Chinese President Xi Jinping chats with President Donald Trump during a welcome ceremony in Beijing on Nov. 9, 2017.

AP Photo | Andy Wong

The stock market got caught in the perfect storm of escalated trade tensions and impeachment fears in September, but it came out just fine with the S&P 500 poised to eke out a nearly 2% gain. October might be a different story.

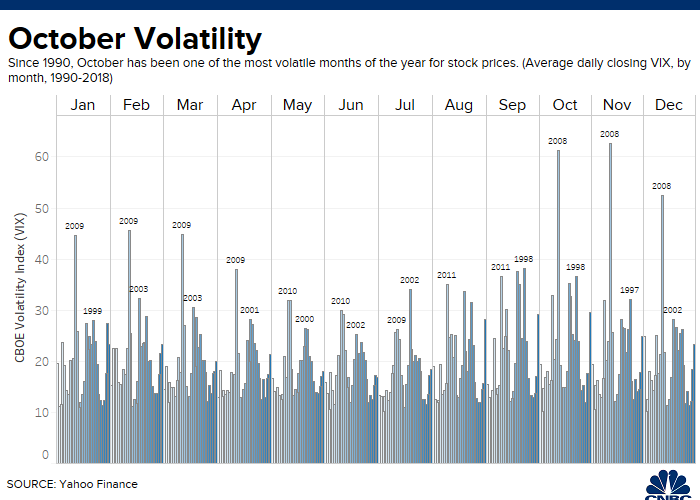

October has historically been the most volatile month as the Cboe Volatility Index, or the VIX, tends to peak in the month, jumping to more than 21 points on average over the past 30 years, according to Macro Risk Advisors. The market’s surprising resilience in September, which is typically the worst month for stocks, could also signal the rally is about to lose steam.

“We’ve been spoiled by the lack of volatility this month, and it increases the chances of a little more explosive October,” Ryan Detrick, senior market strategist for LPL Financial, told CNBC. “One thing we know is the markets don’t stay calm forever and we’ve seen that multiple times this year.”

There isn’t a lack of catalysts to drive the market crazy, including upcoming trade talks, third-quarter earnings reports and President Donald Trump’s impeachment saga. Over the past 30 years, more than 190 S&P 500 companies have seen a daily move of more than 1% in October, the most companies in any given month, according to Macro Risk Advisors.

Tensions escalated ahead of the highly-anticipated trade talks, which resume on Oct. 10 in Washington. Reports on Friday said Trump administration officials are considering ways to limit U.S. investors’ portfolio flows into China, including delisting Chinese companies from American stock exchanges.

The U.S. Treasury Department said on Sunday “the administration is not contemplating blocking Chinese companies from listing shares on U.S. stock exchanges at this time.” White House trade advisor Peter Navarro called the reports “fake news” in an interview with CNBC.

Trade tensions, however, will remain a concern even if there are delays in tariffs or other actions.

“We have more conviction that, without a circuit breaker, escalation continues over the medium term, meaning any pause is fleeting,” Michael Zezas, Morgan Stanley’s head of U.S. public policy, said in a note on Monday. “Investors should price in all announced actions even if further delays or pauses are announced.”

Average returns

Since 1950, Octobers have averaged a slight gain of about 0.9% for the S&P 500, according to the Stock Trader’s Almanac. The data also show that during pre-election years dating back to 1950, the market has been flat with the S&P 500 posting a 0.1% return on average.

October is also the month when big crashes have occurred, including 1929 and 1987, adding to fears that do not always prove warranted.

“Historically, October is just right about an average month. The bottom line is Octobers do tend to be volatile even with some of the years that you’ve had good gains,” Detrick said. “Everyone is going to be hyper-sensitive to any potential trade news this coming October.”

Data from Bespoke Investment Group show October has mostly “oscillated” between intra-month gains and losses throughout the month from 1983 to 2018. It has a tendency to finish the month off strong, however.

“While there has tended to be some weakness in the opening days of the month, from that point on, the S&P 500 has seen steady gains finishing with an average gain of 1.89%,” Paul Hickey, founder of Bespoke said in a note on Monday.