Square (NYSE:SQ) sits right at the corner of just about every major trend of the modern age. But is SQ stock worth owning now? When you do your homework on this payment-processing company, you’ll find much for bulls to appreciate here – and one major warning sign for investors – ahead of Wednesday evening’s earnings report.

SQ stock has undoubtedly been a better performer than CEO Jack Dorsey’s original venture, Twitter (NYSE:TWTR). SQ is up a nice 366% since its Nov. 2015 IPO. In the same timeframe, TWTR stock is up barely 13%, so that’s a pretty impressive run, especially when you consider that Square has yet to turn a profit.

Profitability is a key factor in the stock-picking strategy I developed to find the best growth investments. But so is sales growth, and Square has that in spades. The company has nearly tripled its revenues in the past three years, from $1.3 billion in 2015 to $3.3 billion in 2018.

There are two reasons for this. The first is that Square executives clearly have their eye on the latest consumer trends… and aggressively pursue them. Last month, the company announced that its payment products and services would now be available nationwide to sellers of cannabidiol (CBD) – an industry where vendors have struggled to find bank partners.

Previously, Square ventured into the food delivery trend with the app Caviar, which it just sold to DoorDash for $410 million. But its Venmo competitor, Cash App, has had more staying power. In fact, Square has expanded Cash App into providing debit cards, bitcoin, and now even free stock trading.

But, ultimately, the company’s success (and that of SQ stock) is due to its fundamental business model. Square’s core products are perfectly suited to anyone starting “side hustles” and small businesses these days. But until Square came along in 2009, payment processing was a major hurdle. Now “there’s an app for that” – as Apple (NASDAQ:AAPL) would say – and to access it, sellers just need to plug their tablet or phone into one of Square’s sleek devices.

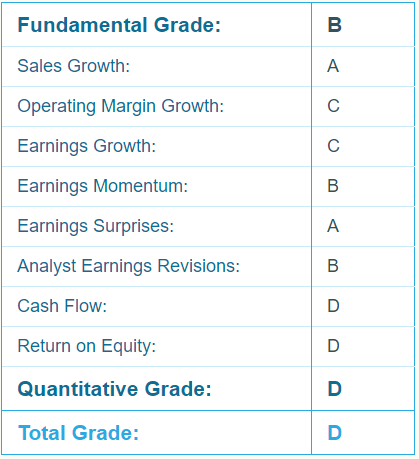

This is the context for SQ stock’s overall Report Card from my Portfolio Grader tool. As you see, SQ rates a “B” on the fundamentals:

Given the steep climb Square’s revenues have made in just a few years, it’s unsurprising to see its “A” rating for Sales Growth. Those who already own SQ stock (or want to) will also be pleased to see Square’s strong history of positive earnings surprises.

But investors should also take note of SQ stock’s dismal Quantitative Grade of “D.”

I’ve been at the investing game for a while, ever since my grad-school days at Cal State Hayward in the late 1970s. And I discovered that stock performance is largely determined by institutional buying pressure. Stocks that are popular on Wall Street are, naturally, more likely to succeed long-term. This is what my Quantitative Grade is designed to measure.

And when a stock falls down on its Quant Grade, it becomes an automatic “Sell” in my stock-picking system.

Timing is everything – and it appears that big money is fleeing SQ stock ahead of earnings. So, that should certainly give investors pause. While I appreciate its strong fundamentals, ultimately I like to go where I see strong momentum for future gains. SQ stock just doesn’t fit the bill now.

Meanwhile, a very different group of stocks is tapping into a major technological advance. Most folks don’t know much about it – but once you do, you’ll see the incredible potential here. Click here for a free briefing on a major trend that’s just getting started.

Louis Navellier had an unconventional start, as a grad student who accidentally built a market-beating stock system — with returns rivaling even Warren Buffett. In his latest feat, Louis discovered the “Master Key” to profiting from the biggest tech revolution of this (or any) generation. Louis Navellier may hold some of the aforementioned securities in one or more of his newsletters.