U.S. stock futures are trading higher this morning after Bloomberg News reported that China is open to a partial trade deal. Ahead of the bell, futures on the Dow Jones Industrial Average are up 0.7%, and S&P 500 futures are higher by 0.8%. Nasdaq-100 futures have added 0.9%.

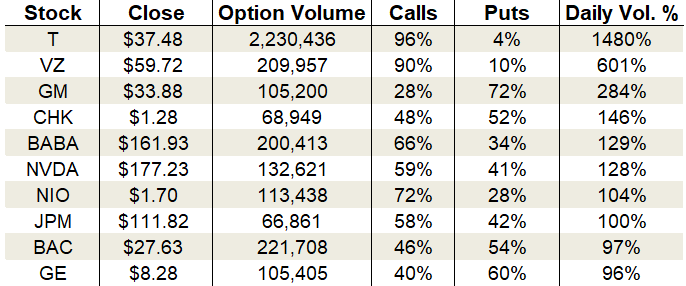

In the options pits, call volume surged despite the late-day beat down in stocks. Approximately 20.3 million calls and 16.7 million puts changed hands on the session.

The CBOE single-session equity put/call volume ratio dropped back to 0.73 but remains near the upper end of its one-year range. The 10-day moving average recently popped to a six week high at 0.75.

Options traders swarmed JPMorgan Chase (NYSE:JPM), AT&T (NYSE:T) and General Motors (NYSE:GM), among others.

Let’s take a closer look.

JPMorgan Chase (JPM)

Bank stocks were particularly hard hit during Tuesday’s rug-pull. JPMorgan shares fell 2.2% on heavy volume, returning to the south side of their 50-day moving average. Not that the 50-day has been all that helpful with JPM stock. Its uptrend this year has been so rickety that almost every pullback along the way has breached it.

What’s perhaps most unfortunate about the past three weeks of selling is the failure of last month’s breakout attempt. The stock’s breach of resistance at $119 only lasted a few days before rejection. Earnings loom next week, so investors should wait and see if bulls deliver before wading into the waters.

On the options trading front, calls proved more popular than puts. Total activity matched the average daily volume, with 66,861 contracts traded. Calls drove 58% of the tally.

The increased demand pushed implied volatility up to 28% or the 40th percentile of its one-year range. Premiums are pricing in daily moves of $1.94 or 1.7%.

AT&T (T)

Dividend targeting options activity was in full force for AT&T on Tuesday. With the telecom titan trading ex-dividend today, income seekers flooded the derivatives market with call demand to acquire short-term control of the stock for the payout. Its 51 cent dividend out translates into a beefy 5.52% yield.

Activity zoomed to 1,480% of the average daily volume, with 2,230,436 contracts changing hands. 96% of the trading came from call options alone.

Implied volatility climbed to 28% or the 47th percentile of its one-year range. Premiums are baking in daily moves of 65 cents or 1.8%.

The price chart for T stock looks great. All major moving averages are rising, showing bulls dominating across time frames.

General Motors (GM)

The downtrend in General Motors worsened yesterday after the automaker broke short-term support with a 2.5% drop. Weeks ago, the United Auto Workers labor union went on strike, and both sides have yet to settle on a deal. Add in the weakening market sentiment on economic slowdown fears and continued angst over the trade war and, well, you have a bearish backdrop for GM stock.

Support zones do lurk in the $32-$33 area, but until the trend turns higher, floors were made to be broken. Options trading was buzzing with puts driving the bus. Activity jumped to 284% of the average daily volume, with 105,200 total contracts traded. 72% of the trading came from put options alone.

The demand push lifted implied volatility to 36% placing it at the 52nd percentile of its one-year range. Premium sellers will be happy to note this is the highest level since January.

As of this writing, Tyler Craig didn’t hold positions in any of the aforementioned securities. For a free trial to the best trading community on the planet and Tyler’s current home, click here!