It’s been easy to criticize Tesla (NASDAQ:TSLA) and its brash CEO, Elon Musk. For years, Musk has specialized in overpromising and underdelivering, hurting TSLA stock in the process.

He’s developed something of a habit of suggesting he doesn’t think his company will need to raise more cash, only to issue more TSLA stock or new bonds just a few months later. And, let’s not forget that nearly a decade since its IPO, Tesla has only been profitable in four of its quarters.

The future, however, may not be the “more of the same” many investors burned by Tesla stock might expect. Last quarter was something of a turning point for the company, even if it didn’t lift TSLA stock.

Is Tesla Over the Hump?

To give credit where it’s due, Musk did what long-established automakers like Ford Motor (NYSE:F) and Toyota Motor (NYSE:TM) arguably should have done, but couldn’t: make electric vehicles popular.

Granted, Tesla may have done it the most backwards way possible, starting with the very cool but completely unpractical Roadster sports car to demonstrate the practicality of EVs, and then dialing its product line back to just luxury-class cars like the Model S in 2012 and then the Model X in 2015. Deliveries of the much more affordable Model 3 didn’t start until 2017. Before that year, TSLA bled money most of the time.

There may have been a method to the madness, however.

Largely missing over the course of the past ten years was something that might have finally taken shape for Tesla last quarter … significant size.

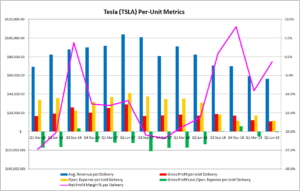

To make money in the car business, a certain amount of cars must be produced to cover fixed as well as variable costs. Fixed costs like corporate overhead are, well, fixed. Variable costs, meanwhile, change depending on how big or small an operation becomes. Ideally, variable or per-unit costs will shrink as an operation grows, leading to higher profit margins.

Tesla didn’t benefit from its size. Indeed, the electric-car company suffered from its growth all the way through the middle of 2017. That is to say, the more Model S and Model X vehicles it made, the more money it lost on each one it produced.

A funny thing happened during the latter half of 2017, though. The company started to spend less on each car it produced, and that trend has continued ever since.

That’s because the lower cost Model 3 vehicle should cost less to make, since it retails for around $40,000. The Model S and Model X sell for over $100,000 per vehicle.

That shift isn’t the whole story, though. The proverbial “rest of the story” is that Musk has whittled down the company’s per-car production costs a lot more than the average selling price for any Tesla vehicle has fallen, thanks to the rollout of the Model 3.

Something’s Different

TSLA is, broadly speaking, spending less of the money it collects when it sells a car. That’s because its costs to make a car as well as its costs to run itself are shrinking more quickly than the average price of its vehicles sold are falling.

The chart tells the tale. Though the company slipped slightly back into the red on a per-car basis in the first and second quarters of this year, it earned a profit of $5,596 per EV in the final quarter of last year. That was way up from its $597 profit per car delivered during the third quarter of last year.

Click to Enlarge

It’s not a perfect analysis. Its operating expenses include spending related to its solar and power-storage business.

But this data should start to address some of the concerns about the company simply growing its top line with no reasonable hope for sustained profits. That’s because selling more lower-priced cars is more profitable than selling fewer high-end cars.

Musk probably did take too long and burned through too much cash to reach this point, but this could be a positive tipping point for the organization.

Looking Ahead for TSLA Stock

But a couple of good quarters doesn’t necessarily make a trend.

One also can’t ignore that the so-called Tesla of China, Nio (NYSE:NIO), is off to a rough start as an electric car company as well as a publicly-traded entity. NIO stock was rocked this week following word that it needs to raise cash.

Nio’s problems may be company-specific or China-specific. Perhaps they’re due to problems with EVs in China. They may even be a subtle sign of a global economic slowdown.

By and large, though, the way things seem on the surface is probably the way things are. Tesla is probably at — or at least near — a point where it can build vehicles and sell them for a profit.

For this reason, the Q3 earnings announcement slated for early November could be a big one. The net income figure will be interesting, but the number to watch is going to be the average selling price per car minus the average cost to produce a car.

As of this writing, James Brumley did not hold a position in any of the aforementioned securities. You can learn more about him at his website jamesbrumley.com, or follow him on Twitter, at @jbrumley.