TLT – Today’s featured article covers the iShares Treasury Bond (TT) and reveals how the Federal Reserve is preventing a bond calamity. Read on for all the details.

Get Free Updates

While the moves in the stock market have been wild and the largest we’ve seen in over a decade, it’s the bond market that has seen unprecedented – a word that I and others continue beating to death— and threatened to take the entire financial system down.

Two weeks ago, I wrote how Bonds have Gone Bonkers as the 10-Year Note yield sank below 50bs. That was driven by a flight to safety as the selling in stocks accelerated. The Federal Reserve mostly stood pat and made it clear that they had no intention of sending rates to zero — or even negative yield — as many other developed nations from Japan to Germany have done.

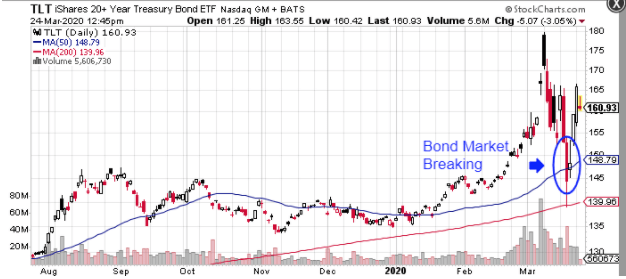

But, then as things turned from bad to worse with businesses being shut down and cities ordering lockdowns we saw a complete reversal in bond prices as yields jumped back towards pre-virus levels. The chart of the “iShares Treasury Bond (TLT)” ETF shows the parabolic move higher followed by a sharp reversal. The market has since stabilized thanks to the Fed takes, yes, unprecedented moves.

What happened was all buyers disappeared and transactions were not taking place at any price. This forced the Fed on Monday to step in and say it will buy an unlimited amount of Treasuries, boosting the daily repo operations to $120 billion per day. It will also purchase everything from municipal bonds to mortgage back securities to corporate debt. It is basically hoovering up all bond/debt instruments to keep the market liquid and functioning. Unprecedented!

Bonds are generally more stable than equities and have a predictable stream of income, acting as a “shock absorber” in the overall scope of a portfolio and over time using bonds can help diversify and lower the risk of a portfolio, without sacrificing returns. More importantly, the bond market is about five times the size of the stock market and is the essential plumbing of not just the financial system but crucial to the day to funding of corporate, city, state and federal operations. If the bond market breaks it all stops functioning.

That’s why the Fed’s unprecedented intervention was crucial and justified. Let’s run through what are bonds and the different types.

What are Bonds?

- An interest-bearing instrument that promises to pay a stated amount of money at some future date.

- Bonds are redeemed at the end of a term, called a maturity date. Some bonds have “call dates.” Issuers may call bonds earlier than its maturity date if it suits them at that time. Other bonds have “put features.” This is the opposite of a call date. “Put” allows the holder to sell the bond back to the issuer at a predetermined price before the stated maturity date.

- When you buy a bond, you are in effect “lending money” to the issuer, much like an “I.O.U.”

Who Issues Bonds and Why are They Issued?

- Bonds are issued by many types of entities, including Governments, Corporations, Municipalities and Federal Agencies.

- Bond issuers issue bonds generally to fund their operation. They pay the owner interest so long as the bond is outstanding.

When a bond is issued, the issuer assumes that they can earn more in their business than they are paying out on the interest payments. For a corporation, by example, this means they feel their “return on equity” will exceed their interest payment rate. Bonds can be issued to fund an acquisition, for general corporate purposes or to pay off a maturing bond issued previously.

Government Bonds: Bonds that are issued by the U.S. Treasury. U.S. Treasury bonds are used to finance the federal government debt and are considered to have the bond market’s lowest risk because they are guaranteed by the U.S. Governments “full faith and credit” or, in other words, its taxing authority.

Corporate Bonds: A debt obligation issued by a corporation, such as “IBM(IBM)”. Corporate bonds have ratings from AAA (such as “Johnson and Johnson (JNJ)” all the way down to BBB- (Standard and Poor’s) or Baa3 (Moody’s). Interest is generally paid semi-annually.

Exchange-Traded Funds (ETFs) These are not technical bonds but rather “stock’ funds whose shares represent underlying bond holdings. I place them high on the list as these have become the most popular vehicle for many, both money managers and individuals, to trade/get exposure to various slices of fixed income. Ie, “iShares Barclay 20 year (TLT)” tracks long term Treasury bonds while “SPDR High Yield (JNK)” tracks ‘junk’ bonds.

Municipal Bonds: A city or state-issued instrument. Interest on municipal bonds are generally tax exempt. If the bond was issued in the bondholder’s state of residence, interest is usually exempt from state tax. It’s generally paid semi-annually. Municipal bonds are generally favored by high-income earners.

Federal Agencies: Government agencies and government-sponsored enterprises such as Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC) issue debt to support their role in financing mortgages that enable Americans to buy homes. Without the government bailout these bonds would have gone to zero. And their market has since become much smaller.

High-Yield or “Junk Bonds”: A junk bond is a “speculative” bond with a rating of BB+ (Standard and Poor’s) or Ba1 (Moody’s) or lower, but with a higher yield than investment-grade bonds. There are two distinct types of junk bonds. First, many junk bonds are issued by young companies or companies with questionable credit and no access to bank credit; they are frequently issued to finance corporate takeovers. The second type of junk bonds are “fallen angels.” These bonds are represented by companies that were formerly investment grade, but whose fundamentals have deteriorated to no longer warrant an investment-grade rating. An example of a high profile fallen angel is General Motors (GM) leading into and post-financial crisis.

Pass-Through Mortgage-Backed Securities: Perhaps the most confusing of all bond types, also called mortgage pools. Mortgage-backed securities are debt instruments with a pool of real estate loans as the underlying collateral. The mortgage payments of the individual real estate assets are used to pay interest and principal on the bonds. Also known as “pass-through securities,” because interest and principal is passed-through from the mortgage holder to the servicing agent to the bondholder. The servicing agent earns a fee for performing the service.

Collateralized Mortgage Obligations: Otherwise known as CMO’s, these are securities in which mortgage pools are combined and separated into short, medium and long term securities (called tranches). Individuals need to be careful in this area. These were the real “nuclear weapons” of the financial crisis.

Here’s the basic definition: Tranches are set up to pay different rates of interest depending upon their intended maturity. In the case of both mortgage pools and CMO’s, maturity dates can be a moving target. This is because prepayment speeds of the underlying mortgages change as interest rates change. Generally, as rates rise, prepayment speeds decrease and maturities “extend.” Vice versa, as rates fall and maturities shorten. This market is a mostly institutional market as advanced analytics are necessary to calculate the yields and potential changes in maturities, prices and yield.

Asset-Backed Securities: Otherwise known as ABS, these are bonds backed by financial assets. These financial assets typically consist of receivables other than mortgage loans. These include credit card receivables, auto loans, manufactured housing contracts and home-equity loans. Issuance and repackaging of these bonds grew out of control and helped contribute to the financial crisis.

Derivatives: A derivative security is a financial instrument whose value is based on, and determined by, another security or benchmark (i.e. stock options, futures, interest rate swaps, floating-rate notes, caps/floors). This is a market dominated by institutions due to their complexity and are rarely suitable for individual investors.

Adjustable-Rate Bonds: Bonds whose coupons change periodically based upon an underlying index, like prime, LIBOR of COFI (11th district cost of fund index). Investors buy and sell these depending on which way they think the underlying index will move.

Closed-End Bond Funds: Closed-end bond funds are mutual funds that only offer shares once, usually in an initial public offering. Then they trade as an equity would on an exchange. Closed-end funds can be municipal or corporate (investment grade or junk) and are sometimes leveraged to add yield to the portfolio in the form of a “carry trade.” Closed-end funds trade at both premiums and discounts to net asset value, usually discounts. Most individuals that buy closed-end funds at IPO get burned as they are offered at an automatic premium to NAV because of brokerage and other fees associated with the offering. Most of the time, it pays to wait for them to settle down and wait for them to go trade at a discount – usually 45 to 60 days. The amount of discount or premium generally represents an investor’s attitudes towards the bond market. The more pessimism, the larger the discount. This is in direct contrast to open-ended funds, where investor sentiment is reflected by the issuance of new shares or redemption of outstanding shares.

The bond market is about five times the size of the stock market and is the essential plumbing of not just the financial system but crucial to the day to funding of corporate, city, state and federal operations. If the bond market breaks it all stops functioning.

TLT shares were trading at $163.18 per share on Tuesday afternoon, down $2.82 (-1.70%). Year-to-date, TLT has gained 20.82%, versus a -26.32% rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Smith

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More…

More Resources for the Stocks in this Article

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!

More iShares 20+ Year Treasury Bond ETF (TLT) News View All

| Event/Date | Symbol | News Detail | Start Price | End Price | Change | POWR Rating | |||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait… | |||||||||

Page generated in 1.356 seconds.