I’m just going to come right out and say it: Today is the most important day of the year for the stock market. And if you play it right, you could set yourself up to make a small fortune.

You may have heard. Stocks just had a great month. In fact, the Dow Jones had its best October ever.

The reason for the big rally boils down to one thing: the Fed pivot.

That is, investors are hopeful that the U.S. Federal Reserve will start to slow its pace of rate hikes soon. This so-called “Fed pivot” is expected to happen today. If it does, the big October rally in stocks will turn into an even bigger November and December rally. Investors will say goodbye to the bear market of 2022 and hello to a new bull market in 2023.

However, if the Fed doesn’t pivot this afternoon, then the stock market may see all its record October gains disappear.

I repeat: It’s a very important day for the stock market. Whether stocks soar or crash into the end of the year will likely be decided today.

So… what’s going to happen? Let’s find out.

A Critical Juncture for the Stock Market

We’re at a very critical juncture for stocks. You could find a dozen fundamental and technical indicators to illustrate as much. But perhaps the best is the stock market’s 200-day moving average (MA).

The 200-day moving average is the long-term price trend for the stock market. It is considered the “gold standard” for long-term price trend analysis. It’s short enough that it captures weekly price movement, yet long enough that it doesn’t succumb to daily price volatility.

That’s why traders watch it so closely. Breaks above and below the 200-day MA are often indicative of a long-term price trend reversal in the market.

That is, when a bull market breaks below the 200-day, it usually means a bear market is on the way. Conversely, when a bear market breaks back above the 200-day, it usually means a bull market is on the way.

We’ve been in a bear market all year long. The stock market has consistently traded below its 200-day moving average. But the October rally in stocks was so powerful that the market has actually retaken this moving average.

Over the past 20 years, almost every time the market retook its 200-day MA after a crash, it indicated a bullish trend reversal in stocks. See the chart below.

Obviously, there are false signals. But they are rare.

Consequently, we must ask ourselves: With the market retaking its 200-day moving average in October – something it never did in the 2008 crash until after the bottom – are we staring at a new bull market or the greatest headfake of all time?

The Fed will ultimately decide the answer to that question today. And I’m cautiously optimistic that you’ll end up liking the answer.

Why This Time May Be Different

I think a Fed pivot is coming soon and that a new bull market in stocks could form today. And given the huge October rally in stocks, Mr. Market is clearly hopeful, too.

To be sure, this isn’t the first time the market has been hopeful for a “Fed pivot.” In fact, in each previous Fed meeting since May, investors went into the event hopeful for a pivot. They left disappointed each time, as the Fed still has yet to pivot. As a result, stocks have been crashing all year long.

But the November meeting could be different for one big reason: expectations.

Going into previous meetings, the market was consistently underestimating the Fed. That is, the Fed has been guiding to higher interest rates all year long through its quarterly Summary of Economic Projections. However, the market has consistently failed to believe that the Fed will hike rates as much as it says it will. So, when the Fed has continued to reiterate that it is not deviating from its initial plan, the market is shocked – and stocks fall.

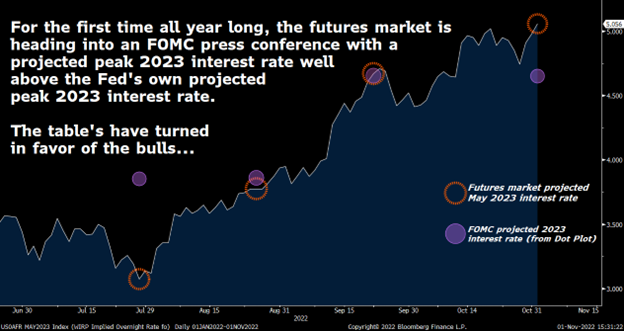

For example, going into the June meeting, the market’s forecasted peak interest rate for 2023 was a full 80 basis points below the Fed’s forecast. Going into the July meeting, the market was about 10 basis points below the Fed. And ahead of the September meeting, the two were about the same.

Said differently, going into the last three Fed meetings, the market was either below or in-line with the Fed in terms of peak interest rate forecast.

That’s not true this time around. This time, the market’s forecasted peak interest rate for 2023 is 5.05%, a full 40 basis points above the Fed’s forecasted peak interest rate for 2023 of 4.65%.

The tables have turned in favor of the bulls.

The market was priced for a dovish surprise going into the last three meetings – and got smacked in the face when the Fed stayed hawkish. The stock market is now priced for a hawkish surprise going into this meeting and could soar even if the Fed stays hawkish.

We like that risk-reward setup.

And that’s why we think today could be a big day for the markets.

The Final Word on the Stock Market Turnaround

No one knows exactly when a bear market will end or when it will turn into a new bull market.

But we all know that inevitably, it will happen. All bear markets eventually end and turn into bull markets.

So, that means you need to be buying stocks today in this bear market. Over 100 years of history says you will make great money over the next two, five, and 10-plus years.

Luckily for us, we have a catalyst on deck today that could end this bear market. So, not only do you have 100 years of history on your side, but you also may have the luck of a huge upside catalyst, too.

Don’t let this opportunity pass you up.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.