Equities opened higher on Friday, but faded throughout the afternoon, with the S&P 500 finishing about flat on the day. After a very strong start to September, here’s a look at a few top stock trades going into next week.

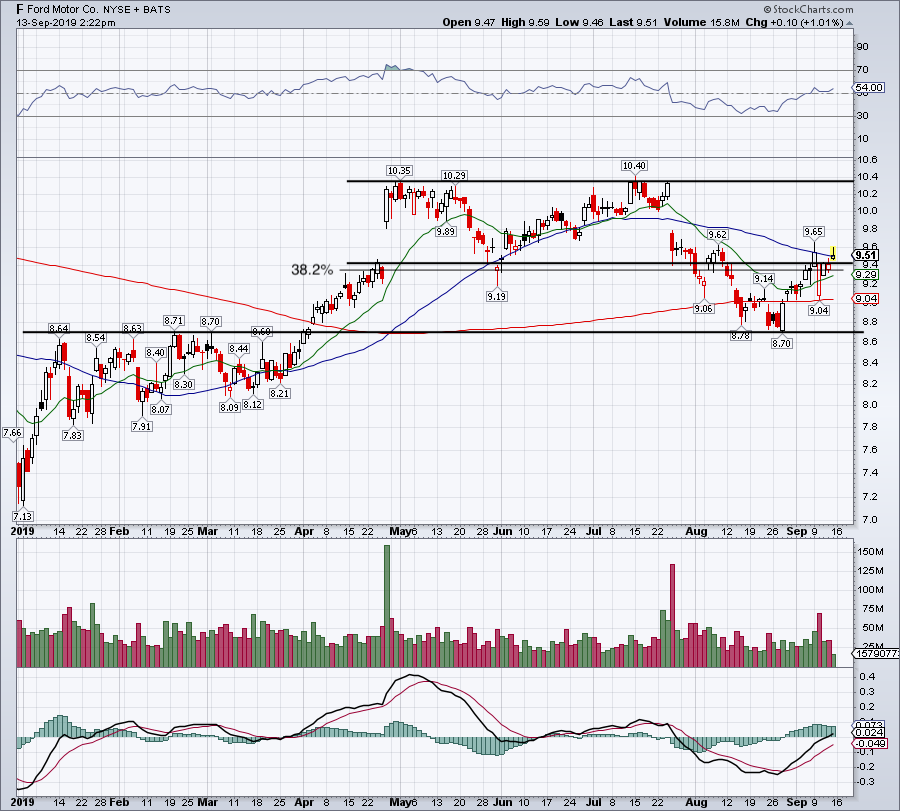

Top Stock Trades for Tomorrow #1: Ford

Shares of Ford (NYSE:F) haven’t made much progress this week, but it’s been a good showing from the bulls. Earlier this week, the company had its credit downgraded to junk status, but Ford stock posted a resilient rally.

On Friday, the stock briefly reclaimed the 50-day moving average, the same one which rejected F earlier in the week. A move above it puts $9.65 on watch and above that, a potential gap fill up to $10.20.

On the downside, see that Ford maintains above $9.40-ish. Just below is the 38.2% and rising 20-day moving average to help buoy shares on a possible pullback. Below this week’s low opens up the possibility of $8.75.

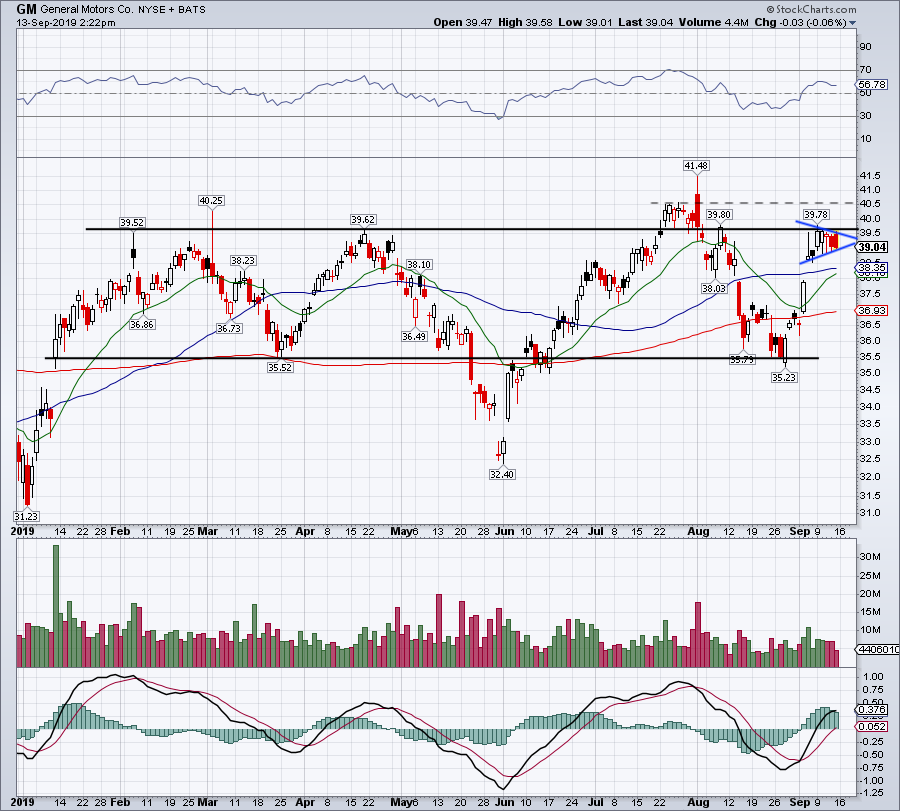

Top Stock Trades for Tomorrow #2: General Motors

Shares of General Motors (NYSE:GM) have had a quiet week, but that comes after last week’s strong gap up action. Consolidating between $38.50 and $39.50, GM stock is bound to move out of this range at some point.

Should it resolve higher, the first target is $40.50. Above that and a run to the July highs is possible, up near $41.48. If it trades lower and falls out of this consolidation pattern, look for support from the 50-day and 20-day moving averages.

If they fail as support, it puts the 200-day moving average on watch, with range support at $35.50 below that.

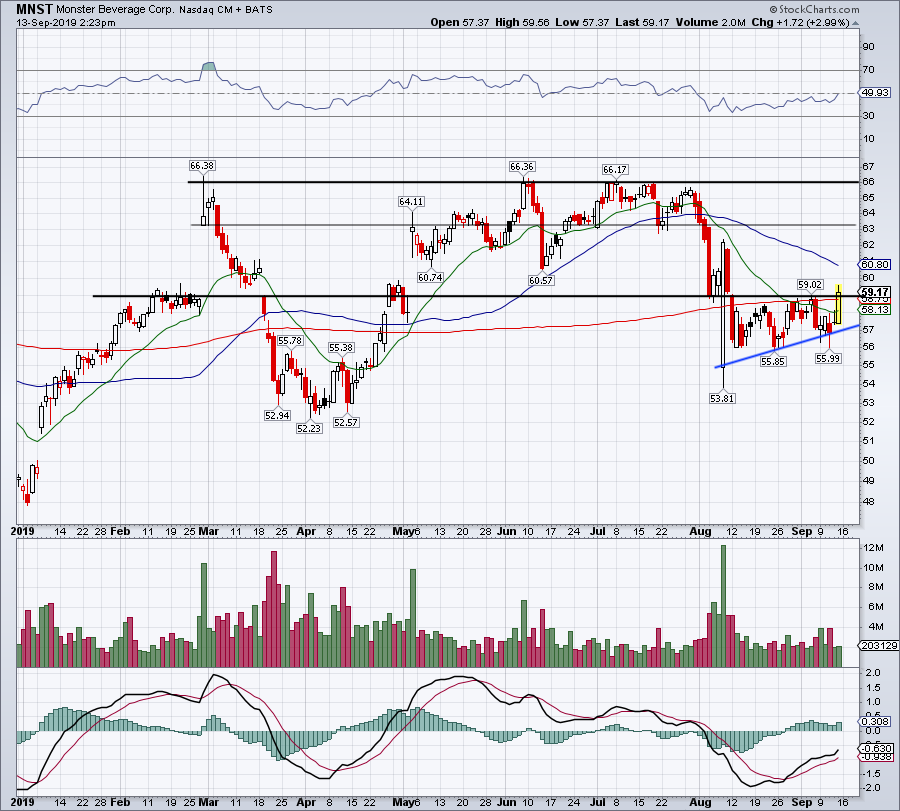

Top Stock Trades for Tomorrow #3: Monster

Monster Beverage (NASDAQ:MNST) has a really interesting setup for traders. Uptrend support (blue line) continues to squeeze shares against static resistance at $59. That’s known as an ascending triangle, a bullish technical pattern.

At $59.27, the stock also has the 38.2% retracement it’s trying to reclaim. Should it finally breakout, look for a possible run to the 50-day moving average. Above that and $63 is possible.

If the 200-day and $59 resistance reject MNST stock, look for a pullback into uptrend support.

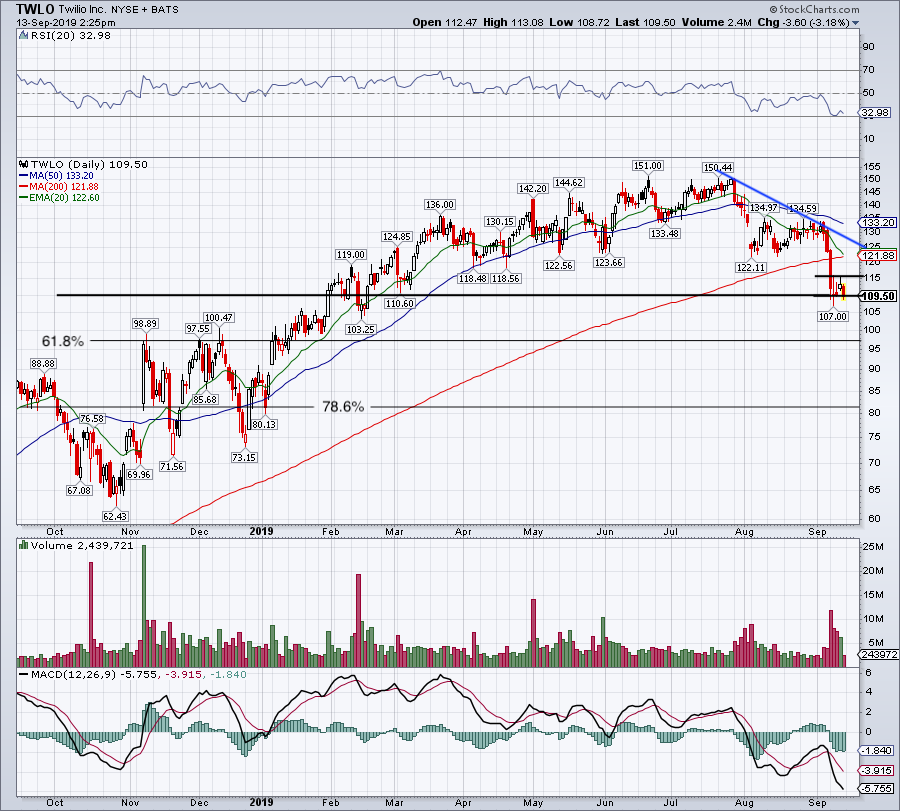

Top Stock Trades for Tomorrow #4: Twilio

After the thrashing we’ve seen in high growth stocks, many were hoping for a more impressive rebound. This bounce has been tepid, and that’s putting it kindly. Just look at the action in Twilio (NYSE:TWLO) for instance.

Short of a flood of buy orders, Twilio and others look set to roll over once again. Should TWLO get hit, I would love to see a correction down to the $96 to $98 area, and see whether that draws in buyers.

High-growth selloffs are tough. If there are a few companies you really like and are willing to hold for the long term — and embrace the risk — nibbling on these declines can be rewarding. But they’re difficult to time. In TWLO’s case, let’s take it one day at a time and see how it holds up on a potentially deeper decline.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, Bret Kenwell did not hold a position in any of the aforementioned securities.