Back during Sony’s (NYSE:SNE) tough days, I personally witnessed the dramatic rise and influence of GoPro (NASDAQ:GPRO). At the time, I was a senior business analyst tasked with increasing Sony’s digital camera market share. From a product perspective, GPRO had the better ideas. But I’m glad I invested in SNE rather than GoPro stock.

Here’s the painful reality about GoPro stock: it’s fighting an increasingly difficult war with irrelevancy. Now, I’m not suggesting that action cameras will go completely out of style. Clearly, they perform a function that no standard camera can carry out. As a result, GPRO stock continues to trudge along.

But the question really isn’t whether action cameras are useful or attractive. After all, no other cameras are appropriate for extreme sports or sports in general. But how many people actually need an action camera? The data suggests that the number of such consumers is dwindling. Thus, the days of niche camera specialists like GoPro are numbered. That doesn’t bode well for the GoPro stock price.

More critically, GPRO stock faces the same threat that has disrupted digital point-and-shoot cameras: the smartphone.

In recent years, I’ve criticized Apple (NASDAQ:AAPL) for not producing any exciting innovations. With its iPhone 11 Pro, it’s proven me wrong. The device’s three rear cameras each feature a different angle, ensuring every Pro owner has a semi-professional camera rig in their pocket.

Thus, it’s a tall order for GoPro to convince consumers that they need a separate camera. Sure, some sporting enthusiasts will buy GoPro’s cameras, but not many. And that’s the main headwind staring down GoPro stock.

GoPro Stock Suffers From a Flawed Business Plan

Last month, Sony rejected active investor Dan Loeb’s proposal to break up the company. Specifically, Loeb wanted to spin off the company’s image-sensor business. In Loeb’s view, spinning off the image sensors business will release value for Sony’s shareholders. Theoretically, the spinoff would also allow the company to focus on more lucrative entertainment projects.

However, Sony gave Loeb the proverbial finger. In a statement, the Japanese consumer technology giant responded:

Many of the world’s leading entertainment companies are now seeking to acquire technology, while many technology companies are moving into the entertainment space. The clear trend we see is for entertainment businesses of today to be directly connected to technology.

In other words, consumer tech firms are now focused on integration, not segregation. Thus, it doesn’t make sense for Sony to move against a broader industry trend. Moreover, we already have a case study of tech segregation: the GoPro stock price.

The reason why Loeb’s proposal is unreasonable is that the image-sensor business. if left alone, would die an unexpectedly quick death. But combined with other robust businesses, the whole entity can move forward.

Of course, that means buying SNE probably won’t make you rich. At the same time, Sony likely won’t turn into GPRO stock. Companies that get most or all of their revenue from a relatively small group of consumers can expect wide valuation swings.

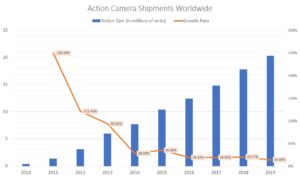

Click to Enlarge

What’s particularly troubling for GoPro stock, though, is the action-camera industry’s diminishing returns. Between 2011 and 2012, the number of action cameras shipped increased 121% to 3.1 million. Between 2012 and 2013, the growth rate slipped to 93.5%.

But last year, action-camera shipments increased by a comparatively pitiful 20%. And this year, experts, on average, forecast a growth rate of just 14%.

Separate the Product From the Investment

As I said at the top, GoPro had a better idea than Sony. But GoPro stock is obviously nowhere near the caliber of Sony’s shares. Perhaps a personal story may better illustrate why this is the case.

I own two GoPro cameras, and I use them frequently. Not only do these cameras work under inclement conditions, they provide gorgeous footage and clear audio. Additionally, GoPro’s product ecosystem is second to none. While I’m bearish on GPRO stock, I will sing the praises of the company’s product engineers.

But here’s the thing: I’m an anomaly, and I know it. Primarily, I take in-car video because frankly, I have a car worthy of such footage. However, the average Joe or Jane, driving in his or her low-cost vehicle, has nothing interesting going on.

And that’s why action-camera sales are declining rather precipitously. When there’s an iPhone that combines the power of multiple interchangeable lenses in one cohesive platform, why bother with other cameras? Unfortunately, the trend of digitalization is making GoPro irrelevant for everyone but a diminishing few.

As of this writing, Josh Enomoto is long SNE.