Friday featured some volatility, a few earnings reports, and a selloff in several blue-chip and high-growth stocks. Here’s a look at some top stock trades for next week.

Top Stock Trades for Tomorrow No. 1: Boeing (BA)

Shares of Boeing (NYSE:BA) were hammered on Friday as worries heat up over the 737 MAX once again. It sent the stock nosediving through $360 support, as well as all of its major moving averages.

Should BA fail to hold the 38.2% retracement now, more losses could be on the way.

Let’s see how it handles this area now. Falling further could send it into the $320’s. Above could send shares back to the $358-to-$365 area.

Honestly, BA stock is a bit too volatile and news-driven for me at the moment.

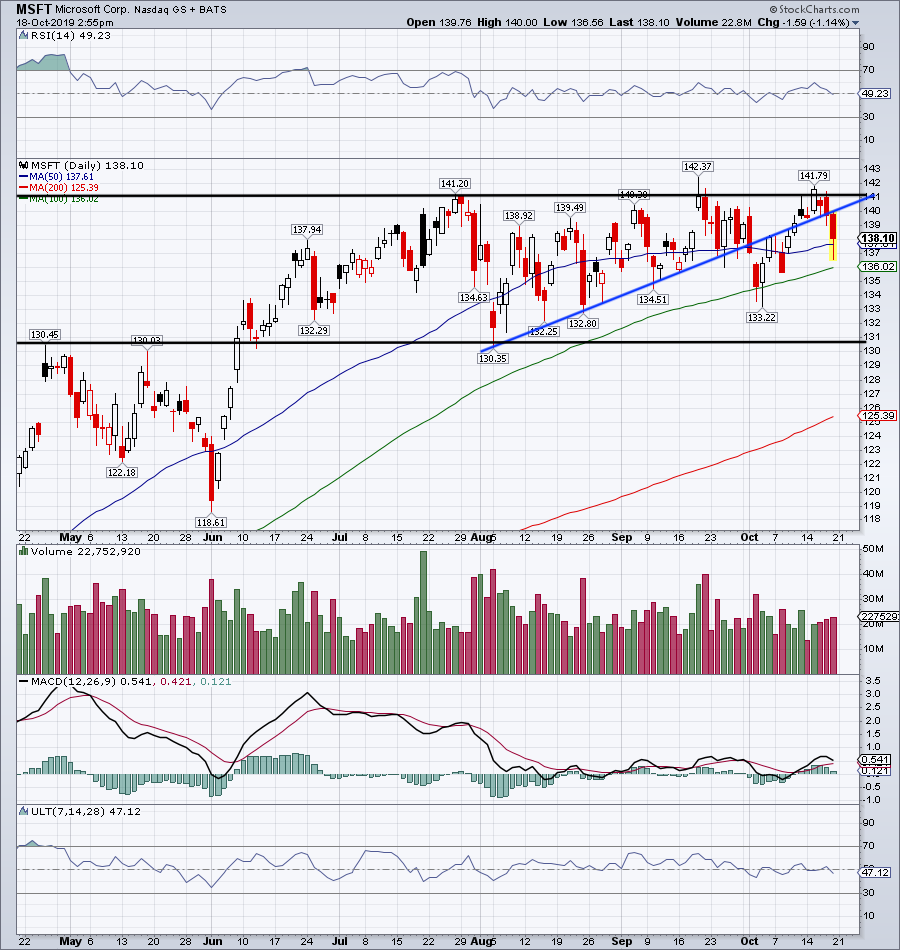

Top Stock Trades for Tomorrow No. 2: Microsoft (MSFT)

Microsoft (NASDAQ:MSFT) will report earnings next week, and has been giving investors a little shake-and-bake in the days ahead.

Shares nearly broke out just a few days ago. Yet on Friday, the stock momentarily crashed through the 50-day moving average. Below the 50-day could cause a further decline into the report — which would seem to increase the odds of a post-earnings pop afterwards.

Either way, should MSFT rally before or after earnings, see if it can push through resistance around $141. Below the 50-day and 100-day moving averages, could put the $130 to $131 level on the table, where it will also find the 78.6% retracement.

Top Stock Trades for Tomorrow No. 3: Johnson & Johnson (JNJ)

Man, Johnson & Johnson (NYSE:JNJ) just keeps shooting itself in the foot.

Shares had been range-bound between $126.50 and $132.50 for months. After a beat-and-raise quarter earlier this week, shares were finally breaking out of this range.

Then on Friday, the company announced a recall out of “an abundance of caution.” The move sent J&J tumbling lower, and it is now back in its prior range. So long as range support holds, bulls can stay long JNJ.

Below that level makes J&J susceptible to more losses, though.

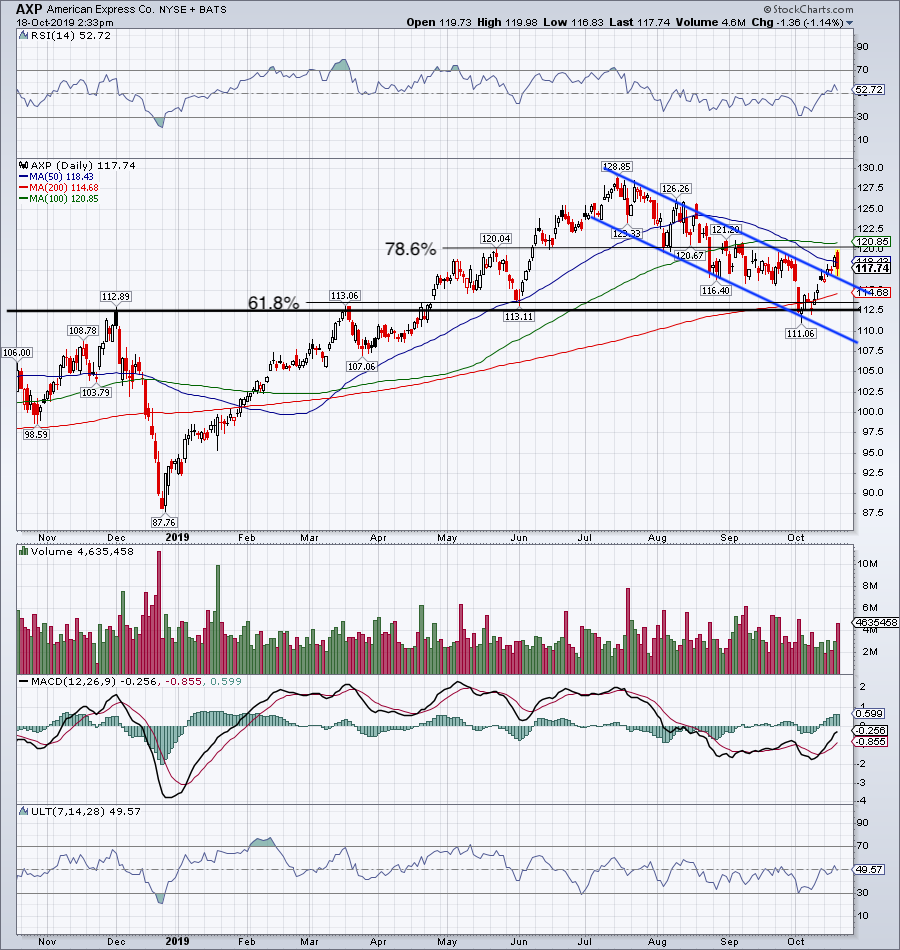

Top Stock Trades for Tomorrow No. 4: American Express (AXP)

A top- and bottom-line earnings beat wasn’t enough to jumpstart American Express (NYSE:AXP) stock on Friday.

While the stock has finally broken out of that nasty downward channel (blue lines), it’s failing to reclaim the 78.6% retracement and hold above the 50-day moving average.

Keep it simple.

Back below prior channel resistance, and the 200-day moving average and 61.8% retracement will likely be tested. Below $112.50 support is bearish. Above the 78.6% retracement and 100-day moving average at $120.85 is bullish.

Top Stock Trades for Tomorrow No. 5: Snap (SNAP)

Even an upgrade can’t snap Snap (NYSE:SNAP) out of its latest funk, (apologies on the lame pun).

Should shares lose the $13.50 level and fall below the 61.8% retracement near $13.25, a test of the 200-day moving average could be on the way. If they hold as support, investors need to see SNAP break out over channel resistance and reclaim the 20-day moving average.

It wasn’t that long ago that this name was on fire, but it has been a total dud over the last three to four weeks. Until it shows signs of turning it around, be careful on the long side.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, Bret Kenwell did not hold a position in any of the aforementioned securities.