When a company’s quarterly results indicate its prospects have worsened, the markets react quickly and decisively. The stock typically sells off if the company fundamentals show any hint of a downturn.

Other times, bad news the markets didn’t anticipate can send stocks lower. In these cases, investors need to decide if these losers are in a temporary slump or headed for the dump. If the headwind is only short-term, then these are the stocks to buy.

There are seven current losers whose stock price puts them in deep value territory. In effect, the stock discount today compensates investors for taking the risk of buying into their improving fortunes tomorrow. After all, to become tomorrow’s winner, a company needs more than luck. It needs competent management to steer the company back to growth.

After markets rose by at least 20% in the last year, underperforming companies are less risky. Their lower valuations price in a less-rosy future. So, which companies have better futures than the markets expect?

Losers to Buy For Big Wins: Conagra Brands (CAG)

On Feb. 17, 2020, Conagra Brands (NYSE:CAG) slashed its 2020 sales and earnings outlook. It said that holiday restaurant traffic during the holiday period continued into January, but the softer-than-expected performance extended across a wide range of categories.

As a result, net sales for fiscal 2020 will grow by no more than just 0.5%. Operating margins are now in the 15.8% to 16.2% range. And the earnings per share is between $2.00 to $2.07.

At $5.1 billion in retail sales, Conagra has the second-largest frozen retail business besides Nestle, which had $7.4 billion. It is a big player in the ready-to-eat snacking market. If the growth slowdown proves temporary, then Conagra stock is trading at a discount. Besides, frozen meals and snacks are products that consumers will continue buying. The company might need to strengthen its partnerships with retailers to drive distribution rates.

Conagra stock has a fair value of $37.91 (per Stock Rover), while analysts have an average price target of $34.62 (according to Tip Ranks).

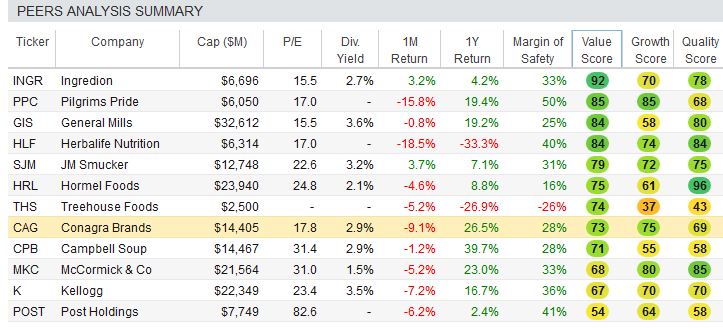

Here’s where Conagra stock stands in value compared to its peers:

Data Courtesy of Stock Rover

Ford Motor (F)

Ford Motor (NYSE:F) stock closed at a 52-week low last week as speculation that China car sales fell by 92% in the first half of February hurt Ford shares. Despite the regional setback, Ford isn’t relying on business growth from the Chinese market. There are a few more positive developments to look forward to that may set Ford stock as a winner.

Rivian, a startup financed by both Ford and Amazon (NASDAQ:AMZN), is set to develop an entirely new Lincoln electric vehicle. Rivian has design advantages that will make Lincoln’s full EV a success. The batteries are carried in a broad floor, and this “skateboard” platform is simple and elegant. Ford promoting James Farley to Chief Operating Officer will accelerate the company’s turnaround efforts. Farley will be responsible for growing Ford’s global earnings before interest and taxes (EBIT) at 8% or higher. Farley was previously Ford’s president of New Businesses, Technology, and Strategy.

The promotion suggests that Farley will embrace adding more technology in Ford vehicles.

Previously, Ford’s Mustang Mach-E announcement re-invigorated the company brand. So its launch, first in Europe, is crucial to the EV initiative. Launching in a smaller market will let Ford iron out any wrinkles to the launch. This should result in a smooth launch in the U.S.

In a revenue multiples model, assume the numbers below, and the fair value of Ford stock is $8.13:

| Metrics | Range | Conclusion |

| Selected LTM Revenue Multiple | 1.0x – 1.2x | 1.1x |

| Selected Fwd Revenue Multiple | 1.0x – 1.2x | 1.1x |

| Fair Value | $3.98 – $12.27 | $8.13 |

| Benchmarks | ||

| General Motors Company | ||

| Tesla, Inc. | ||

| Standard Motor Products, Inc. | ||

| Ferrari N.V. | ||

| Lear Corporation | ||

| Ford Motor Company |

Chart courtesy of finbox.io

ViacomCBS (VIAC)

ViacomCBS (NASDAQ:VIAC) fell by around 17% after the company’s 2019 Q4 earnings report on February 20. Ahead of the report, hedge funds like Baupost Group held sizable positions. But the company posted non-GAAP earnings per share (EPS) of 97 cents, and revenue fell 3.1% Y/Y to $6.87 billion.

Management clearly wrote down all that it could following the Viacom and CBS merger. But investors hoped for more. The transitional quarter fared poorly when the film entertainment business posted revenue of only $532 million.

Still, domestic streaming and digital video may set ViacomCBS stock as tomorrow’s winner. Pluto TV monthly active users soared by 75% to 22.4 million. Streaming subscribers grew by 56% to $11.2 million. Finally, its domestic streaming and digital video revenue rose by 60%.

The company is building a streaming ecosystem that targets multiple markets using different price points. It will have free, broad pay, and premium services. For example, Pluto TV and Showtime over-the-air (OTT) already have free or premium options. CBS All Access will have such shows as Comedy Central, House of Brands, and MTV.

Analysts think ViacomCBS stock is worth $44.07 (per Tipranks). Conversely, a relative comparison to its competitors suggest that the stock is worth over $48 (per finbox.io)

Match Group (MTCH)

Match Group (NASDAQ:MTCH) topped ~$93 in mid-January ahead of its earnings report on Feb. 4, 2019. And all it took was an analyst downgrade at UBS and a $95 price target to send the stock spiraling lower. The record high close had investors nervous, increasing the stock’s risk profile. Still, a leadership shuffle at the very top is a positive development that will reverse this stock from a loser to a winner for investors.

Shar Dubey will replace Mandy Ginsberg as CEO. Dubey has been a leader in Match Group for 14 years, and as Chief Operating Officer of Tinder, led the launch of Tinder Gold. The success of the premium product release suggests that the company at large will easily post a re-acceleration in revenue and profits.

In Q4, Match reported Q4 GAAP EPS of 45 cents as revenue grew 19.6% Y/Y to $547 million. Both Tinder and Hinge show no signs of slowing down. But investors are looking for more and Match has to deliver on better user experience. For example, the company took away the chat function and removed many optional user details. By taking out such basic features, user activity on the site could slow.

At worst, revenue growth of 13% Y/Y in a 5-year discounted cash flow model (Gordon Growth Exit) implies that Match stock is worth $92:

| $ millions) | Input Projections | |||||

| Fiscal Years Ending | 19-Dec | 20-Dec | 21-Dec | 22-Dec | 23-Dec | 24-Dec |

| Revenue | 2,051 | 2,407 | 2,796 | 3,179 | 3,730 | 4,213 |

| % Growth | 18.60% | 17.30% | 16.20% | 13.70% | 17.30% | 13.00% |

| EBITDA | 690 | 909 | 1,107 | 1,277 | 1,714 | 2,010 |

| % of Revenue | 33.60% | 37.80% | 39.60% | 40.20% | 45.90% | 47.70% |

Data courtesy of finbox.io

First Solar (FSLR)

First Solar (NASDAQ:FSLR) dropped 15% on Feb. 21, 2020 after the company posted weak guidance. It said it would review options for its U.S. project development business after losing money in Q4.

The company reported net sales of $1.4 billion but lost $1.09 per share in 2019, 56 cents of which was in Q4. But the company has a solid product despite U.S. and China governments interfering in the industry. The market shock of a quarterly loss may send the stock lower for a while longer, but investors are aware that stocks in a cyclical industry will face temporary downturns and then bounce back.

First Solar achieved a milestone of 25 gigawatts (GW) of cumulative modules shipped in 2019. Net bookings topped 6.1 GW, and Series 6 operations are proceeding nicely. So assuming a discount rate of 10% and a terminal revenue multiple of 1.6 times, First Solar stock has a fair value of $62.27.

Yelp (YELP)

Yelp (NYSE:YELP) fell on Feb. 13 after it posted Q4 revenue missing expectations. But with revenues growing by double-digit percentage points to $268.8 million, markets are ignoring its potential. The company targets revenue compound annual growth rate (CAGR) in the mid-teens between 2019-2023. Profitability (adjusted EBITDA margin) of 30-35% by 2023 may seem ambitious but is possible.

Yelp’s drivers for profitable growth come from improved retention, favorable product mix to the multi-location and self-serve channels and staff reductions of 10%. The business model is evolving too. This will enable the company to grow profits from the digital media advertising space and grow its consumer base

Yelp is currently enhancing the customer experience by adding features such as Yelp reservations, waitlist, and personalized recommendations. By cultivating its lead users, the business will grow. Last year, it said that ~10% of its leads were being monetized. Business will get bigger if that monetization rate increases.

According to Stock Rover, Yelp stock has a fair value of $42, while analysts, on average, have an average price target of $36.10.

DXC Technology (DXC)

DXC Technology (NYSE:DXC) is trading at around 50% below its 52-week high. The company has lots of work ahead to revive the business.

Operationally, DXC is improving its engagement with customers and key accounts. As it polls customers on what they like and dislike with DXC, its business will evolve for the better. DXC may convert more sales in the enterprise technology stack and sell industry solutions that its customers want.

DXC said in the company’s earnings presentation (slide 6) that it added ~50 leaders in Q3 along with two more senior executives. But what the company needs are great workers that deliver great services to customers. For 2020, DXC needs to demonstrate that its income and revenues are improving. Plus, it may not have more massive goodwill impairment losses, which totaled $2.9 billion YTD for FY 2020. Restructuring costs also took away 79 cents in EPS and pushed DXC to a GAAP EPS loss of $7.20.

DXC forecast non-GAAP EPS of $5.25 – $5.75. FCF of 80% of adjusted net income is enough to cover the interest cost on debt and its dividend. So, investors may wait for the stock to rebound while collecting some income.

Disclosure: the author owns shares of Ford Motor.