Summer and back-to-school are, traditionally, prime time for retailers. Not so this year – with the notable exception of Lululemon Athletica (NASDAQ:LULU).

When researchers at Refinitiv polled industry analysts for their Q2 Retail Earnings Report, the respondents were “cautious” about results, and Refinitiv noted that so far, forward guidance is trending negative overall.

In contrast, when Lululemon released its second-quarter results on Thursday evening, the company beat Wall Street expectations on comparable sales, net revenue AND earnings per share. The latter came in at $0.96 per share, up 35% from the year-ago quarter. Analysts had only been expecting $0.89 per share, according to FactSet. So, the company posted a 7.9% earnings surprise.

What’s more, Lululemon raised its guidance for fiscal-year 2019, to $4.63–$4.70 per share, which is in-line with Wall Street projections. (The company’s prior forecast was $4.51–$4.58 per share.)

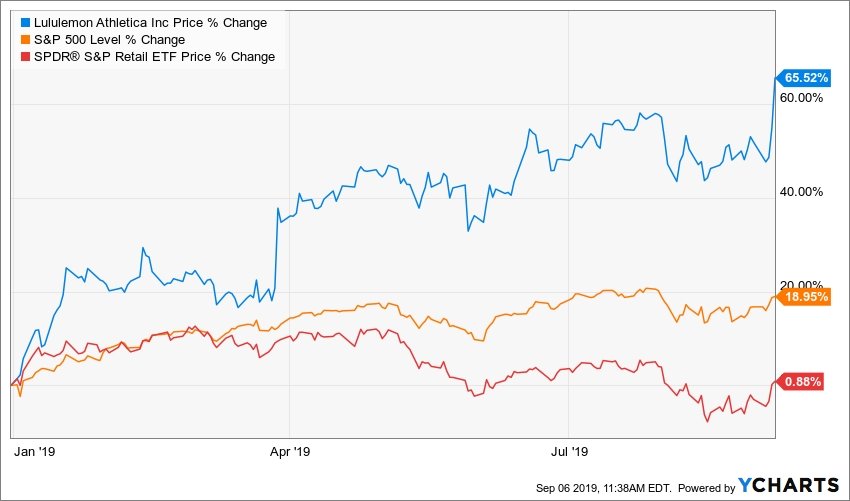

With yet another blowout earnings report, LULU stock is now up over 60% for us at Growth Investor, and 65% on a year-to-date basis. Shares refuse to be held down by the U.S.-China trade war that is depressing the S&P 500 overall, and especially the retail group, as you can see in the chart below.

If you’re wondering why a retail stock focused on yoga clothes has been such a top performer, well, there’s much more to the story than that. It’s an entire lifestyle known as “athleisure.”

Lululemon has been the vanguard of this athleisure trend for over two decades. The company was founded in 1998 by Chip Wilson, who spent the prior 20 years working in the surf, ski and skatewear industries. Lululemon started as a design studio by day and yoga studio at night in Vancouver, Canada. And that became the company’s first standalone store in 2000.

Initially, LULU grew by word of mouth, pop-up shops in yoga studios and brand ambassadors. Now, the company has more than 400 stores across four continents.

As more retailers jump on the bandwagon, you can get yoga pants almost anywhere. So what differentiates Lululemon? The brand is all about high quality and comfort. Plus, the stores are beautiful and equally stylish, and lately the company has been investing heavily in your experience there. Take a look at its new Chicago mega-store below.

It’s huge, ultra-modern, and in addition to clothes shopping, you can linger for coffee, smoothies, even yoga classes and meditation.

And for workout buffs who are too busy to drive to their nearest store, there are multiple Lululemon e-commerce sites and mobile apps.

In fact, within total sales of $883 million in the second quarter – a 22% gain, year-over-year – digital sales gained 31%! E-commerce has been so successful for Lululemon that they’ve now expanded in-store pickup of online purchases to nearly all North American locations.

No wonder Merrill Lynch analysts were out there saying Lululemon would “remain an outlier” in this otherwise lackluster environment for retail – and that was in late August, before the second-quarter results were actually announced.

Even prior to the second-quarter report, LULU stock was already a “Buy” in my Portfolio Grader, as you see here:

LULU stock gets strong marks on sales, operating-margin and earnings growth, as well as return on equity. While earnings surprises and momentum weren’t rating quite as strong, perhaps that’ll start to change with the better-than-expected +35% EPS growth in the second quarter.

So, when the talking heads on TV try to convince you that investors are headed for a major crisis, just remember stocks like LULU. I won’t pretend that the global landscape is looking pretty, with Brexit, the trade war and mini-recessions in Europe dominating financial headlines. (Boy, where’s a “puppy channel” when you need to get away from all this doom-and-gloom media?)

But nonetheless, “bulletproof” stocks are yours for the taking – if you know where to look. And that’s exactly what LULU stock is. I even chose it for InvestorPlace’s Best Stocks of 2019 contest, where it’s currently leading the pack.

There’s Another Piece to the Puzzle

While LULU stock is undoubtedly a powerful growth play right now, there’s another strategy to consider as well.

Besides Portfolio Grader, which identifies stocks with solid fundamentals as well as powerful buying pressure on Wall Street, I’ve also got a Dividend Grader system. The idea there is to find income investments that reward you with a reliable, growing dividend.

And when a stock earns an “A” from both Portfolio Grader AND Dividend Grader…well…that’s a must-buy.

I’ve nicknamed this group the Money Magnets. And especially now, when the market is disappointing and Wall Street’s clients are getting restless, you can bet that big money will continue to flow into this elite group of stocks.

Click here for my free briefing and get everything you need to know on this phenomenon.

Louis Navellier had an unconventional start, as a grad student who accidentally built a market-beating stock system — with returns rivaling even Warren Buffett. In his latest feat, Louis discovered the “Master Key” to profiting from the biggest tech revolution of this (or any) generation. Louis Navellier may hold some of the aforementioned securities in one or more of his newsletters.