U.S. stock futures are pushing higher, led by strength from small-cap stocks. The rally is a welcome change of pace to Friday’s weakness.

The Dow Jones Industrial Average slumped ahead of the weekend due to terrible performance from Johnson & Johnson (NYSE:JNJ) and Boeing (NYSE:BA). Options volume rocketed higher in both names making them worthy of discussion below. Despite the beatdown, the Dow remains above its 20-day moving average, so we’ve yet to see any critical support zones crack.

Ahead of the bell, futures on the Dow Jones Industrial Average are up 0.17%, and S&P 500 futures are higher by 0.43%. Nasdaq Composite futures have added 0.51%.

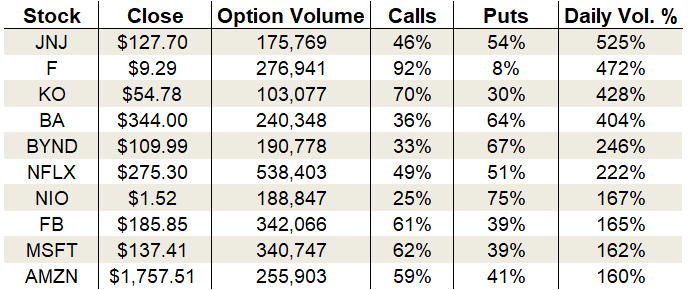

In the options pits, call trading drove the bus Friday, while expiration for Oct monthly options pushed overall volume well above average levels. Approximately 21.7 million calls and 20.3 million puts circled the tables on the day.

Meanwhile, the action at the CBOE Volatility Index (VIX) was an eyebrow raiser. The single-session equity put/call volume ratio zipped to 0.99 — its highest reading of the year. Typically such fear is reserved for monster down days, not some measly 0.4% stumble. I suspect a quick return toward more normal readings is imminent. On the back of the rally, the 10-day moving average popped to 0.69.

Options activity saw heavy put demand in Johnson & Johnson and Boeing stock. On the flipside, calls were all the rage in Coca-Cola (NYSE:KO) after the company topped revenue estimates for the third quarter.

Let’s take a closer look.

Johnson & Johnson (JNJ)

Source: ThinkorSwim

Johnson & Johnson shares suffered one of their worst days of the year, tanking 6.2%. Over 25 million shares changed hands, making it the most active day of 2019 as well. The bloodbath came after the company reported it recalled a single lot of its Johnson’s Baby Powder after a U.S. Food and Drug Administration test discovered “sub-trace levels” of asbestos in a bottle of the powder.

The technical picture of JNJ stock has deteriorated, but it remains above this year’s low, which is the south end of its trading range. The 200-week moving average also sits in the $126 zone and hasn’t been breached since 2011. If buyers emerge to defend their turf, then Friday may turn out to be a one-off. But, if support gives way, then I see few reasons to entertain any bullish trade ideas on JNJ.

On the options trading front, puts outpaced calls by a slim margin. Total activity grew to 525% of the average daily volume, with 175,769 contracts traded. Puts accounted for 54% of the day’s take.

The increased demand drove implied volatility higher on the day to 23%, placing it at the 37th percentile of its one-year range. Premiums are pricing in daily moves of $1.86 or 1.5%.

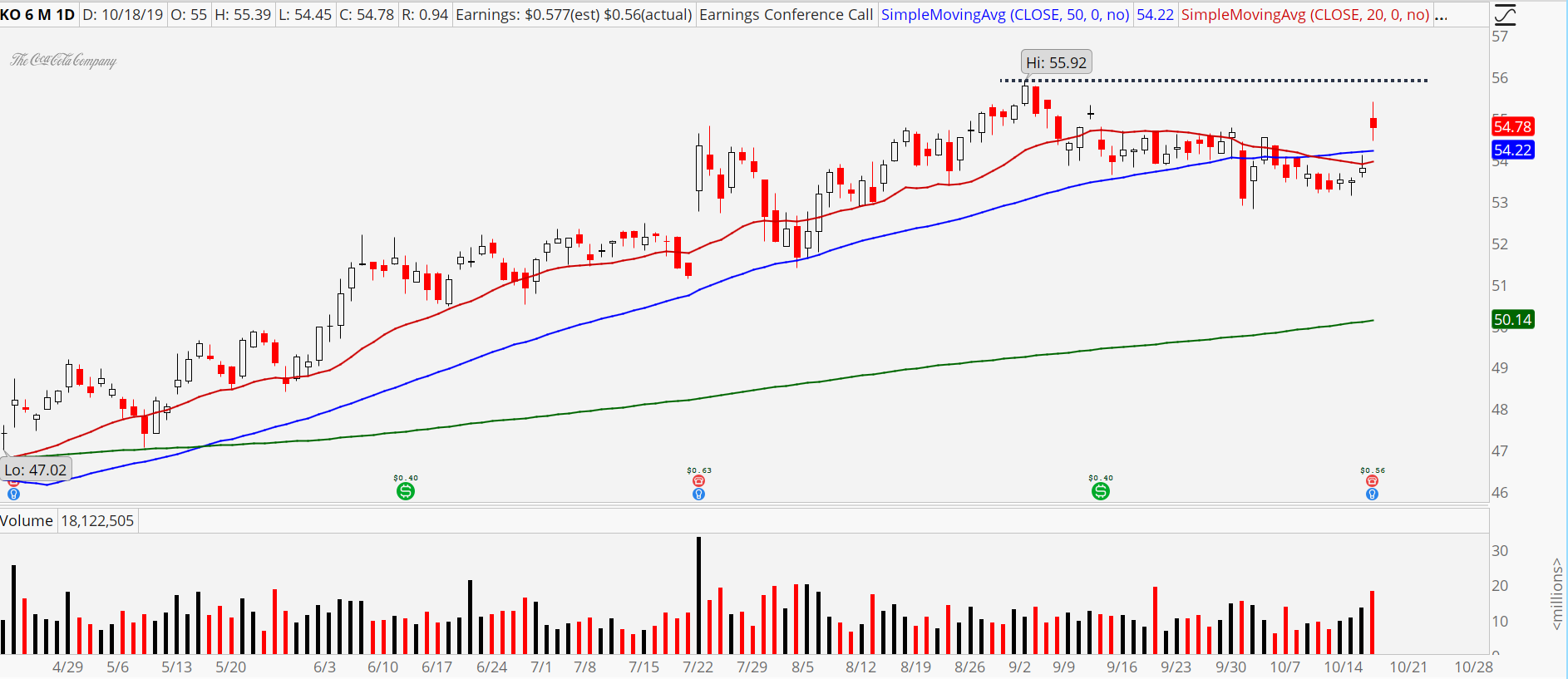

Coca-Cola (KO)

Source: ThinkorSwim

Coca-Cola shares received a boost after the soft drink giant posted third-quarter revenue that beat analysts’ estimates. The $9.5 billion revenue topped forecasts for $9.4 billion, generating adjusted earnings of 56 cents, which was in line with expectations.

KO stock rallied as high as 3% before profit-taking knocked it back to a 1.8% gain on the day. The jump pushed KO back above its 20-day and 50-day moving averages, positioning it for a return to its September peak near $56. Coca-Cola shares sit in a sweet spot right now. Consistent earnings, bullish technicals and a juicy dividend (2.9%) should keep the stock aloft into year-end.

On the options trading front, calls dominated the day. Activity swelled to 428% of the average daily volume, with 103,077 total contracts traded. 70% of the trading came from call options alone.

The post-earnings volatility crush was on full display, driving implied volatility down to 16% or the 27th percentile of its one-year range. The expected daily move is now 55 cents or 1%.

Boeing (BA)

Source: ThinkorSwim

So much for the technical improvement in BA stock. Almost all that was gained over the past month rapidly unwound Friday after news hit that the troubled aerospace titan misled the Federal Aviation Administration regarding the safety system of the 737 MAX aircraft.

By day’s end, BA shares were down 13%. And the pain isn’t over yet. The stock is down another $10 or 3% in pre-market trading and is on track for testing $320 support over the coming days. With BA back below all major moving averages on the daily time frame, it’s impossible to be bullish here.

Earnings are slated for Wednesday morning, but the report is unlikely to change the narrative and win the hearts of the understandably spooked shareholders.

On the options trading front, traders chased puts throughout the session. The drama pushed total activity to 404% of the average daily volume, with 240,348 contracts traded. Puts added 64% to the session’s sum.

Implied volatility shot to the moon and now sits at 38% or the 53rd percentile of its one-year range. Premiums are baking in daily moves of $8.13 or 2.4%.

As of this writing, Tyler Craig didn’t hold positions in any of the aforementioned securities. For a free trial to the best trading community on the planet and Tyler’s current home, click here!