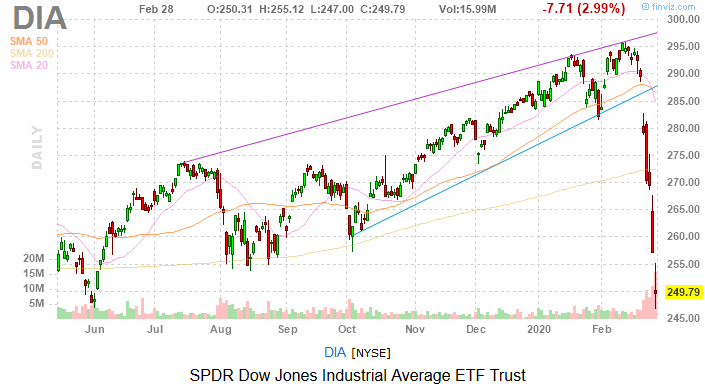

Friday was another rough day for stocks as the tale of the tape below indicates, but some signs of hope emerged as stocks cobbled together some incremental momentum late in the day.

- The S&P 500 shed another 0.82%

- The Dow Jones Industrial Average dropped 1.39%

- The Nasdaq Composite inched up 0.01%

- In a move that investors have become all too familiar with, Boeing (NYSE:BA) was the worst offender on the Dow today, tumbling 4.40%

As was the case Thursday, stocks probed four-month lows today. Other ominous anecdotes include the S&P 500 residing around 15% below its all-time high and the benchmark equity gauge notching its worst weekly performance since 2008 during the global financial crisis.

Federal Reserve Chairman Jerome Powell said in a statement issued earlier today that the “Federal Reserve is closely monitoring developments and their implications for the economic outlook. We will use our tools and act as appropriate to support the economy.”

It can be seen as good news that the Fed is taking the coronavirus from China seriously, but this is being interpreted by some market participants as increasing the likelihood of an interest rate cut, explaining why rate-sensitive names Goldman Sachs (NYSE:GS) and JPMorgan Chase (NYSE:JPM) were among the Dow’s worst performers today.

In late trading, four of the 30 Dow stocks were high, still a dismal percentage, but an improvement over what was seen earlier this week.

Boeing Boondoggle

Spirit AeroSystems (NYSE:SPR), a major Boeing supplier, released fourth-quarter earnings earlier today and those results were about as bad as one would expect due to the grounding of the 737 Max passenger jet.

However, the real drag on Boeing stock today, alongside broader market weakness, may have been a Wall Street Journal article highlighting the company’s contentious relationship with the Federal Aviation Administration (FAA), the very regulator that needs to sign off on Boeing sending the 737 Max back into service.

Look, companies often knock heads with regulators, but in Boeing’s case, it would be advisable to make nice with the FAA. That’s not business school speak, but it’s the truth.

Not Much Safety

As I pointed out yesterday, defensive names such as Procter & Gamble (NYSE:PG) belied their reputations this week. Add Verizon (NYSE:VZ) to the list as the telecom giant careened to its lowest close since August 2018.

VZ now yields an enticing 4.7%, but investors would do well to not take the bait. This is a yield that can increase and with defensives not working right now, there’s no need to yield hunt with VZ here.

Another One to Wait Out

Intel (NASDAQ:INTC) was another Dow loser today, though not of the most severe magnitude. There were some encouraging comments out from noted semiconductor research firm Jon Peddie Research about Intel’s new GPU chips.

That’s a credible catalyst for Intel stock and out-performance by chip stocks on Friday should not be glossed over, but Intel, like so many other Dow stocks, has plenty to prove to investors, namely that it’s capable of confining coronavirus impact to the first quarter.

Bottom Line on the Dow Jones Today

Not surprisingly, analysts are trimming first-quarter earnings estimates for S&P 500 companies due to the coronavirus. As John Butters of FactSet Research notes, the “Q1 bottom-up EPS estimate has dropped by 3.3%” over the past two months.

Interestingly, that decline may not be cause for concern.

“It is important to note that while this 3.3% decline is above the five-year average and the 10-year average, it is not an unusually high number. It is smaller than the decline recorded in the previous quarter (-4.2%) over the same time frame,” said Butters in a note out Friday.

As of this writing, Todd Shriber did not own any of the aforementioned securities. He has been an InvestorPlace contributor since 2014.