Netflix (NASDAQ:NFLX) stock is coming off record highs and just issued quarterly earnings that show skyrocketing subscriber growth. You’d think that’s a recipe for the bullish rally to continue, right?

Not so fast. There are actually a lot of contrarians out there who pushed Netflix stock down following its April 21 report.

If you’re confused, you’re probably not alone. Wall Street sends a lot of mixed messages and leaves it to the individual investor to work out what’s important and what’s just noise. And that’s one reason why I think my Portfolio Grader tool is so important for investors today.

Let’s cut through the noise and take an objective look at Netflix stock through the eyes of my Portfolio Grader to see if NFLX is worth an investment today.

Netflix Stock at a Glance

First, the earnings report. Netflix reported earnings per share of $1.57 on revenue of $5.77 billion. Wall Street expected EPS of $1.65 and sales of $5.76 billion. From that perspective, the earnings were a mixed bag.

However, it’s important to note that year-over-year earnings rose by 108% – that’s a huge number – and sales rose by 28%.

For the fourth quarter, revenue increased by 27.6% from the fourth quarter of 2018.

The most eye-opening number, though, was subscriber growth. Netflix reported a net increase of 15.8 million new subscribers, more than double the 7 million analysts expected. The reasoning behind that, of course, is the novel coronavirus pandemic that has most of America hunkered down at home.

It appears that in a pandemic, Netflix becomes as essential a service as they come.

Netflix is expecting another 7.5 million new subscribers in the second quarter, which also beat analysts’ expectations, and now has more than 180 million subscribers. Investor’s Business Daily reported that 20 Wall Street analysts raised their price targets for NFLX stock after the earnings report.

The Contrarian Argument for Netflix

Netflix raised some eyebrows, however, by casting doubt about the company’s growth in the second half of this year and into 2021. The company acknowledged in a letter to shareholders that it expects viewership to drop and membership growth to slow as the U.S. and other countries lift home confinement rules.

“Intuitively, the person who didn’t join Netflix during the entire confinement is not likely to join soon after the confinement,” the company stated.

Netflix also notes that it is experiencing some problems in content production as global filming came to a standstill. The company said that some post-production work, such as voice dubbing into some foreign languages, has come to a halt because voice actors don’t have home studios.

NFLX says it has plenty of content to round out 2020. In fact, the company that brought us “Tiger King,” “The Crown,” and “Stranger Things” says it will have more new programming this year than ever, as much of its content is shot far in advance. But programming to be released in 2021 is currently being affected by the pandemic, and it’s unknown when filming will resume.

Meanwhile, Netflix continues to lose some of the tried-and-true shows that people love to binge. That’s because they’re going to competing streaming services such as Disney+ (NYSE:DIS), HBO Max and NBCUniversal.

Finally, Netflix announced this week that it will issue $1 billion in debt to fund future content acquisitions and production. This is standard operating procedure for Netflix, but it’s also raising questions about whether Netflix’s business model is sustainable when it’s already missing quarterly EPS and is expecting slower subscriber growth.

All this has Stifel analyst Scott Divitt cutting his rating on NFLX stock from “buy” to “hold,” and lowering his price target from $460 to $410.

“While the timing of a potential return to normalcy remains unknown, we expect some form of trend reversal to materialize as lockdowns are lifted and a portion of recent demand proves to have been pulled forward,” he wrote.

The Bottom Line for Netflix

All that is a lot to investors to digest. It’s no wonder why Netflix stock, which rose more than 30% year-to-date, is now in a slight decline.

Let’s take a look at how my Portfolio Grader evaluates NFLX stock.

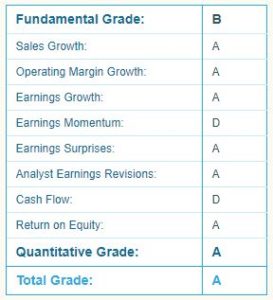

Netflix gets high marks on many important categories – return on equity, sales growth, operating margins, and earnings growth are all tried-and-true indicators of success in growth stocks. Netflix as a fundamental grade of “B” and a quantitative grade of “A” for an overall score of “A.”

True, there’s a lot of mixed messaging out there about Netflix stock today. It’s certainly important for investors to look at the whole picture when evaluating whether they should open a position, expand an existing position, or take their profits.

But cut through the clutter with my Portfolio Grader, and you’ll see that Netflix remains one of the best stocks you can own today.

Louis Navellier had an unconventional start, as a grad student who accidentally built a market-beating stock system — with returns rivaling even Warren Buffett. In his latest feat, Louis discovered the “Master Key” to profiting from the biggest tech revolution of this (or any) generation. Louis Navellier may hold some of the aforementioned securities in one or more of his newsletters.

Louis Navellier had an unconventional start, as a grad student who accidentally built a market-beating stock system — with returns rivaling even Warren Buffett. In his latest feat, Louis discovered the “Master Key” to profiting from the biggest tech revolution of this (or any) generation. Louis Navellier may hold some of the aforementioned securities in one or more of his newsletters.