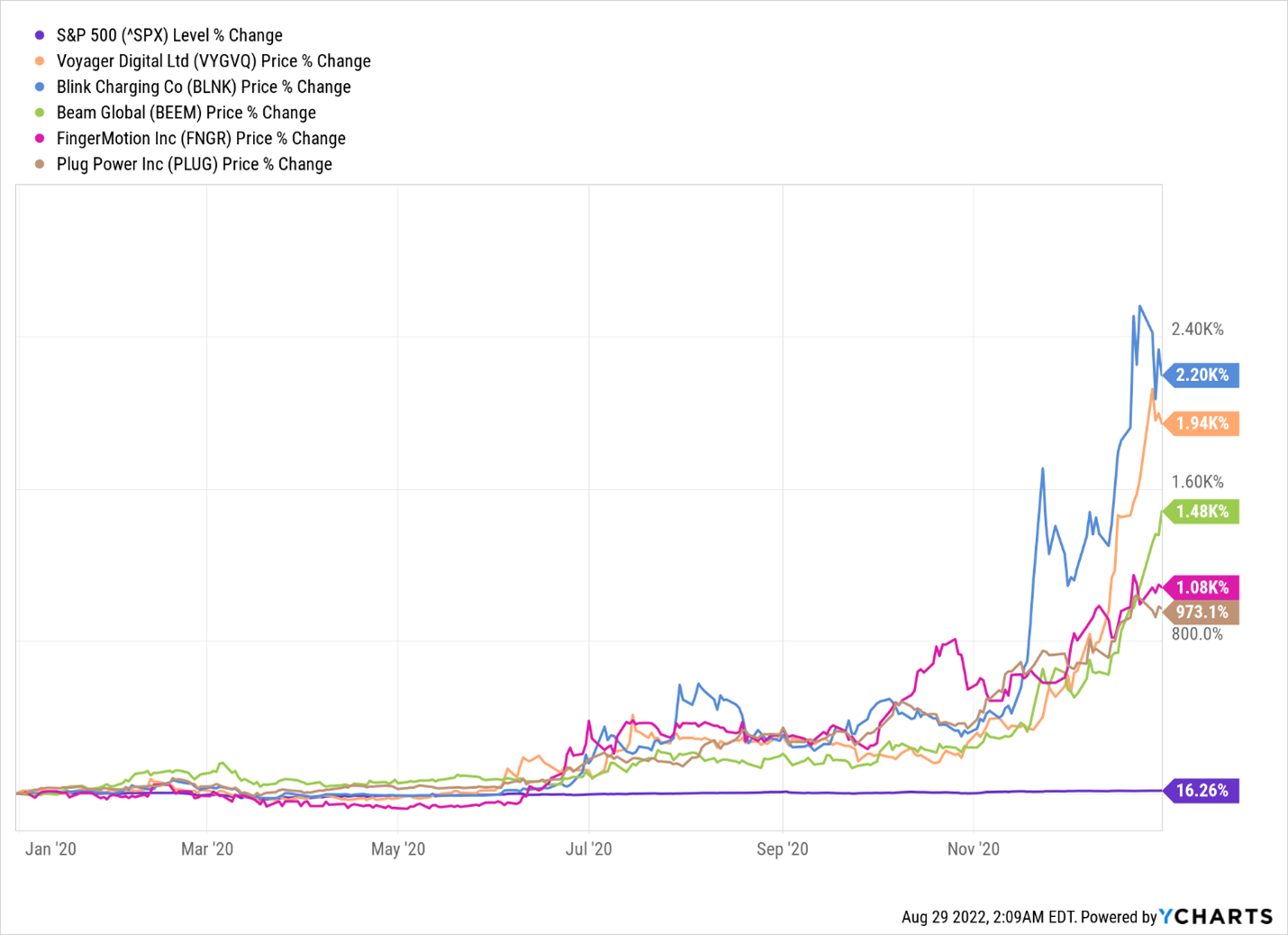

And that brings us to 2020 and the COVID-19 pandemic. Despite falling more than 30% during the bear-market low, the S&P climbed 16% on the year.

Meanwhile, Blink Charging (BLNK) made its investors 2,190%. Voyager Digital (VYGVQ) returned 1,983%. Beam Global (BEEM) soared 1,483%. FingerMotion (FNGR) added 1,084%, and Plug Power (PLUG) climbed 973%.

That’s all in just one year.

Even in 2022, with the worst inflation in 40 years and stocks getting pummeled, you’re kidding yourself if you think there weren’t localized bull markets.

Take energy and shipping stocks, for instance.

Thanks to the Russia-Ukraine war and severe tightness in the oil market, the price of oil stayed high in Q1 and Q2 of 2022. That sent oil and gas stocks soaring and allowed some traders to make a lot of money in oil stocks.

This was also a huge boon for certain shipping stocks that load exports of diesel and gasoline.

You could have done well with any of the big oil names – Exxon (XOM), Chevron (CVX), or BP (BP). In the first half of the year, they gained between roughly 30% and 50%.

But a moment ago, we talked about 100%-plus returns.

Well, by late summer of 2022, ProShares Ultra Natural Gas (BOIL) had popped 305% on the year. BP Prudhoe Bay Royalty Trust (BPT) was up 470%. And Scorpio Tankers (STNG) had risen 225%.

Again, this is in less than eight months – and during a broad bear market.

This is not an anomaly.

These individualized bull markets happen all the time, and they make their investors life-changing returns.

So, the question becomes: how do you find these mega winners?

Well, that brings us to our brand-new quantitative system.

The Final Word on Finding Bull Markets

Everyone has a “system” when it comes to the stock market.

An investor may not think of their investment approach that way, but that’s what it is.

Are you a blue-chip investor?

Your system involves finding veteran stocks with beloved brands and loyal customers that stand the test of time.

Are you a value investor?

Your system involves finding companies with stock prices that appear undervalued relative to the intrinsic value of the company’s assets and cash flows.

Maybe your system is more sector-based. You find cutting-edge technology stocks.

Well, the new system that we’ve developed focuses on the one thing that really matters to your wealth…

A price breakout.

Specifically, our first-of-its-kind system finds all the stocks in the market in the early stages of meaningful price breakouts. It finds all the stocks entering their own personal bull markets.

In so doing, this process is literally programmed to make you money in any market. Our back test of the model to 1980 shows that it works in any market conditions.

This is the tool you need to beat the Fed, inflation, and the past year’s bear market – and make lots of money in 2023.

Don’t miss your chance to make huge gains, no matter the market weather.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.