Stocks opened higher on the day, but took it on the chin as reports surfaced of President Trump taking action against Chinese equities. Let’s look at some of these names as part of our top stock trades.

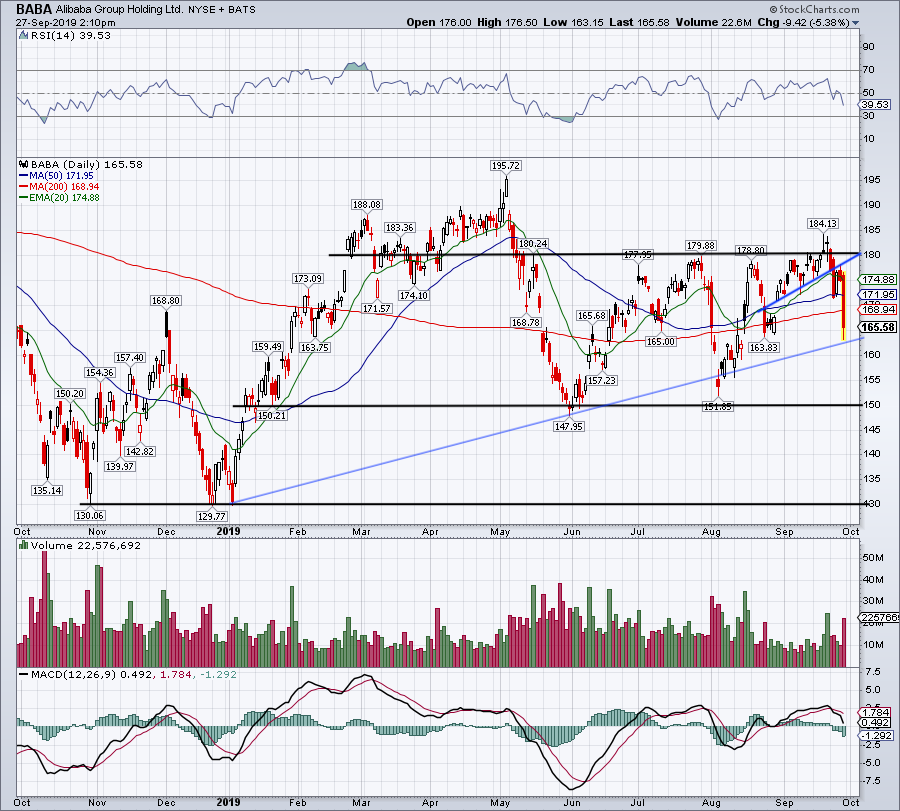

Top Stock Trades for Tomorrow #1: Alibaba

It wasn’t all that long ago we were looking for a breakout in Alibaba (NYSE:BABA), given the ascending triangle formation that the stock had. That breakout failed to build momentum and shares petered out.

On Friday though, they were flat out crushed.

The decline sent BABA below its 20-day, 50-day and 200-day moving averages. It’s now coming into potential 2019 uptrend support (blue line), but I know I wouldn’t be banking on that level to hold — especially as we go into the weekend.

If Alibaba bounces, see if it can reclaim the 200-day moving average. On the downside, look to see if buyers step in between $150 and $155. Below the former and the selling pressure could really accelerate.

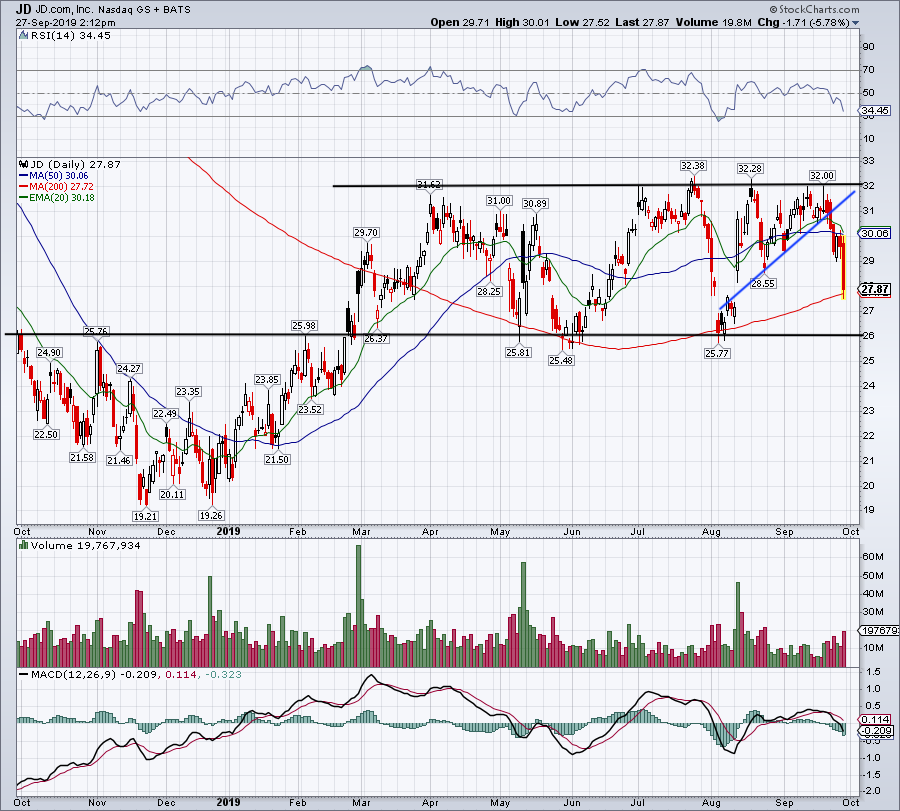

Top Stock Trades for Tomorrow #2: JD.com

JD.com (NASDAQ:JD) has a similar-looking chart, with shares puking lower on Friday. However, the 200-day moving average is propping up JD at this time.

Now, As much as I’d love to see that mark hold and for JD to rebound next week, the risk simply isn’t worth it going into a weekend where tensions may escalate.

Instead, I want to see if JD can reclaim the 50-day moving average on a rebound. On a further decline, I want to see if JD.com finds support near $26, just as it has for most of 2019. $26 has been a pivotal level over the past year.

Top Stock Trades for Tomorrow #3: Baidu

Compared to BABA and JD, the action in Baidu (NASDAQ:BIDU) isn’t all that bad. Still, the chart doesn’t look great.

The 20-day and 50-day moving averages are acting as resistance, while downtrend resistance (blue line) is also keeping a lid on BIDU. The stock did put in a higher low, but I fear a retest of the August lows.

If Baidu tests down to that level and fails to hold ~$93, then the selling could accelerate. Below $110, this is a hard one to trust on the long side.

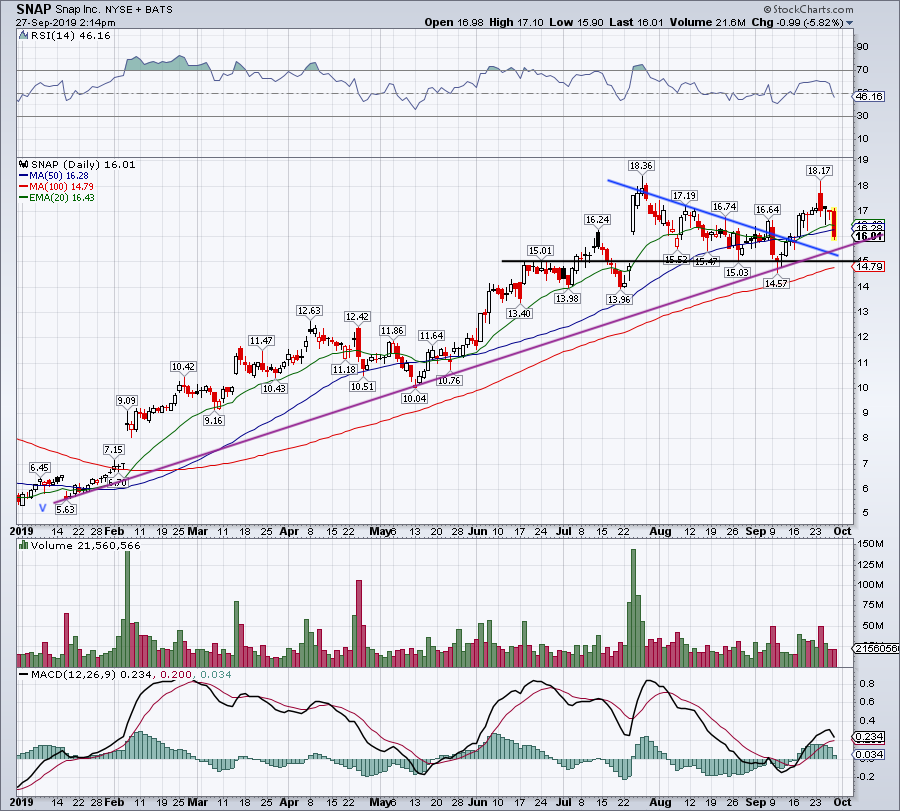

Top Stock Trades for Tomorrow #4: Snap

After nearly hitting new 52-week highs earlier this week, Snap (NYSE:SNAP) stock is starting to unwind.

It’s now below both the 20-day and 50-day moving averages, as it sinks below the $16 mark.

I would love to see a larger correction down to the $15 level, where it has multiple support levels in play. There is has the backside of prior downtrend resistance (blue line), 2019 uptrend support (purple line), range support (black line) and the 100-day moving average.

If that can’t give SNAP a bounce, I don’t know what will.

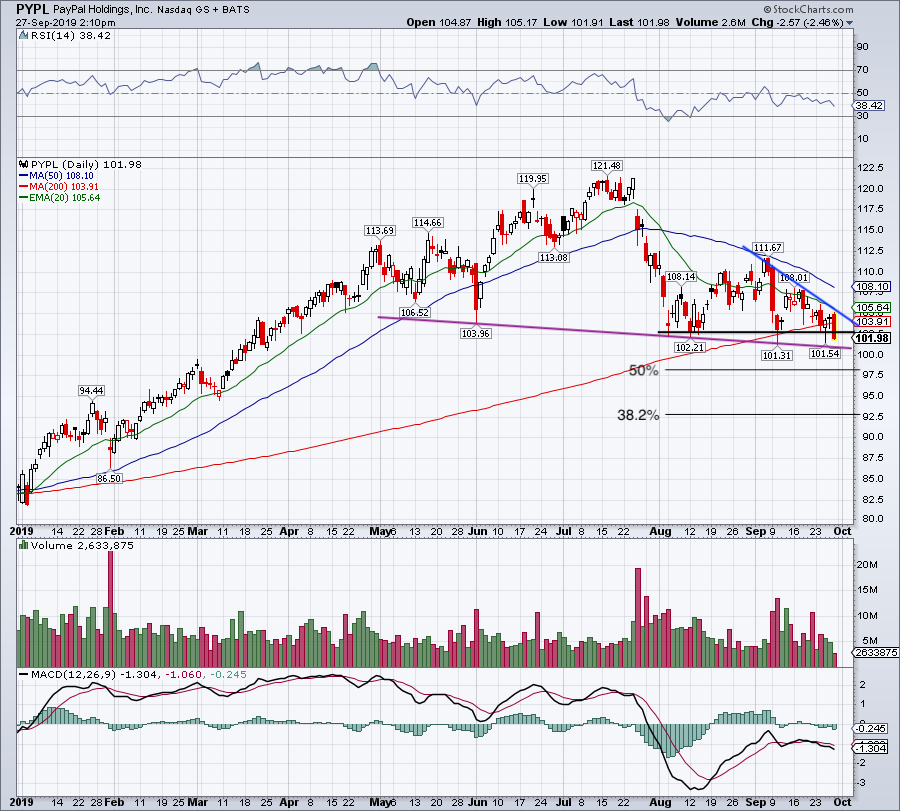

Top Stock Trades for Tomorrow #5: PayPal

PayPal (NASDAQ:PYPL) is like a diseased tree, slowly but surely rotting.

For the record, I really like PYPL and hope bulls can find a cure for its deteriorating condition. But as it stands, it’s not looking pretty. Downtrend resistance (blue line) and 20-day moving averages are squeezing PYPL lower, while its 200-day moving average is no longer providing support.

Nor is the 61.8% retracement up near $103.60, while $102.50 — which has buoyed PayPal for two months — is also giving way. There’s a chance that downtrend support (purple line) holds as support, but again, that’s not a hill I’m willing to die on.

If this one loses $100, see if the 50% retracement supports the stock. If not, a deeper correction is in store. On the upside, I need to see PayPal clear $106 before it looks healthier.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, Bret Kenwell did not hold a position in any of the aforementioned securities.