U.S. equities are struggling with minor losses on Tuesday after reports Chinese officials are losing confidence in President Trump as an honest negotiator. This follows frustrations in the way the Huawei situation has been handled. China considers this a trade issue, but the U.S. calls it a security issue.

Still, key areas of the market are perking up nicely (led by energy) as buyers swoop in on beaten down names. A number of stocks trading around the $1 mark are rallying nicely, pointing to the potential for big gains for penny stocks in the days ahead. Here are five dollar stocks worth a look:

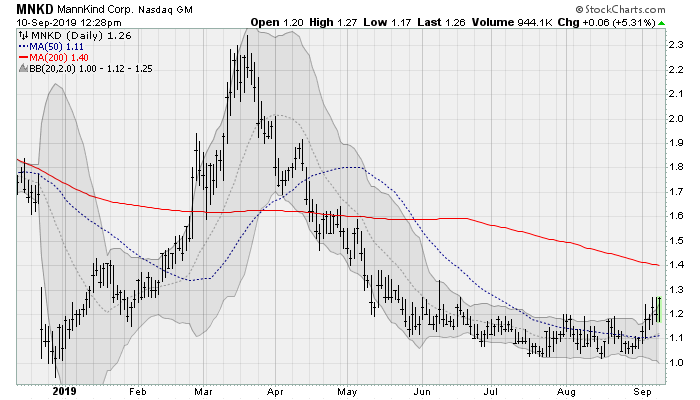

MannKind Corporation (MNKD)

Shares of MannKind (NASDAQ:MNKD), a biopharmaceutical company focused on treatments for ailments such as diabetes and hypertension, are emerging from a multi-month consolidation range and looks set to challenge its 200-day moving average. The company recently completed construction of a new manufacturing site for high-potency molecules.

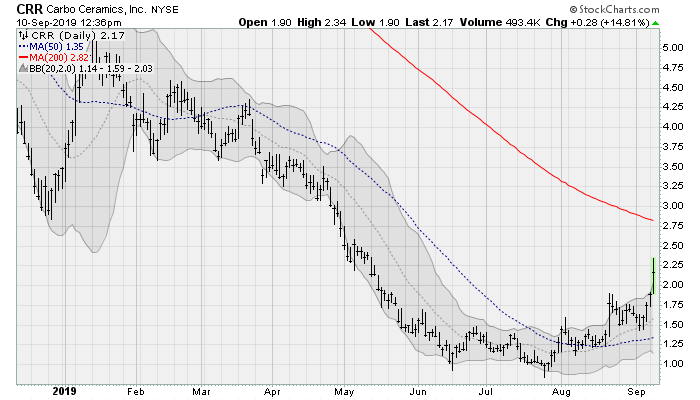

Carbo Ceramics (CRR)

Shares of Carbo Ceramics (NYSE:CRR), a provider of frac products and services to the oil and gas industry, are blasting higher today rising more than 14% to move closer to its 200-day moving average. A return to the highs seen in the summer of 2018 would be worth a 5x gain from here.

The company will next report results on October 24 before the bell. Analysts are looking for a loss of 48 cents per share on revenues of $47.9 million.

Nabors Industries (NBR)

Shares of Nabors Industries (NYSE:NBR), a provider of drilling and drilling-related services to the energy industry, is enjoying a share price bounce back above its 50-day moving average.

The company will next report results on October 29 after the close. Analysts are looking for a loss of 21 cents per share on revenues of $788.2 million.

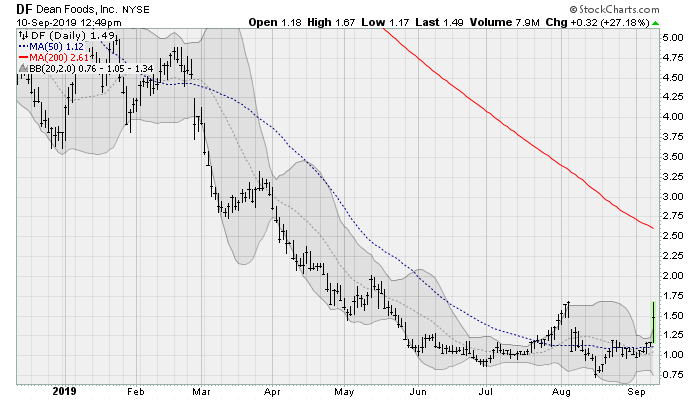

Dean Foods (DF)

Shares of Dean Foods (NYSE:DF), a food and beverage provider focused on the sale of milk and other daily products, is enjoying a rise off of a tight five-month consolidation range. Watch for a run at the 200-day moving average, which would be worth a gain of two-thirds from here.

The company will next report results on November 6 before the bell. Analysts are looking for a loss of 20 cents per share on revenues of $1.9 billion.

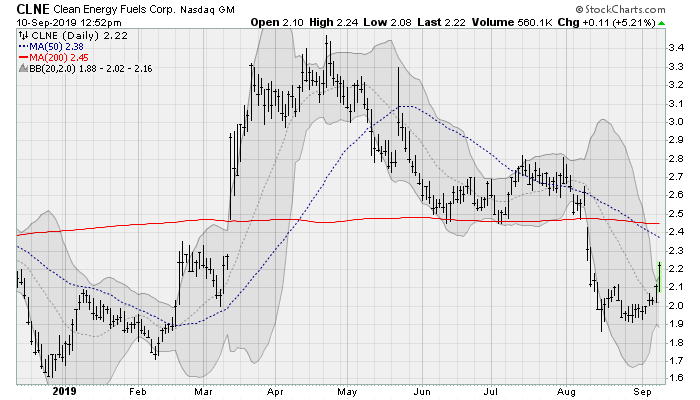

Clean Energy Fuels (CLNE)

Clean Energy Fuels (NASDAQ:CLNE), a provider of compressed natural gas to vehicle fleets, is rallying off of two-month support and looks ready to return to the highs seen back in July — which would be worth a gain of more than 20% from here. The company recently reported that quarterly earnings grew 7.7% from last year on higher volumes.

As of this writing, William Roth held no positions in the aforementioned securities.