All stocks correct. It’s also a fact that growth stocks come and go. But sometimes Wall Street’s cautious dismissal of future prospects can lead to big-time profits. And right now Abiomed (NASDAQ:ABMD), Ulta Beauty Salon (NASDAQ:ULTA) and Baidu (ADR) (NASDAQ:BIDU) are three former dearly-held companies that maintain growth stock potential and bottoms ready for purchase.

ABMD, ULTA and BIDU stock owners have all enjoyed better years than 2019. Shares of Abiomed are off roughly 33%. Ulta Salon has a blemish of 5% for its year-to-date performance. And Baidu is down by about 22% for the calendar year. But it’s not the end of the road for these once dearly held growth stocks.

The truth is most companies won’t become the next Apple (NASDAQ:AAPL), Netflix (NASDAQ:NFLX) or Home Depot (NYSE:HD). But Wall Street also has a great record of overcompensating when the narrative turns to doom and gloom in growth stocks.

I believe common but large corrections aided by Wall Street’s willingness to flee the scene when there’s a bump or two in the road are now setting up new opportunities for ABMD, ULTA and BIDU stock in 2020 and beyond. Let’s examine what’s happening in this diverse trio of former growth stocks who’ve endured big-time corrections and whose stories are poised for new chapters of growth off and on the price chart.

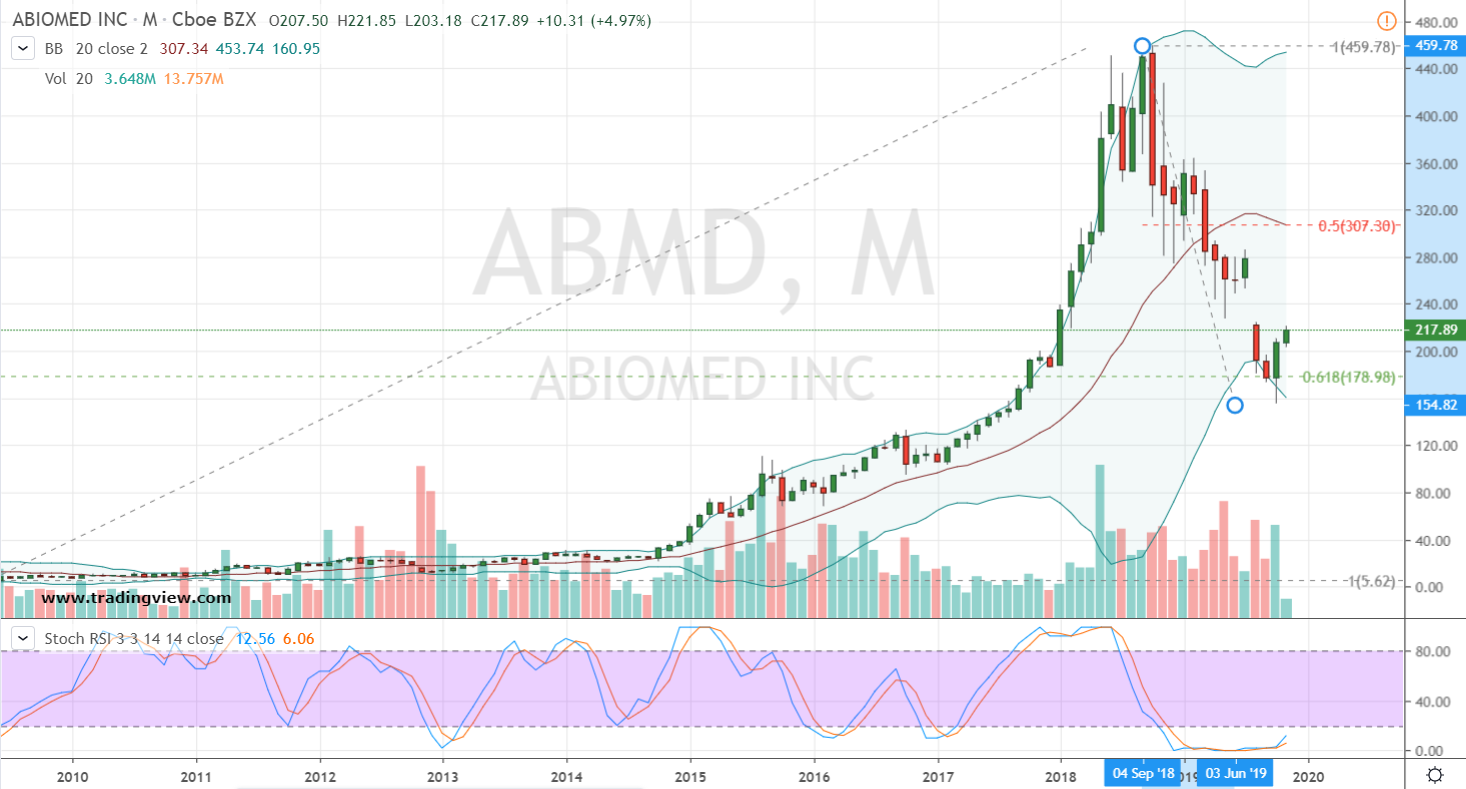

Growth Stocks to Buy: Abiomed (ABMD)

Abiomed is the first of our stocks to buy. The medical device maker and former staple within growth names pitched at Investor’s Business Daily recently delivered a mixed, but decent and very well-received earnings report. And the story gets better for today’s bullish investors. Away from the headlines, analysts are still projecting a five-year growth rate of 24% for the cardiac specialist. At the same time, with Wall Street having literally written off ABMD with a sizable correction in 2019, a bottom has now emerged on the price chart.

ABMD Stock Strategy: With a confirmed monthly chart candlestick reversal pattern off its 10-year cycle, 62% retracement level and oversold stochastics crossover set-up turning higher, ABMD is a stock to buy today. I’d recommend setting a stop-loss beneath $190, which allows enough leeway off and on the price chart. To reduce exposure on a rally, a 50% retracement within the right side of a new bullish base in the range of $300 – $320 makes sense.

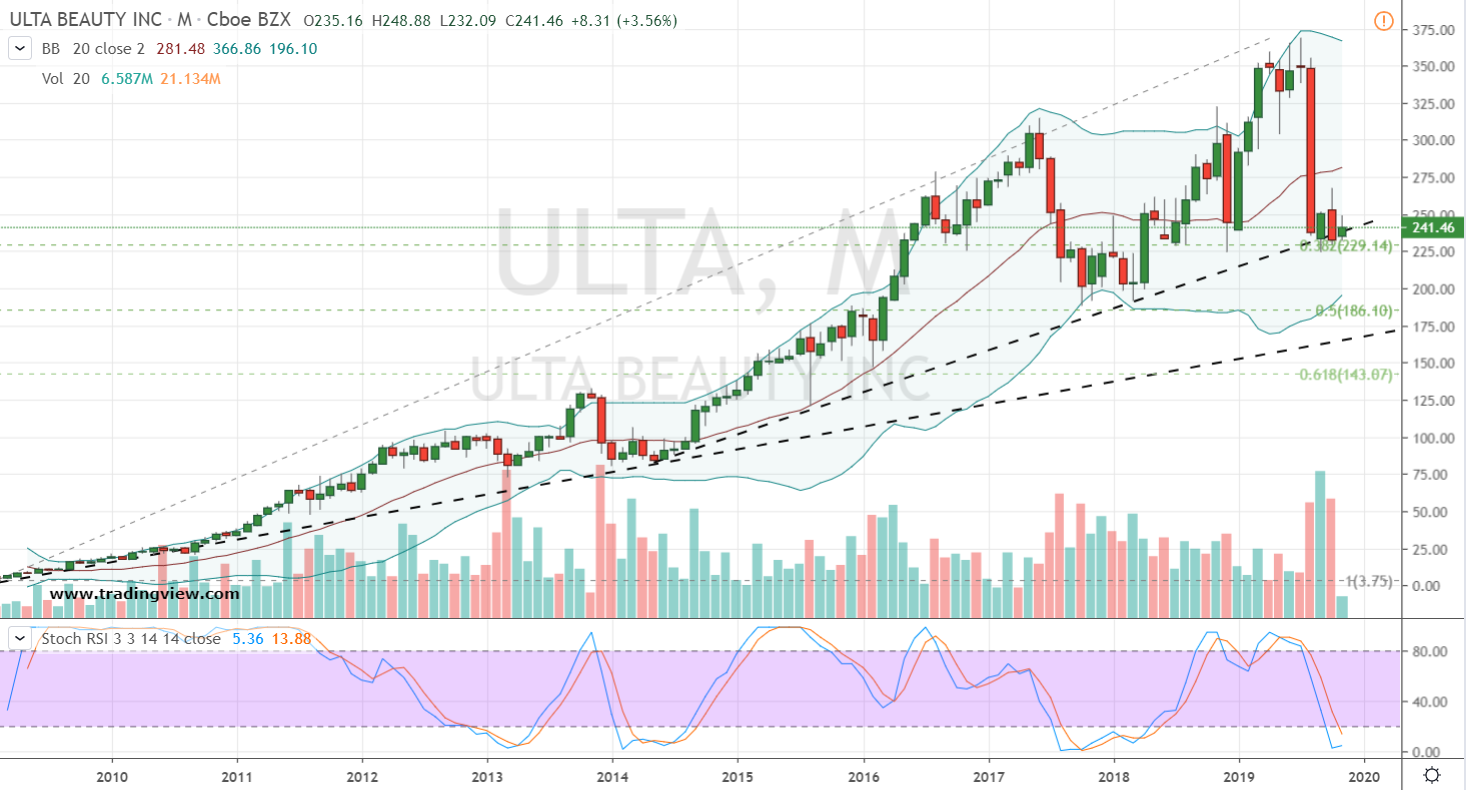

Ulta (ULTA)

Ulta Beauty is another former growth superstar hit by an inevitable correction made worse by failing to live up to Wall Street’s overly high expectations. But don’t think for a second the brick-and-mortar beauty retailer isn’t still a growth stock or at least one well-positioned as a stock to buy.

Sporting an estimated growth rate of over 10% for the next five years, a forward price multiple of 18 and share price that successfully tested its 10-year 38% Fibonacci level and five-year trendline support last month, ULTA has the right foundation as a stock to buy.

ULTA Stock Strategy: My recommendation in this growth stock is to wait for a second price confirmation of the September high of $251.76. Also, the September pivot low of $224.66 is our line in the sand. The fact is, shares have backtracked and, while stochastics are oversold, the indicator hasn’t yet put together a bullish crossover confirmation.

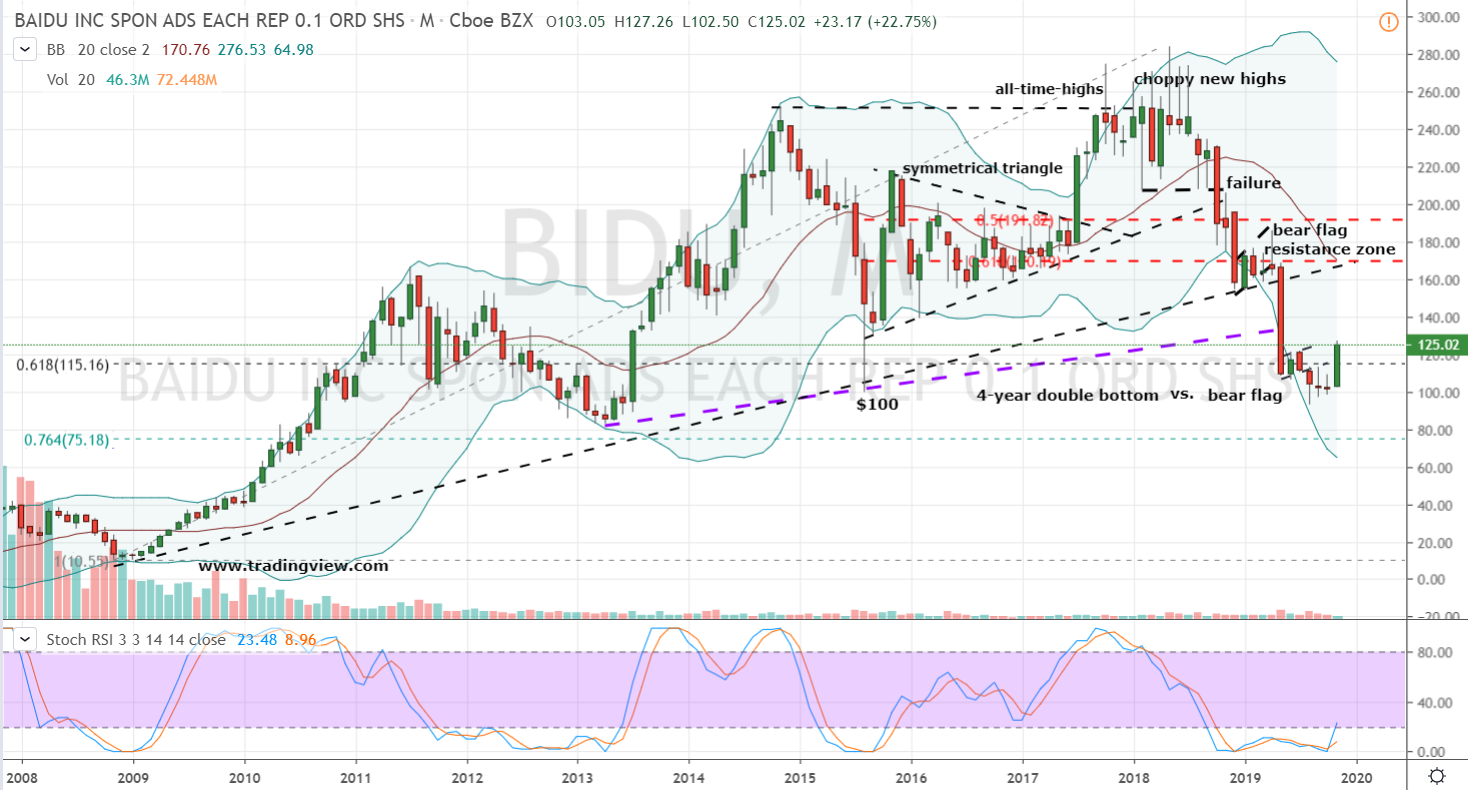

Baidu (BIDU)

Baidu is the last of our growth stocks to buy. The China-based search giant and diversified technology play touted as China’s Alphabet (NASDAQ:GOOGL, (NASDAQ:GOOG) has lost roughly two-thirds of its value since mid-2018. Blame it on dashed expectations and even some scandal along the way. And you can.

But as the dust has settled on shares, BIDU stock is showing sure signs of a comeback worth buying into. This week, the company reported stronger-than-expected results and Wall Street has been receptive to the report. To be clear, growth of days past isn’t there at this point, but the stage for a turnaround in this market leader is certainly in progress.

BIDU Stock Strategy: Technically, the reaction to Baidu’s earnings has hoisted shares of this return-to-growth stock above a failed bear flag and three-month long consolidation just below its decade-plus 62% level. With stochastics backing a longer-term bottom, BIDU is a stock to buy. However, given a shorter-term overbought condition and expectations this turnaround will take some time to unfold, I’d recommend watching for an opportunity to buy Baidu on weakness, rather than momentum. Also, consider a stop-loss below $100.

Disclosure: Investment accounts under Christopher Tyler’s management do not currently own positions in securities mentioned in this article. The information offered is based upon Christopher Tyler’s observations and strictly intended for educational purposes only; the use of which is the responsibility of the individual. For additional market insights and related musings, follow Chris on Twitter @Options_CAT and StockTwits.