U.S. stock futures are trading higher this morning in a continuation of Thursday’s powerful breakout. With equities finally busting outside of last month’s range, the stage is set for a resumption of the market’s long-term uptrend.

Ahead of the bell, futures on the Dow Jones Industrial Average are up 0.35%, and S&P 500 futures are higher by 0.38%. Nasdaq-100 futures have added 0.27%.

In the options pits, call activity exploded yesterday, helping to drive overall volume to the moon. Specifically, about 24.1 million calls and 19.3 million puts changed hands on the session.

Not surprisingly, the mad dash into calls had a significant impact on the CBOE’s single-session equity put/call volume ratio. The reading plunged to a two-month low at 0.53, reflecting a sharp increase in bullish sentiment. Meanwhile, the 10-day moving average ticked down to 0.67.

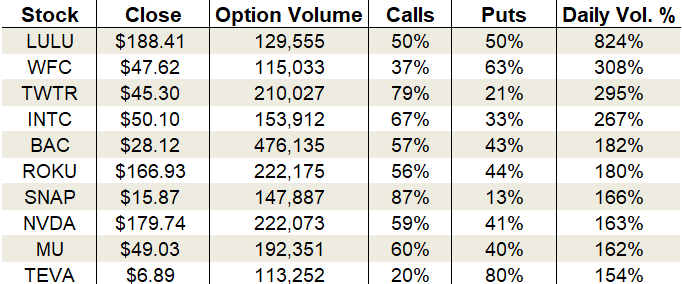

Options traders swarmed in Lululemon (NASDAQ:LULU), Twitter (NASDAQ:TWTR), and Bank of America (NYSE:BAC).

Let’s take a closer look:

Lululemon (LULU)

Lululemon reported better-than-expected earnings last night, sending the stock over 6% higher to $200 for the first time in its history. Yesterday saw LULU stock surge on huge volume ahead of the number. Almost 6 million shares changed hands or three times the daily average.

For the quarter, Lululemon posted earnings of 96 cents per share on revenue of $883 million. Both measures bested estimates which called for earnings of 89 cents per share on $844 million in sales. Same-store sales grew 10%, but the number jumps to 15% when including digital sales.

The company boosted forward guidance. In the third quarter, LULU expects earnings per share in the 90-92 cent range and revenue between $880 and $890 million.

On the options trading front, calls and put demand was balanced ahead of earnings. Activity ballooned to 824% of the average daily volume, with 129,555 total contracts traded. The tally was split 50-50 between calls and puts.

Premiums were pricing in a $15.25 or 8% move on earnings, so this morning’s 6% jump is inside of expectations. Expect a sharp drop in implied volatility today as traders unwind their earnings bets.

Twitter (TWTR)

The S&P 500 wasn’t the only chart departing its range on Thursday. Twitter also blasted through a month-long resistance zone. The breach was all the reason spectators needed to jump in. Buyers swarmed all day long pushing TWTR stock to a 4.5% gain on the session.

Volume grew to its highest levels in a month confirming the breakout’s legitimacy. This makes it much more likely that the move sticks. The blue bird’s year-to-date gains have now grown to an impressive 58%.

On the options trading front, traders came after calls with a vengeance. Total activity climbed to 295% of the average daily volume, with 210,027 contracts traded; 79% of the trading came from call options alone.

With uncertainty easing, implied volatility sank to 37% placing it at the 15th percentile of its one-year range. With premiums officially cheap, long option trades like calls or call spreads are attractive if you’re betting bullish.

Bank of America (BAC)

Traders also came after bank stocks Thursday with Wells Fargo (NYSE:WFC) and Bank of America landing atop the options leaderboard. BAC stock scored a 2.3% gain on above-average volume, while WFC stock climbed 2.4%.

Company-specific news for Bank of America was non-existent so consider its upward thrust a technically-driven move sparked by the broader market breakout.

Turning to its price chart shows BAC stock was able to rise above short-term resistance at $27.50, but it’s still a hot mess. The crisscrossing moving average confirms BAC’s inability to carve out a sustainable trend this year. It now sits in the middle of its range, giving little clarity to bulls or bears. That said, with the broader market in bull mode and the stock now turning higher, the path of least resistance is likely up.

On the options trading front, calls outpaced puts by a slim margin. Activity swelled to 182% of the average daily volume, with 476,135 total contracts traded. Calls accounted for 57% of the session’s sum.

Implied volatility dripped to 27% placing it at the 24th percentile of its one-year range. Premiums are pricing in daily moves of 49 cents or 1.7%.

As of this writing, Tyler Craig held bullish positions in TWTR. Check out his recently released Bear Market Survival Guide to learn how to defend your portfolio against market volatility.