On one level, the surge in interest toward electric vehicles when the novel coronavirus pandemic capsized our paradigm was peculiar, to say the least. Because Covid-19 isn’t just a health crisis but an economic one as well, now didn’t seem to be the best time to buy a car. However, the disruption to global automotive supply chains was enough for affluent consumers to rethink everything. Still, if you’re interested in EVs, you may want to consider battery stocks instead.

For one thing, EVs are driven by consumer sentiment. So far, that has worked out incredibly well for Tesla (NASDAQ:TSLA), the dominant leader in the space. But it’s also possible that one day, mainstream automotive manufacturers could disrupt Tesla in the way that it initially disrupted the previously staid auto industry. For instance, Porsche, which is produced and manufactured under Volkswagen (OTCMKTS:VWAGY), could potentially steal market share in the high-end EV market.

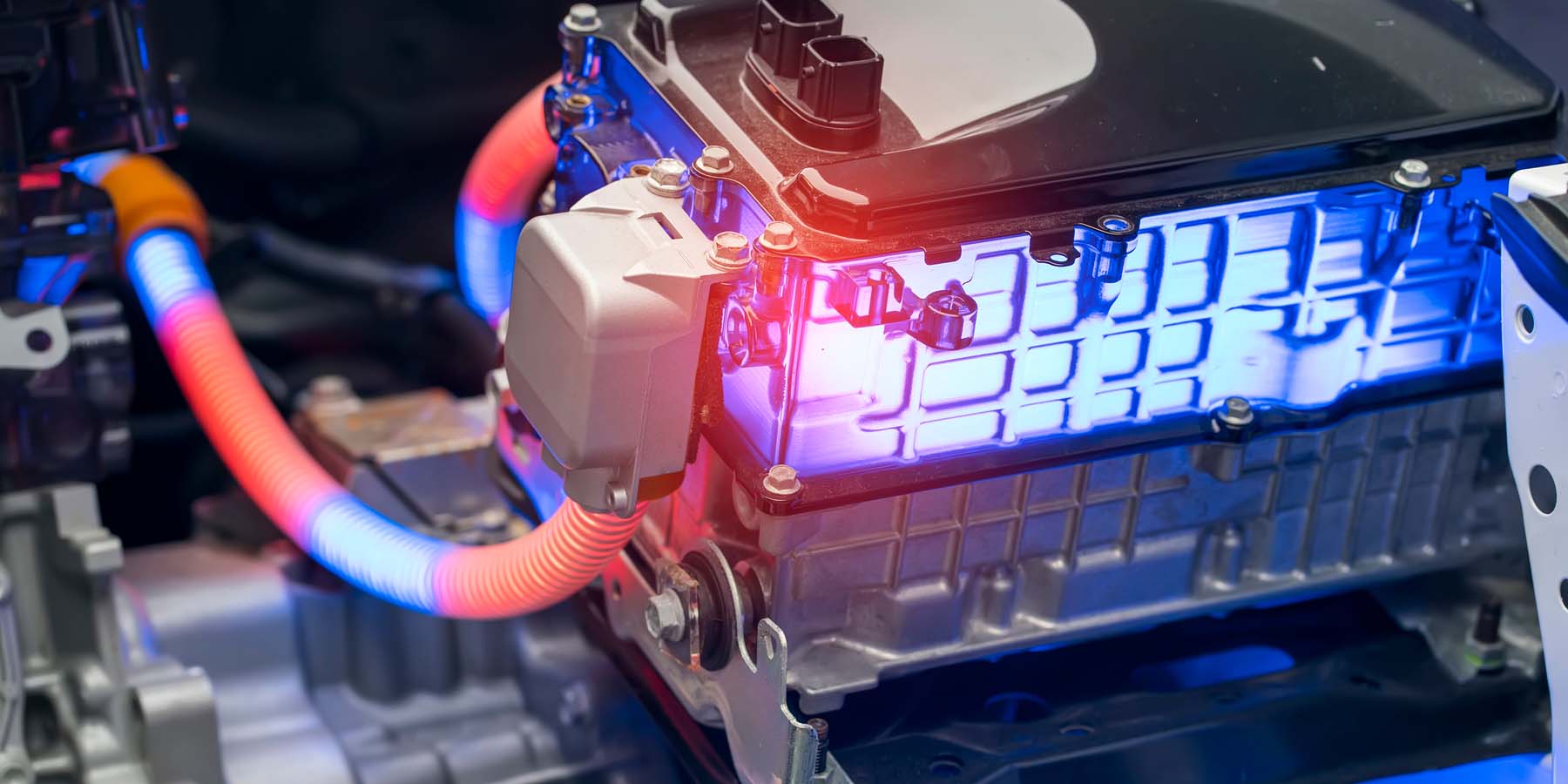

Further, other car manufacturers known for their economy models could dominate the lower end of the price spectrum. That could negatively impact TSLA in the future. However, battery stocks that are tied to lithium-ion-based EV powerplants are relatively insulated. With this sector, it’s not about picking specific winners but the winning market. For the foreseeable future, battery technology will grow increasingly relevant, making this space a no-brainer.

Second, battery stocks offer multiple applications beyond EVs. For instance, the clean energy industry, specifically wind and solar, has enjoyed a surge in momentum. As we’ve seen, historically awful wildfires have cast doubt on the narrative that climate change doesn’t exist. This has led government officials to propose go-green initiatives.

However, you can’t get to the point of mainstream integration without a way of storing intermittent renewable energy sources for high-volume usage at a later time. Therefore, whether you’re talking about EVs or environmental protocols, these battery stocks are sure to enjoy relevance over the next several years.

- Toyota (NYSE:TM)

- Murata Manufacturing (OTCMKTS:MRAAY)

- General Motors (NYSE:GM)

- Panasonic (OTCMKTS:PCRFY)

- Albemarle (NYSE:ALB)

- Sociedad Quimica y Minera de Chile (NYSE:SQM)

- AES Corp (NYSE:AES)

Finally, the U.S. and the rest of the free world is looking forward to new leadership at the White House. As you know, President-elect Joe Biden has consistently stated that he will follow science, not science-fiction, regarding future policies. This augurs well for these seven battery stocks to buy.

Battery Stocks to Buy: Toyota (TM)

One of the more intriguing bets for battery stocks isn’t primary a battery company at all. Instead, Toyota is world renowned for its reliable cars, often sold at very reasonable prices. As well, through its Lexus brand, the Japanese auto giant competes with multiple European luxury automakers, making the Germans nervous. If you can fluster the Germans in, well, anything, you know you’ve done a great job.

But Toyota’s management team may want you to consider TM stock as a diverse play rather than one strictly associated with automobiles. That’s because technology is constantly shifting, and one of the biggest changes is in battery-related innovations. As you know, Toyota is among the many players researching and developing solid-state batteries.

In August, Toyota and partner Kyoto University announced that they developed a “fluoride-ion solid state battery with up to 7 times the energy density of a conventional lithium-ion battery.” Due to the platform’s superior thermal management, a cooling system is not required, leading to more space dedicated to power generation. That means more power and longer range as well as reduced cost.

To be fair, this development is a laboratory queen, so don’t expect this narrative to immediately skyrocket TM stock. However, over the next several years, it’s possible that a distinguished company like Toyota can make the major breakthrough. In the meantime, you can potentially profit from its high-volume auto business.

Murata Manufacturing (MRAAY)

Although it’s hardly what you would call a household name in the U.S., Murata Manufacturing is the “Trump supporter” of battery stocks. As you know, fans of the outgoing (supposedly) President love calling themselves the silent majority. You don’t know what they think because they keep their cards close to their chest. Apparently, they also deliberately mislead pollsters. Then, on election day, surprise!

If it weren’t for the allegedly fake ballots, President Trump asserts that he would have won easily. And let’s be honest, the electoral battle was very close.

It’s the same principle for MRAAY stock. You may not know what Murata does or have even heard of the company. But according to the organization’s website, it covers a wide spectrum in battery applications, ranging from small electronic equipment to smartphones to energy storage systems. Put another way, Murata makes battery stocks great again.

According to the Nikkei Asian Review, Murata is also one of the competitors in solid-state battery R&D. What makes MRAAY stock intriguing in this regard is that the company isn’t just focused on electric vehicles. Rather, Murata is also thinking small, such as utilizing solid-state innovations for Internet of Things (IoT)-based medical wearables. Again, Murata isn’t well known, but that doesn’t mean you should ignore it.

General Motors (GM)

Over the years, I’ve blasted American car companies for their staid product portfolio (the full-sized pickup truck being one of the few exceptions) and their mediocrity. By this, I mean that companies like General Motors have often reflected the typical American work ethic: asking what is the least they can do and get away with it, and sure enough, doing exactly that.

Listen, America is my citizenship of choice, not my birthright. Acquiescence to mediocrity is the one thing I still find incredibly alien. If anything, someone should deport that. But in a way, General Motors is getting rid of their mediocre ways and implementing exciting and relevant initiatives. This brings some intrigue toward GM stock.

Primarily, the iconic automaker is making a big push toward EVs, developing its Factory Zero plant solely dedicated to the platform. Further, CNN reports that “GM has previously committed to using 100% renewable energy, such as wind and solar power, to run all of its US factories by 2030. Factory Zero, for instance, will have a 30-kilowatt solar carport and a 516-kilowatt ground-mounted solar panel array.”

Under this new long-term strategy, General Motors is a play on battery stocks for two reasons: first, utilization of renewable energy will require energy storage systems and second, EVs will require battery packs to run. Clearly, this isn’t your parents’ GM stock.

Panasonic (PCRFY)

One of the pivotal reasons why so many battery stocks are levered to solid-state R&D is the platform’s potential advantages over current lithium-ion batteries. Basically, the electrolyte is in liquid or polymer gel form in a traditional battery setup, which has a major setback because the chemical reaction involved in converting stored energy into usable power creates heat.

Obviously, that’s not a great outcome because you need a cooling mechanism to prevent catastrophic failure. That’s where solid-state batteries could take over because they don’t generate the kind of heat that traditional batteries do. Therefore, the physical space needed for cooling systems can be used in other ways, thereby improving overall performance. For companies like Panasonic, the solid-state battery is the holy grail of the EV industry.

However, the road to this innovation is a complicated one due to present cost restrictions as well as durability challenges. To address the problem, you must know the problem and Panasonic’s imaging solution for solid-state research may be pivotal to its ultimate breakthrough. Thus, PCRFY stock is the practical pathway toward novel EV solutions.

While research is underway, you can bank on PCRFY stock on its underlying lithium-ion and nickel-metal battery business units, both of which are in high demand as the world moves toward net zero emissions.

Albemarle (ALB)

Currently, battery stocks can be separated in two phases: hype and practicality. As I mentioned with the companies above, investors have been piling into the space due to the possibility of a solid-state battery breakthrough. Thanks to the innovative platform’s superior thermal properties, EVs can drive longer on a single charge. Further, that charging can take place much quicker, as well as overall costs being considerably lower because solid states are 80% to 90% thinner, thereby using less raw material.

However, breakthroughs aren’t easy to come by. As The New Yorker pointed out, aluminum was once hailed as a wonder substance around the time it was discovered in minute quantities in the 1820s. But it wasn’t until decades later that a new process utilizing electricity allowed for aluminum’s industrial application. We could see a similar dynamic with solid-state battery stocks, meaning that Albemarle is still a name to consider for the industry’s practical (and current applications).

While it’s clear that we need an alternative to lithium-ion batteries to power the future, for now, this platform isn’t going anywhere. Therefore, I like ALB stock because it provides a relatively safe exposure to lithium production. And until we get that breakthrough that is commercially viable, Albemarle should continue enjoying upside.

You don’t have to take my word for it. Just look at the year-to-date performance of ALB stock, which at time of writing is 61%. Thanks to recent relevancy, shares have erased much of the disappointment over recent years.

Sociedad Quimica y Minera de Chile (SQM)

One of the biggest advantages for electric vehicles is their contribution toward net zero emissions. This impact can be felt across the entire spectrum. On the consumer front, there’s no chance of people accidentally killing themselves due to carbon monoxide poisoning, a risk factor associated with combustion-engine cars. Broadly speaking, EV integration would make our most air polluted cities breathable again.

At the same time, I can’t help but wonder about the fundamental contradiction of certain battery stocks like Sociedad Quimica y Minera de Chile. A prolific lithium miner, SQM stock has soared this year due largely to the EV revolution. Many people (with money that is) realized how vulnerable their combustion cars were to global supply chain disruptions. Frankly, the novel coronavirus was a free marketing blitz for the EV industry.

But on the other hand, Sociedad Quimica has to get the lithium from somewhere. And that has caused negative impacts, ranging from environmental violations to disruption in indigenous communities. That’s not to suggest that SQM stock is an unprofitable idea because it’s obviously a strong performer. However, the way that Sociedad gets the business done may not appeal to everyone.

Still, with EV integration rising, lithium demand has never been greater. Therefore, if you don’t mind a little vice in your portfolio of battery stocks, SQM is a solid idea.

AES Corp (AES)

As you know, clean and renewable energy development is all the rage these days. In addition, this environmentally friendly factor may have played at least a small role in President-elect Joe Biden’s victory. According to the Biden Plan, his administration will implement policies and initiatives that will get the American economy to achieve net-zero emissions by 2050.

In the spirit of transparency, I’m skeptical about green energy replacing or even taking a majority share from fossil-fuel based energy sources. Over the years, we’ve seen incredible technologies bolster the efficiency and effectiveness of renewables, yet they still represent a minute portion of global energy consumption.

Nevertheless, clean energy will probably be a complement to traditional energy sources rather than a competitor. And that should bode well either way for AES Corp and specifically AES stock. What makes the underlying organization stand out from other battery stocks is its emphasis on energy storage.

One of the fundamental setbacks of solar and wind is that they are intermittent energy sources; they depend on environmental factors that are largely out of their control. Thus, for the green industry to be truly effective as a complement to traditional infrastructures, it must be able to store the energy accrued from when the sun is shining, or the wind is blowing.

The strength of AES stock is evident in that shares have more than doubled since the March doldrums. With a new administration taking over, now may be a good time to consider the green energy specialist.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) any positions in the securities mentioned in this article.

A former senior business analyst for Sony Electronics, Josh Enomoto has helped broker major contracts with Fortune Global 500 companies. Over the past several years, he has delivered unique, critical insights for the investment markets, as well as various other industries including legal, construction management, and healthcare.