U.S. stock futures are close to unchanged as traders return from the weekend. After opening strong Sunday night, they have since given back gains due to weak data from Europe fanning the flames of a global slowdown.

Against this backdrop, futures on the Dow Jones Industrial Average are down 0.10%, and S&P 500 futures are higher by 0.01%. Nasdaq-100 futures have added 0.10%.

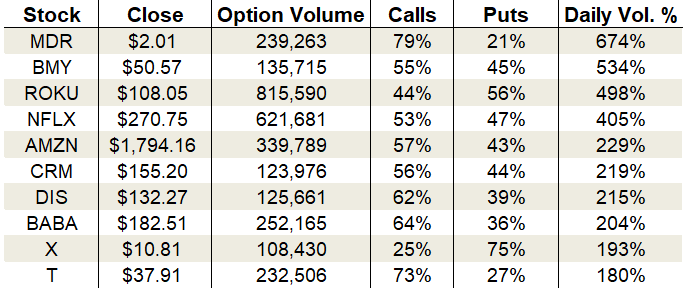

Friday’s options volumes pushed well above average levels due in part to quadruple witching. On the third Friday of the last month of each quarter (Mar, Jun, Sep, Dec), four different trading products expire simultaneously – market index futures, market index options, stock options, and stock futures. Approximately 22.7 million calls and 21 million puts changed hands.

Despite the booming volumes, the CBOE single-session equity put/call volume ratio didn’t move much. A mild drop took it to 0.65 while the 10-day moving average climbed to 0.62.

Options traders zeroed in on tech stocks Friday. Roku (NASDAQ:ROKU) saw its largest one-day drop in history, falling just shy of 20%. Netflix (NASDAQ:NFLX) breached significant support and pushed to a new nine-month low. Finally, Amazon (NASDAQ:AMZN) slipped on heavy volume, but remains stuck in an uninspiring range.

Let’s take a closer look:

Roku (ROKU)

Roku’s meteoric rise (up 421% over nine months) more than justified a pullback, but no one could have predicted the speed with which its uptrend has been dismantled. Apparently, Icarus flew too close to the sun. Roku stock’s downside reversal reached terminal velocity Friday, crashing 19% in a single session. Trading volumes rocketed to historic levels with over 65 million shares changing hands.

All told, the stock has fallen 39% from its peak in less than two weeks. Given the groundswell in activity and severity of the stock’s oversold conditions, there’s a decent chance we’re close to capitulation, at least for this stage of the selling. That means a relief rally could be in the offing. Chart watchers will also note ROKU filled its earnings gap.

On the options trading front, puts outpaced calls by a modest margin. Activity boomed to 498% of the average daily volume, with 815,590 total contracts traded. Puts accounted for 56% of the take.

Implied volatility surged to 82% or the 61st percentile of its one-year range. If you’re brave enough for a bullish bet then bull put spreads are paying juicy premiums right now.

Netflix (NFLX)

Ever since earnings torpedoed Netflix in July, the streaming media giant has been cruising lower. The selling pressure crescendoed on Friday with a nasty high-volume breakdown. Almost 24 million shares traded while the stock slid 5.5%.

The breakdown cracked key short-term support, placing NFLX stock in a precarious position. There isn’t any major support until $231, which is 22% lower from here. Couple that with the stock’s location beneath all major moving averages and bulls haven’t a leg to stand on.

Friday’s swoon lit a fire in options trading with calls leading the charge. Total activity grew to 405% of the average daily volume, with 621,681 contracts traded. 53% of the trading fell on the call side of the ledger.

The increased demand drove implied volatility up to 52% or the 44th percentile of its one-year range. Given Netflix’s large price tags, bear put spreads make sense if you’re looking for further weakness.

Amazon (AMZN)

Amazon has been a ship without a rudder over the past two months. The lack of momentum has made it a tricky stock to play directionally. Not that it hasn’t tried to break out — it has. But thus far each attempt has failed. Friday’s 2% drop put the nail in the coffin of its latest breakout bid and thrust AMZN stock back into the center of its range.

Until we reclaim the high side of the 50-day moving average above $1850 or breach support near $1750, I suggest steering clear of directional bets.

On the options trading front, calls were more popular than puts despite the day’s drop. Activity rose to 229% of the average daily volume, with 339,789 total contracts traded. Calls contributed 57% to the session’s sum.

Implied volatility rests near the lower end of its one-year range at 24%. Premium sellers aren’t receiving much compensation, and directional trades have the pesky trading range to contend with. This is a stock best placed in the “too hard” bucket for now.

As of this writing, Tyler Craig held bullish positions in ROKU. Check out his recently released Bear Market Survival Guide to learn how to defend your portfolio against market volatility.