Insider buying can be a bullish signal for a stock. This is especially the case if the stock has recently had a large drop in price.

Insiders are people who have access to confidential information about a company. When they buy or sell their company’s stock, they need to make a public filing with the SEC. This is intended to prevent the insiders from taking advantage of information that the public does not have access to. Because of this we can find out when insiders are buying or selling their company’s stock.

There are many reasons why they may sell. Maybe they need to raise money to buy a house or to pay college tuition.

However, there is only one reason why an insider will buy the stock. They believe that it is currently undervalued and that buying it will lead to profits.

There has been significant insider buying in the following stocks over the past week.

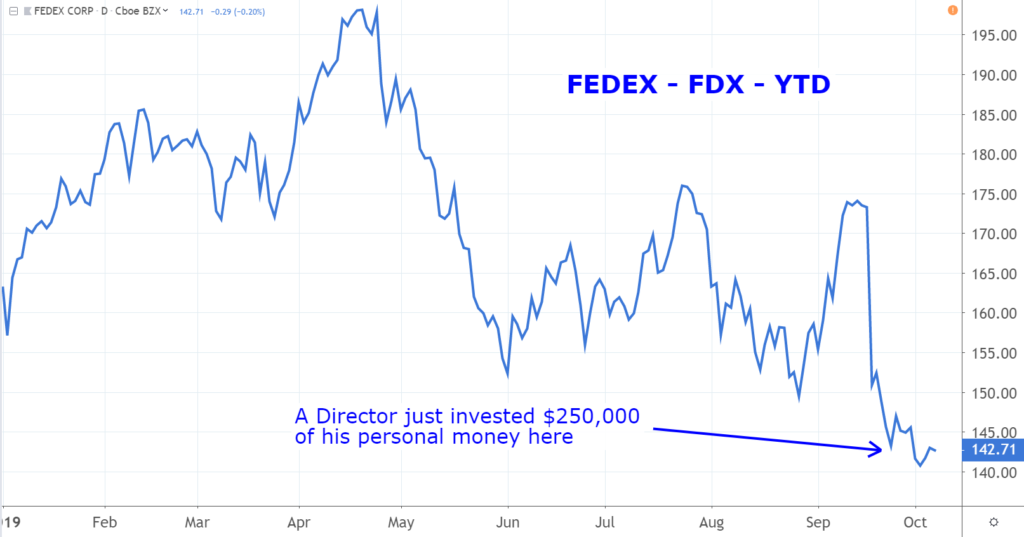

FedEx (FDX)

FedEx (NYSE:FDX) provides worldwide transportation, e-commerce, and business services.

FDX stock has been under pressure due to concerns about a possible recession and trade wars. Since April, the price has dropped by about $50.

Brad Martin is a director at the company. He must believe that the selloff of the stock is over done. He just invested about $250,000 when he bought 1,750 shares at $145 a share.

Fedex is closely followed by Wall Street. It is covered by 25 firms. Most of them are bullish on the future prospects of the company. The average rating is overweight, and the average price target is $168. This is almost 20% higher than where it is currently trading.

Heron Therapeutics (HRTX)

Heron Therapeutics (NASDAQ:HRTX) develops treatments to address unmet medical needs.

Over the past 18 months shareholders of Heron have been very disappointed. In this time period, the stock has lost over half of its value. This is probably due to the fact that the company has reported large losses in each of the past five years.

CEO Barry Quart probably thinks that the stock is about to rally. He just made an $80,000 investment when he paid $17.50 for 4,571 shares. John Poyhonen is an executive vice president and the chief commercial officer of the company. He just made a similar sized investment as well.

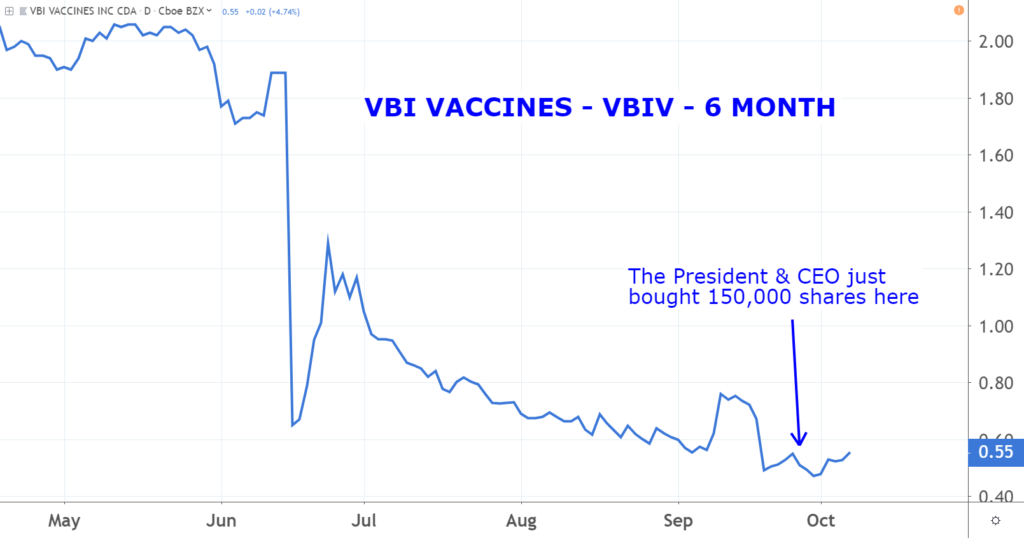

VBI Vaccines (VBIV)

VBI Vaccines (NASDAQ:VBIV) is a biopharmaceutical company that develops and sells vaccines to address unmet needs in infectious disease and immuno-oncology.

VBIV shares dropped in June after the company reported that a vaccine it was developing failed its secondary goal in a late stage trial. In August, it reported earnings that were below estimates. The stock continues to trend lower.

Jeff Baxter is the president and CEO of VBI. Baxter must believe that the VBIV stock is a bargain at current prices. He just paid 50 cents a share for 150,000 shares. This is a personal investment of $75,000.

Immunomedics (IMMU)

Immunomedics (NASDAQ:IMMU) is a clinical-stage biopharmaceutical company that develops products for the treatment of cancer.

Over the past year IMMU stock has dropped from $24 per share to current levels around $15. This is probably because it reported losses of $1.67 a share in 2018. These were significantly larger than the loss of $1.47 a share that it reported a year earlier.

Bryan Ball is the chief quality officer of the company. He must believe that the stock is about to rally. He recently paid $14.18 for 5,000 shares. This was a personal investment of over $70,000.

KalVista Pharmaceuticals (KALV)

KalVista Pharmaceuticals (NASDAQ:KALV) is a clinical stage pharmaceutical company that develops and commercializes small molecule protease inhibitors.

KALV stock has lost about 60% of its value since April. Currently the market capitalization is around $190 million.

KalVista is losing money and this is probably why the stock continues to fall. The losses are smaller than they used to be however. In fiscal 2019 it reported a loss of $1.38 a share. This was an improvement over the fiscal 2018 loss of $1.53 and fiscal 2017 loss of $4.47.

Daniel Soland is a director at KalVista. Apparently he believes that the selloff is over. He just invested $120,00 into the stock when he bought 10,000 shares at an average price of $11.88.

At the time of this writing Mark Putrino did not have any positions in any of the aforementioned securities.