Dividend stocks that buy back their own shares often have a good chance of doing well. And there are a couple of reasons for this.

For one, stock buybacks help push up the stock price.

In addition, over time the smaller number of shares outstanding allows the company the raise the dividend per share. The stock buybacks reduce the number of shareholders who are entitled to the same dividends. Therefore, a larger increase makes more sense than otherwise.

I researched this and found five well-capitalized dividend stocks with large stock buyback programs. These stocks are also very cheap, with low price-to-earnings ratios.

In addition, the buyback yield, which is the buyback program divided by the market value of the stock, is often higher than the dividend yield. Companies tend to spend more on buybacks than dividends as a way to return capital to shareholders.

It turns out that the total yield, which is dividend yield added to buyback yield, is a good predictor of shareholder returns.

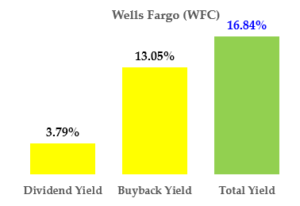

Dividend Stocks: Wells Fargo (WFC)

Dividend Yield: 3.79%

Buyback Yield: 13.05%

Total Yield: 16.84%

Wells Fargo (NYSE:WFC) stock benefits from a large buyback program. WFC received approval in late June from the Federal Reserve for up to $23 billion in buybacks. The company recently bought back $7.5 billion in shares during the latest quarter. That made it one of the top three buyback companies in the U.S.

At this rate, Wells Fargo will buy back $30 billion in shares over the next year. That represents over 13% of its $227 billion in market value over the next year. Combined with its 3.79% dividend yield, the buyback yield together makes a total yield of 16.8%

WFC stock is cheap, with a forward price-to-earnings of just 12.5 times. Shareholders should expect a good return on WFC stock with the company returning so much capital to shareholders.

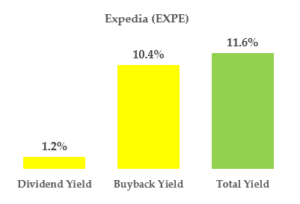

Expedia (EXPE)

Dividend Yield: 1.2%

Buyback Yield: 10.4%

Total Yield: 11.6%

Expedia (NASDAQ:EXPE) will significantly benefit from a massive buyback program announced on Dec. 4, 2019. Barry Diller, the CEO, fired management and immediately announced a new 20 million share buyback program.

Moreover, EXPE has an existing 9 million share buyback program. There are about 145 million shares outstanding. Therefore, the buybacks represent over 20% of its market value over the next two years. I wrote an article recently about this intriguing situation. The buyback yield is over 10% per year. The total yield is over 11.6% per year.

Moreover, Barry Diller, who controls over 49% of the voting stock, said he would also start buying more shares for himself. That is fantastic. It will have the same effect as a buyback on top of a buyback.

So look for really good things to happen to EXPE stock. It is reasonably cheap, with a forward price-to-earnings ratio of just 16 times. In my article, I estimated that the true value of Expedia stock is over $124 per share. That represents a return of at least 12% to investors.

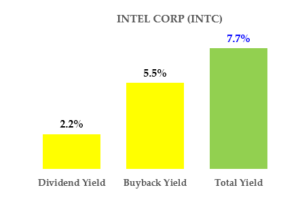

Intel (INTC)

Dividend Yield: 2.2%

Buyback Yield: 5.5%

Total Yield: 7.7%

Intel (NASDAQ:INTC) stock has a total yield of 7.7%. Like most of the other companies here, most of this yield comes from the INTC’s buyback yield of 5.5%.

Intel’s board recently updated its buyback program. They added $20 billion to its existing $7.2 billion share repurchase program. Therefore, over the next two years, the $13.6 billion in buybacks represent a 5.5% buyback yield. This is because the Intel stock market value is $249 billion.

Moreover, Intel stock has a very cheap forward price-to-earnings ratio of just 12.5 times. This will allow the company to buy back shares at a very cheap price.

I recently wrote an article about INTC stock. I estimated the true value is over $65 per share. This represents a potential return of 14% to investors. Shareholders should expect a minimum total return of at least 7.7% per annum as INTC continues its buybacks.

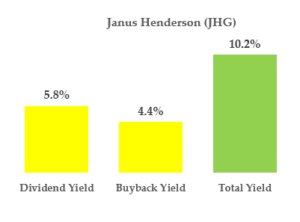

Janus Henderson Group (JHG)

Dividend Yield: 5.8%

Buyback Yield: 4.4%

Total Yield: 10.2%

Janus Henderson (NYSE:JHG) stock benefits from both a high dividend yield and a high buyback yield, as you can see in the chart above. So this gives the fund management company, based in the U.K. and Denver, a high total yield of over 10% for shareholders.

For example, based on my calculations in a recent article I wrote, JHG buys about $200 million of its own shares a year. JHG stock has a market value of over $4.5 billion. So the buyback program represents a 4.4% buyback yield. This will both help the dividend per share rise faster than otherwise, and also help push up the price of Janus Henderson stock.

In addition, JHG stock is very cheap. It trades for just 10 times earnings. So, given that the total yield is over 10%, including the dividend and buyback yields, investors should do well over time.

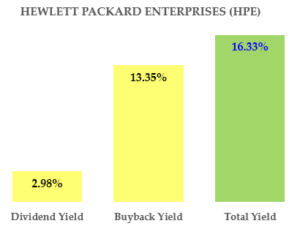

Hewlett Packard Enterprises (HPE)

Dividend Yield: 2.98%

Buyback Yield: 13.35%

Total Yield: 16.33%

Hewlett Packard Enterprises (NYSE:HPE) stock has a very high total yield. This server and cloud storage company — not Hewlett Packard, Inc. (NYSE:HPQ) the printer company — has a $20.5 billion market value.

HPE’s capital return program of $7 billion over two years, including dividends, represents a buyback yield of over 13.3% per year (i.e. $2.7 billion in annual buybacks divided by its $20.5 billion market value). In addition, HPE stock has a nice 3% dividend yield.

HPE is also very cheap at 8 times forward earnings. Combined with its high total yield, investors in HPE stock should do quite well over the next year. I recently wrote an article on HPE stock. I estimated its value at $25.84 per HPE share. This is an estimated return of over 60% for investors.

As of this writing, Mark Hake, CFA does not hold a position in any of the aforementioned securities. Mark Hake runs the Total Yield Value Guide which you can review here. The Guide focuses on high total yield value stocks. Subscribers get a two-week free trial.