Bulls wouldn’t go down without a fight, but they weren’t strong enough to keep the markets elevated heading into the long holiday weekend. Here are our top stock trades after a busy Friday.

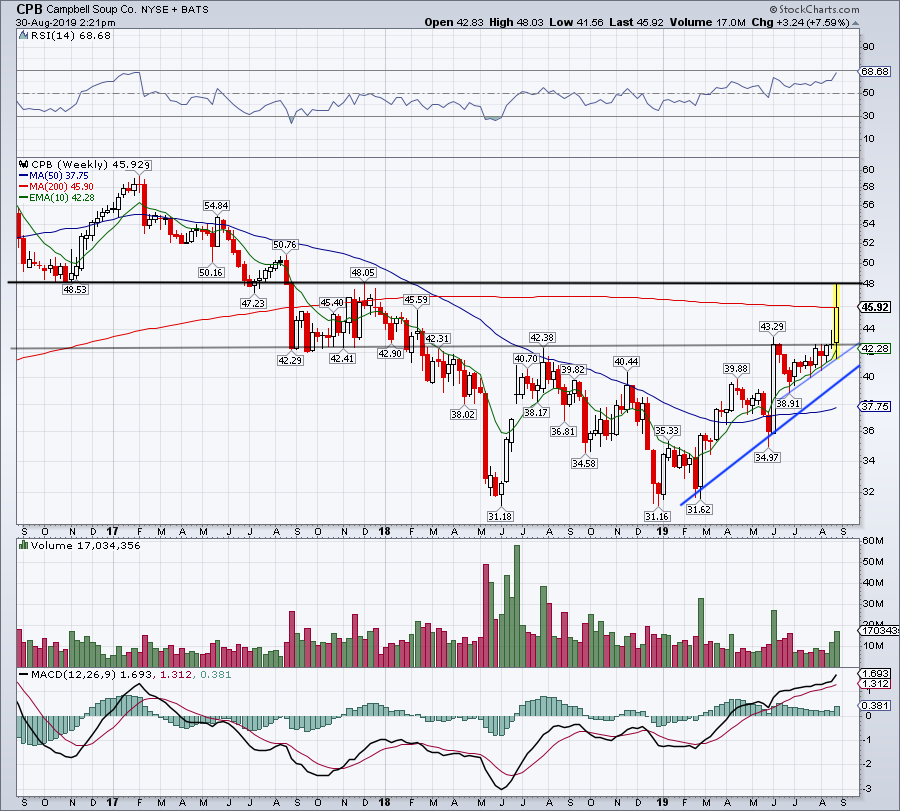

Top Stock Trades for Tomorrow #1: Campbell Soup

Could the setup “be” any more perfect in Campbell Soup (NYSE:CPB) for earnings?

Okay, so moving on from our very touching Friends tribute as it approaches its 25-year anniversary in a few weeks, the setup really was perfect in CPB.

Shares were forming a tight ascending triangle, a bullish technical pattern where rising uptrend support squeezes the stock against a static level of resistance. That resistance was in play around $42.50.

CPB exploded over that level on Friday, racing up to $48 where it hit stiff, multi-year resistance.

I would love to see the stock maintain above the 200-week moving average now and build on its recent momentum in the holiday-shortened trading week to start September. If it can, look to see if we get another run up to $48. On a retreat, see that $42.50 holds as support, as well as the 10-week moving average.

Top Stock Trades for Tomorrow #2: Ambarella

Ambarella (NASDAQ:AMBA) is also putting together a strong rally on Friday, up almost 20% on the day. The move vaults shares over $50 resistance and the 200-day moving average at $48.80.

Bulls now must see these two levels hold as support. Further, the stock now has room to rally up to $65, another 15% above current levels.

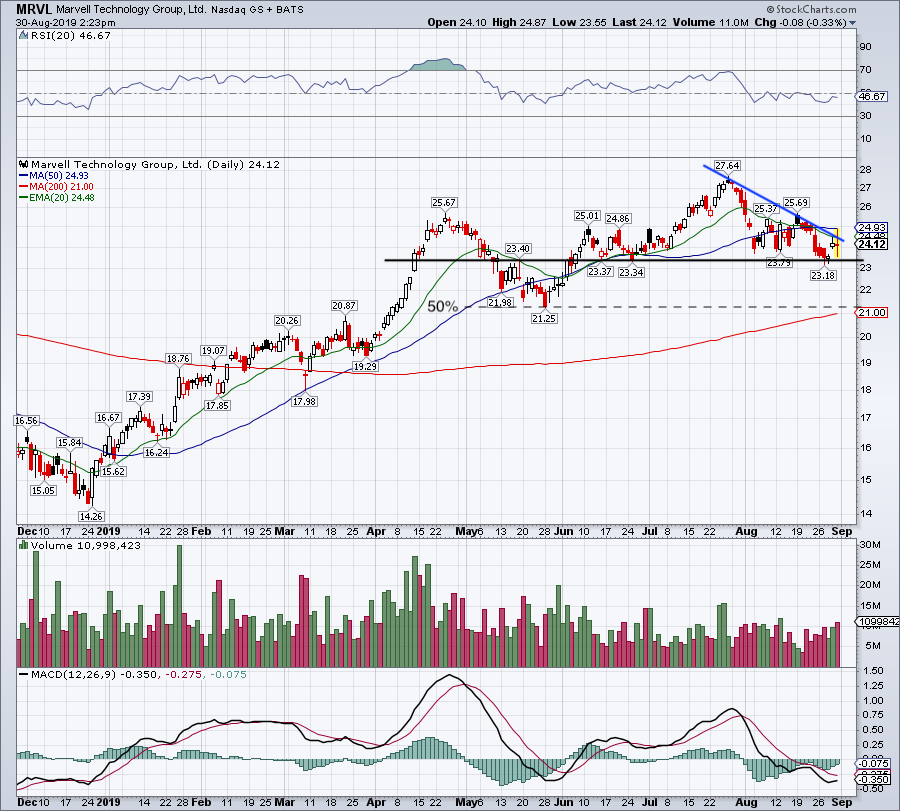

Top Stock Trades for Tomorrow #3: Marvel Technology

First it was up, then it was down, then Marvel Technology (NASDAQ:MRVL) was near flat going into Friday’s close.

The stock was rejected by the 20-day and 50-day moving averages, as well as downtrend resistance (blue line). Investors now need to see $23 hold as support. If it holds, a retest of resistance is in the cards.

If it fails, the May lows at $21.25 may be on the table. Further, the 200-day is down at $21 and rising, while the 50% retracement is near $21 as well. Over $25 and MRVL can gain upside momentum.

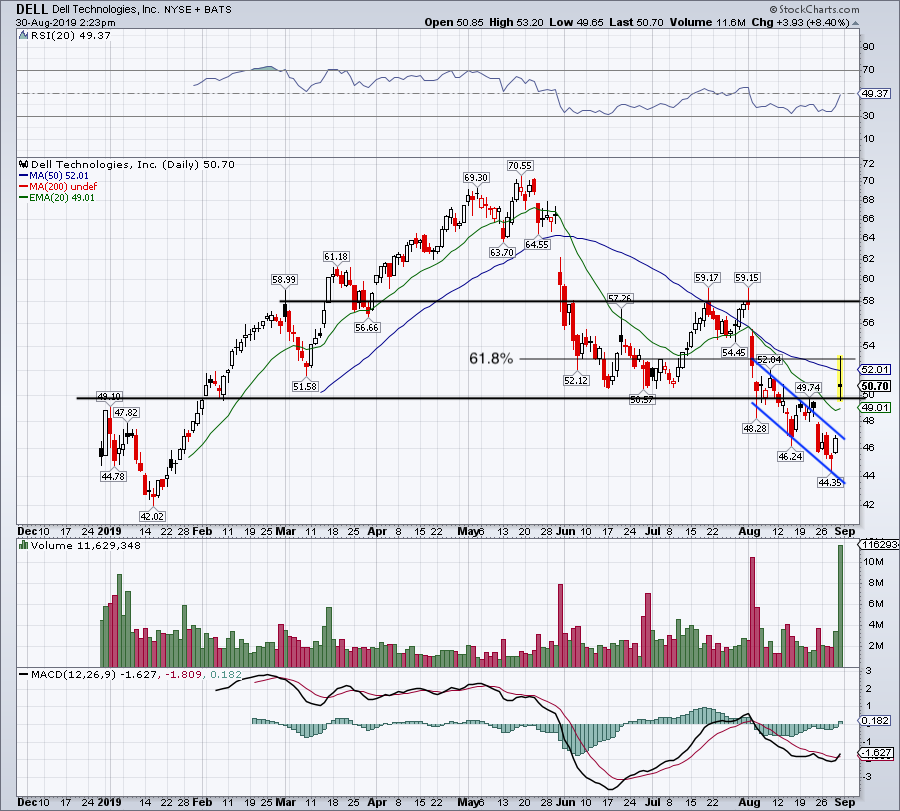

Top Stock Trades for Tomorrow #4: Dell Technologies

Dell Technologies (NYSE:DELL) is jumping almost 10% on the day, but is now ping-ponging between a few key levels.

The good news: Dell stock is back over the 20-day moving average and the key $50 level. It’s also out of that nasty downtrend channel (blue lines).

The bad news: The 50-day moving average and the 61.8% retracement both rejected Dell stock, sending shares lower.

Bulls now needs to maintain above $50 and the 20-day moving average. If they can, it will increase the odds of taking out Friday’s high, and thus the 50-day moving average and 61.8% retracement. From there, it puts $58 back on the table.

Bears need to crack $50 and the 20-day, putting $46 back on the table.

Top Stock Trades for Tomorrow #5: Big Lots

Like Dell, Big Lots (NYSE:BIG) is bouncing between a few key levels on the charts. Unlike Dell though, BIG is not ending the day on a high note. Shares are up more than 2% and above $22.50, but are well off session highs at $25.74.

Shares were promptly rejected from the key $25.50 to $26 area, as well as the 50-day moving average.

While up on the day, the action was not very encouraging. If it can maintain above the 20-day moving average and downtrend resistance (blue line), bulls still have a case to make.

However, I’d much rather wait to see BIG over the 50-day moving average, putting $26 back on the table. Below the 20-day and $20 is on the table.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, Bret Kenwell did not hold a position in any of the aforementioned securities.