President Donald Trump‘s active Twitter feed reverberates across multiple topics, apparently including the price of gold.

Though he has basically never directly tweeted about the yellow metal, his indictments of the Federal Reserve as well as the ongoing updates about the U.S. tariff dispute with China and trade in general influence gold, either directly or indirectly, according to an analysis by RBC Capital Markets.

Trump’s hectoring of the Fed has led to expectations of lower interest rates, according to a National Bureau of Economic Research study. Low rates generally lead to higher inflation, which historically has benefited gold.

“While negative sentiment towards the Trump-driven conversation around China, trade, and the Fed does not bear statistical significance for gold prices, in our view it does present event risk,” RBC commodity strategist Christopher Lourney said in a note to clients.

The analysis does not quantify a specific dollar amount, but Lourney notes that “spikes in negative conversation volume have tended to precede the majority of upward moves in gold prices since late 2018.”

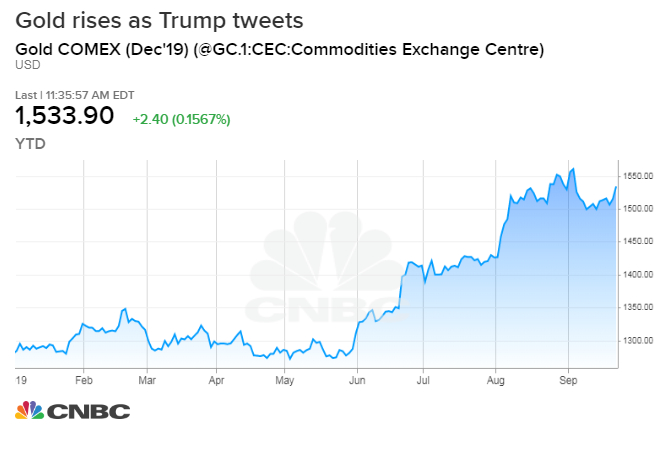

Gold is up 16.5% in 2019 as part of a rally that began in mid-May, but the metal has been on a general upward trajectory that intensified when the Fed started cutting interest rates.

Trump has been relentless in his criticism of the Fed, saying the central bank is keeping interest rates too high and making the U.S. less competitive globally. After raising rates nine times over a three-year period beginning in December 2015, the Fed has cut its benchmark rate twice since July, and gold has responded with another leg in the rally.

RBC, though, does not expect the gold surge to last.

The uncertainty associated with Trump’s policies and his subsequent tweeting present “uncertainty” in trading, meaning there can be “more frequent moves in gold prices, particularly amid the most recent rally,” Lourney said.

With that in mind, RBC projects gold to end the year at $1,474, which would represent about 3% downside from where the precious metal was trading Tuesday.

“We view the Trump-driven conversation around the Fed as a key possible source of uncertainty,” Lourney said.